Raymond James Financial Inc. boosted its holdings in shares of AvePoint, Inc. (NASDAQ:AVPT - Free Report) by 17.7% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 1,287,819 shares of the company's stock after purchasing an additional 193,502 shares during the period. Raymond James Financial Inc. owned about 0.64% of AvePoint worth $18,596,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

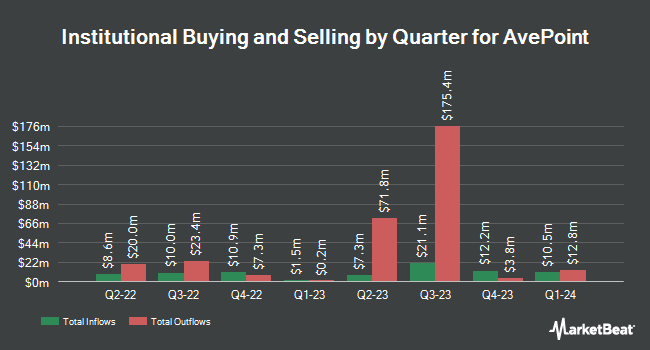

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in AVPT. LPL Financial LLC raised its stake in shares of AvePoint by 21.3% during the 4th quarter. LPL Financial LLC now owns 12,777 shares of the company's stock valued at $211,000 after buying an additional 2,242 shares during the last quarter. Envestnet Asset Management Inc. purchased a new stake in AvePoint in the 4th quarter worth approximately $169,000. Mariner LLC acquired a new stake in shares of AvePoint during the 4th quarter worth approximately $183,000. MetLife Investment Management LLC increased its holdings in shares of AvePoint by 5.6% during the 4th quarter. MetLife Investment Management LLC now owns 77,985 shares of the company's stock valued at $1,288,000 after purchasing an additional 4,102 shares in the last quarter. Finally, Tower Research Capital LLC TRC lifted its stake in shares of AvePoint by 53.6% in the 4th quarter. Tower Research Capital LLC TRC now owns 16,473 shares of the company's stock valued at $272,000 after purchasing an additional 5,745 shares during the period. 44.49% of the stock is owned by institutional investors and hedge funds.

AvePoint Stock Up 1.6%

Shares of NASDAQ AVPT traded up $0.26 during trading on Monday, hitting $16.36. The company had a trading volume of 1,702,038 shares, compared to its average volume of 1,683,191. The firm has a market capitalization of $3.47 billion, a price-to-earnings ratio of -327.13 and a beta of 1.40. The stock has a fifty day simple moving average of $17.53 and a two-hundred day simple moving average of $16.93. AvePoint, Inc. has a fifty-two week low of $11.27 and a fifty-two week high of $20.25.

Analyst Upgrades and Downgrades

AVPT has been the topic of several analyst reports. Citigroup dropped their price target on shares of AvePoint from $19.00 to $18.00 and set a "neutral" rating on the stock in a research report on Monday, August 18th. B. Riley initiated coverage on shares of AvePoint in a research note on Tuesday, August 26th. They set a "buy" rating and a $25.00 target price on the stock. Jefferies Financial Group initiated coverage on AvePoint in a research report on Monday, July 21st. They set a "buy" rating and a $22.00 target price on the stock. Cantor Fitzgerald raised AvePoint to a "strong-buy" rating in a report on Friday, July 25th. Finally, The Goldman Sachs Group increased their price target on AvePoint from $15.00 to $17.00 and gave the stock a "neutral" rating in a research report on Monday, May 12th. One analyst has rated the stock with a Strong Buy rating, four have assigned a Buy rating and two have assigned a Hold rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $20.80.

Read Our Latest Stock Report on AVPT

Insider Buying and Selling

In other AvePoint news, insider Brian Michael Brown sold 35,000 shares of the business's stock in a transaction that occurred on Monday, August 25th. The stock was sold at an average price of $15.47, for a total transaction of $541,450.00. Following the completion of the sale, the insider directly owned 1,155,443 shares in the company, valued at approximately $17,874,703.21. The trade was a 2.94% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In the last ninety days, insiders sold 105,000 shares of company stock worth $1,835,400. 26.19% of the stock is currently owned by insiders.

AvePoint Profile

(

Free Report)

AvePoint, Inc provides cloud-native data management software platform in North America, Europe, Middle East, Africa, and Asia Pacific. It also offers software-as-a-service solutions and productivity applications. The company offers modularity and cloud services architecture to address critical challenges and the management of data to organizations that leverage third-party cloud vendors, including Microsoft, Salesforce, Google, AWS, Box, DropBox, and others; license and support; and maintenance services.

See Also

Before you consider AvePoint, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AvePoint wasn't on the list.

While AvePoint currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.