Raymond James Financial Inc. boosted its stake in shares of Healthpeak Properties, Inc. (NYSE:DOC - Free Report) by 14.4% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,271,968 shares of the real estate investment trust's stock after buying an additional 159,724 shares during the quarter. Raymond James Financial Inc. owned 0.18% of Healthpeak Properties worth $25,719,000 as of its most recent SEC filing.

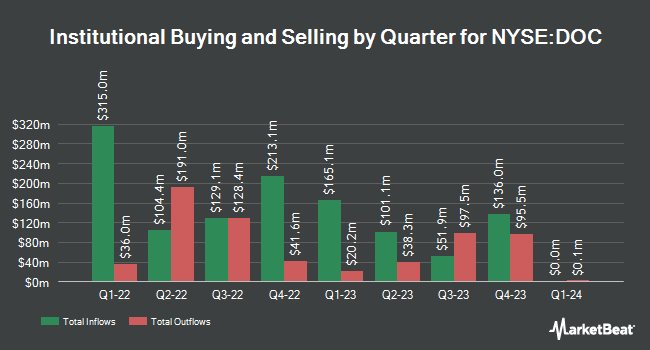

Other hedge funds also recently bought and sold shares of the company. Nuveen LLC purchased a new position in shares of Healthpeak Properties in the first quarter valued at approximately $124,113,000. Resolution Capital Ltd purchased a new position in shares of Healthpeak Properties in the fourth quarter valued at approximately $122,795,000. Invesco Ltd. boosted its stake in shares of Healthpeak Properties by 20.7% in the first quarter. Invesco Ltd. now owns 23,111,320 shares of the real estate investment trust's stock valued at $467,311,000 after purchasing an additional 3,967,830 shares during the period. Northern Trust Corp raised its holdings in Healthpeak Properties by 32.6% in the fourth quarter. Northern Trust Corp now owns 10,526,223 shares of the real estate investment trust's stock valued at $213,367,000 after acquiring an additional 2,590,530 shares in the last quarter. Finally, Centersquare Investment Management LLC lifted its stake in Healthpeak Properties by 18.5% in the first quarter. Centersquare Investment Management LLC now owns 13,285,932 shares of the real estate investment trust's stock worth $268,642,000 after acquiring an additional 2,070,416 shares during the last quarter. Hedge funds and other institutional investors own 93.57% of the company's stock.

Insider Buying and Selling

In other Healthpeak Properties news, Director Tommy G. Thompson bought 5,777 shares of the stock in a transaction dated Wednesday, May 28th. The shares were acquired at an average cost of $17.27 per share, for a total transaction of $99,768.79. Following the completion of the transaction, the director owned 144,290 shares in the company, valued at approximately $2,491,888.30. The trade was a 4.17% increase in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. Also, CEO Scott M. Brinker acquired 2,930 shares of the stock in a transaction that occurred on Thursday, July 31st. The stock was purchased at an average price of $17.06 per share, for a total transaction of $49,985.80. Following the completion of the transaction, the chief executive officer owned 210,416 shares in the company, valued at $3,589,696.96. The trade was a 1.41% increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last 90 days, insiders have bought 14,560 shares of company stock worth $249,898. Insiders own 0.23% of the company's stock.

Healthpeak Properties Stock Performance

Shares of DOC opened at $17.67 on Tuesday. The company has a current ratio of 1.28, a quick ratio of 1.28 and a debt-to-equity ratio of 1.06. The firm has a market cap of $12.28 billion, a PE ratio of 73.63, a price-to-earnings-growth ratio of 2.28 and a beta of 1.05. The company's 50 day simple moving average is $17.63 and its 200-day simple moving average is $18.34. Healthpeak Properties, Inc. has a 12-month low of $16.63 and a 12-month high of $23.26.

Healthpeak Properties (NYSE:DOC - Get Free Report) last announced its earnings results on Thursday, July 24th. The real estate investment trust reported $0.46 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.46. The business had revenue of $694.35 million for the quarter, compared to analyst estimates of $697.14 million. Healthpeak Properties had a net margin of 5.90% and a return on equity of 1.85%. The company's revenue for the quarter was down .2% compared to the same quarter last year. During the same period last year, the firm posted $0.45 earnings per share. Healthpeak Properties has set its FY 2025 guidance at 1.810-1.870 EPS. As a group, equities analysts predict that Healthpeak Properties, Inc. will post 1.86 EPS for the current year.

Healthpeak Properties Dividend Announcement

The firm also recently announced a dividend, which will be paid on Friday, August 29th. Stockholders of record on Tuesday, August 19th will be given a dividend of $0.1017 per share. The ex-dividend date is Monday, August 18th. This represents a dividend yield of 705.0%. Healthpeak Properties's dividend payout ratio (DPR) is 508.33%.

Analyst Upgrades and Downgrades

A number of brokerages recently issued reports on DOC. Deutsche Bank Aktiengesellschaft reiterated a "hold" rating and issued a $18.00 price target (down previously from $28.00) on shares of Healthpeak Properties in a research note on Wednesday, August 20th. Wells Fargo & Company decreased their price target on shares of Healthpeak Properties from $22.00 to $20.00 and set an "equal weight" rating for the company in a research note on Monday, June 2nd. Robert W. Baird set a $21.00 price target on shares of Healthpeak Properties and gave the stock an "outperform" rating in a research note on Wednesday, July 30th. Morgan Stanley decreased their price target on shares of Healthpeak Properties from $22.00 to $21.00 and set an "overweight" rating for the company in a research note on Friday. Finally, Wall Street Zen downgraded shares of Healthpeak Properties from a "hold" rating to a "sell" rating in a research note on Monday, July 7th. Seven equities research analysts have rated the stock with a Buy rating and three have given a Hold rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $21.70.

Check Out Our Latest Stock Analysis on DOC

Healthpeak Properties Profile

(

Free Report)

Healthpeak Properties, Inc is a fully integrated real estate investment trust (REIT) and S&P 500 company. Healthpeak owns, operates, and develops high-quality real estate for healthcare discovery and delivery.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Healthpeak Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Healthpeak Properties wasn't on the list.

While Healthpeak Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report