Raymond James Financial Inc. grew its position in shares of Koninklijke Philips N.V. (NYSE:PHG - Free Report) by 2.3% during the first quarter, according to its most recent filing with the SEC. The firm owned 430,510 shares of the technology company's stock after acquiring an additional 9,699 shares during the period. Raymond James Financial Inc.'s holdings in Koninklijke Philips were worth $10,935,000 at the end of the most recent quarter.

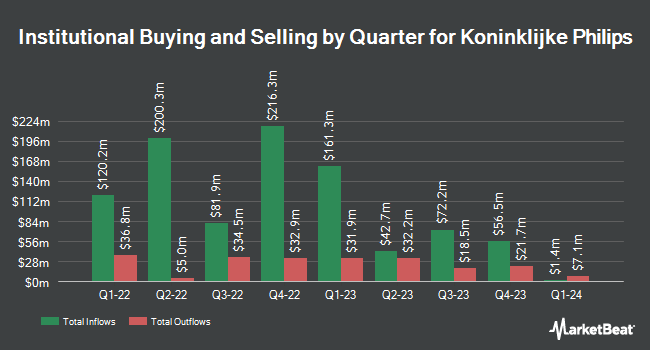

A number of other institutional investors also recently bought and sold shares of PHG. Colonial Trust Co SC raised its stake in shares of Koninklijke Philips by 724.0% during the fourth quarter. Colonial Trust Co SC now owns 1,409 shares of the technology company's stock valued at $36,000 after acquiring an additional 1,238 shares in the last quarter. Bessemer Group Inc. lifted its holdings in Koninklijke Philips by 2,935.4% during the 1st quarter. Bessemer Group Inc. now owns 1,973 shares of the technology company's stock worth $51,000 after buying an additional 1,908 shares in the last quarter. Caitong International Asset Management Co. Ltd grew its position in shares of Koninklijke Philips by 1,170.3% in the 1st quarter. Caitong International Asset Management Co. Ltd now owns 2,439 shares of the technology company's stock valued at $62,000 after buying an additional 2,247 shares during the last quarter. Castlekeep Investment Advisors LLC purchased a new stake in shares of Koninklijke Philips in the fourth quarter valued at about $114,000. Finally, Wealthquest Corp acquired a new position in Koninklijke Philips during the first quarter worth about $116,000. 13.67% of the stock is owned by institutional investors.

Koninklijke Philips Price Performance

NYSE PHG traded up $0.13 during trading on Friday, hitting $27.86. 227,250 shares of the company's stock were exchanged, compared to its average volume of 972,635. The company has a current ratio of 1.26, a quick ratio of 0.81 and a debt-to-equity ratio of 0.69. The company has a market cap of $26.82 billion, a PE ratio of 146.59, a P/E/G ratio of 0.73 and a beta of 0.81. Koninklijke Philips N.V. has a fifty-two week low of $21.48 and a fifty-two week high of $32.91. The stock's 50 day moving average price is $26.06 and its two-hundred day moving average price is $25.00.

Koninklijke Philips (NYSE:PHG - Get Free Report) last posted its earnings results on Tuesday, July 29th. The technology company reported $0.41 earnings per share for the quarter, beating analysts' consensus estimates of $0.29 by $0.12. The company had revenue of $5.05 billion for the quarter, compared to analyst estimates of $4.35 billion. Koninklijke Philips had a return on equity of 11.95% and a net margin of 1.00%. Research analysts expect that Koninklijke Philips N.V. will post 1.63 EPS for the current year.

Analysts Set New Price Targets

Separately, Wall Street Zen lowered shares of Koninklijke Philips from a "buy" rating to a "hold" rating in a research report on Saturday, August 2nd. One investment analyst has rated the stock with a Strong Buy rating, two have given a Buy rating and one has assigned a Hold rating to the company. According to data from MarketBeat, the company has an average rating of "Buy".

Get Our Latest Stock Report on Koninklijke Philips

Koninklijke Philips Company Profile

(

Free Report)

Koninklijke Philips N.V. operates as a health technology company in North America, the Greater China, and internationally. The company operates through Diagnosis & Treatment Businesses, Connected Care Businesses, and Personal Health Businesses segments. It also provides diagnostic imaging solutions, includes magnetic resonance imaging, X-ray systems, and computed tomography (CT) systems and software comprising detector-based spectral CT solutions, as well as molecular and hybrid imaging solutions for nuclear medicine; echography solutions focused on diagnosis, treatment planning and guidance for cardiology, general imaging, obstetrics/gynecology, and point-of-care applications; integrated interventional systems, and interventional diagnostic and therapeutic devices to treat coronary artery and peripheral vascular disease.

Read More

Before you consider Koninklijke Philips, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Koninklijke Philips wasn't on the list.

While Koninklijke Philips currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.