Redhawk Wealth Advisors Inc. lowered its position in shares of Sumitomo Mitsui Financial Group Inc (NYSE:SMFG - Free Report) by 76.0% in the second quarter, according to its most recent 13F filing with the SEC. The firm owned 17,110 shares of the bank's stock after selling 54,279 shares during the quarter. Redhawk Wealth Advisors Inc.'s holdings in Sumitomo Mitsui Financial Group were worth $259,000 as of its most recent filing with the SEC.

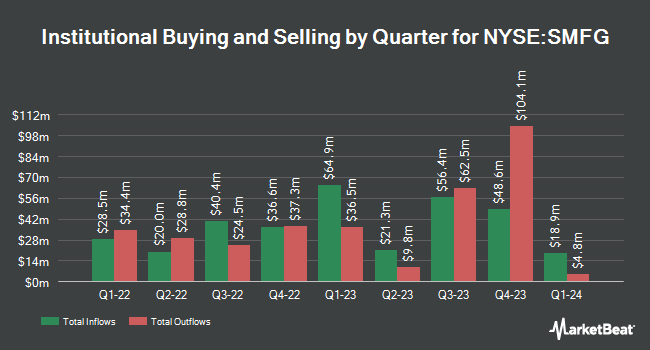

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Capital A Wealth Management LLC acquired a new position in Sumitomo Mitsui Financial Group during the fourth quarter valued at approximately $25,000. Private Trust Co. NA raised its stake in shares of Sumitomo Mitsui Financial Group by 1,044.1% in the 1st quarter. Private Trust Co. NA now owns 2,334 shares of the bank's stock valued at $36,000 after acquiring an additional 2,130 shares during the period. Park Square Financial Group LLC acquired a new position in shares of Sumitomo Mitsui Financial Group during the 4th quarter valued at $34,000. Financial Management Professionals Inc. boosted its position in Sumitomo Mitsui Financial Group by 88.3% during the 1st quarter. Financial Management Professionals Inc. now owns 2,404 shares of the bank's stock worth $37,000 after purchasing an additional 1,127 shares during the period. Finally, Zions Bancorporation National Association UT acquired a new stake in Sumitomo Mitsui Financial Group in the 1st quarter valued at $42,000. Institutional investors and hedge funds own 3.85% of the company's stock.

Sumitomo Mitsui Financial Group Stock Up 0.1%

Shares of SMFG traded up $0.02 during trading on Tuesday, reaching $17.13. The company's stock had a trading volume of 227,044 shares, compared to its average volume of 1,886,983. The company has a market cap of $110.10 billion, a price-to-earnings ratio of 18.04, a P/E/G ratio of 0.82 and a beta of 0.39. The company has a quick ratio of 1.03, a current ratio of 1.03 and a debt-to-equity ratio of 1.75. The company has a fifty day moving average of $16.11 and a two-hundred day moving average of $15.18. Sumitomo Mitsui Financial Group Inc has a twelve month low of $11.83 and a twelve month high of $17.46.

Sumitomo Mitsui Financial Group (NYSE:SMFG - Get Free Report) last issued its quarterly earnings results on Thursday, July 31st. The bank reported $0.40 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.31 by $0.09. Sumitomo Mitsui Financial Group had a net margin of 11.78% and a return on equity of 7.88%. The business had revenue of $16.41 billion during the quarter, compared to analyst estimates of $1,094.67 billion. On average, sell-side analysts predict that Sumitomo Mitsui Financial Group Inc will post 0.39 EPS for the current fiscal year.

Analyst Ratings Changes

Several brokerages have recently weighed in on SMFG. Nomura Securities raised Sumitomo Mitsui Financial Group to a "strong-buy" rating in a research report on Thursday, July 3rd. Wall Street Zen raised shares of Sumitomo Mitsui Financial Group from a "sell" rating to a "hold" rating in a research report on Saturday, August 2nd. Finally, Zacks Research raised shares of Sumitomo Mitsui Financial Group from a "hold" rating to a "strong-buy" rating in a research report on Friday, September 5th. Two equities research analysts have rated the stock with a Strong Buy rating, According to data from MarketBeat, the stock currently has an average rating of "Strong Buy".

Check Out Our Latest Stock Report on SMFG

Sumitomo Mitsui Financial Group Company Profile

(

Free Report)

Sumitomo Mitsui Financial Group, Inc, together with its subsidiaries, provides banking, leasing, securities, credit card, and consumer finance services in Japan, the Americas, Europe, the Middle East, Asia, and Oceania. It operates through Wholesale Business Unit, Retail Business Unit, Global Business Unit, and Global Markets Business Unit segments.

See Also

Before you consider Sumitomo Mitsui Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sumitomo Mitsui Financial Group wasn't on the list.

While Sumitomo Mitsui Financial Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.