Regal Partners Ltd lifted its stake in shares of Uber Technologies, Inc. (NYSE:UBER - Free Report) by 1,963.7% in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 170,706 shares of the ride-sharing company's stock after buying an additional 162,434 shares during the quarter. Uber Technologies comprises approximately 1.3% of Regal Partners Ltd's investment portfolio, making the stock its 19th largest holding. Regal Partners Ltd's holdings in Uber Technologies were worth $12,438,000 as of its most recent SEC filing.

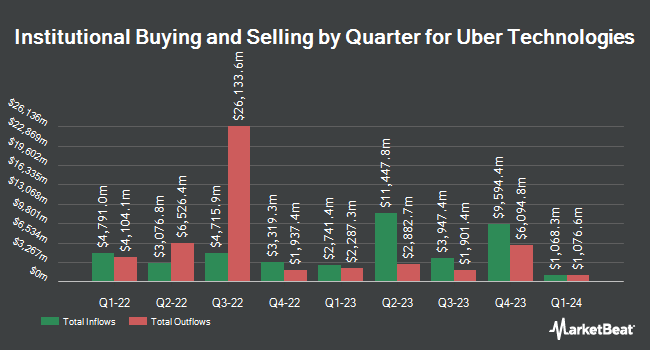

Several other hedge funds have also bought and sold shares of UBER. SHEPHERD WEALTH MANAGEMENT Ltd LIABILITY Co boosted its holdings in Uber Technologies by 232.0% during the 1st quarter. SHEPHERD WEALTH MANAGEMENT Ltd LIABILITY Co now owns 75,937 shares of the ride-sharing company's stock worth $5,533,000 after acquiring an additional 53,065 shares during the last quarter. LGT Group Foundation boosted its holdings in Uber Technologies by 370.4% during the 1st quarter. LGT Group Foundation now owns 435,627 shares of the ride-sharing company's stock worth $31,740,000 after acquiring an additional 343,027 shares during the last quarter. LGT Fund Management Co Ltd. raised its stake in shares of Uber Technologies by 69.7% during the 1st quarter. LGT Fund Management Co Ltd. now owns 82,969 shares of the ride-sharing company's stock worth $6,045,000 after purchasing an additional 34,090 shares during the period. Clal Insurance Enterprises Holdings Ltd raised its stake in shares of Uber Technologies by 68.2% during the 1st quarter. Clal Insurance Enterprises Holdings Ltd now owns 18,584 shares of the ride-sharing company's stock worth $1,354,000 after purchasing an additional 7,534 shares during the period. Finally, Resona Asset Management Co. Ltd. raised its stake in shares of Uber Technologies by 8.7% during the 1st quarter. Resona Asset Management Co. Ltd. now owns 590,615 shares of the ride-sharing company's stock worth $43,022,000 after purchasing an additional 47,042 shares during the period. Institutional investors and hedge funds own 80.24% of the company's stock.

Uber Technologies Price Performance

Shares of NYSE UBER traded down $0.76 during midday trading on Wednesday, hitting $90.97. 16,849,796 shares of the company's stock were exchanged, compared to its average volume of 18,980,150. The company has a market cap of $189.71 billion, a price-to-earnings ratio of 15.50, a PEG ratio of 1.05 and a beta of 1.43. The business's fifty day moving average price is $89.92 and its two-hundred day moving average price is $81.54. The company has a current ratio of 1.11, a quick ratio of 1.11 and a debt-to-equity ratio of 0.41. Uber Technologies, Inc. has a 12-month low of $59.33 and a 12-month high of $97.71.

Uber Technologies (NYSE:UBER - Get Free Report) last issued its earnings results on Wednesday, August 6th. The ride-sharing company reported $0.63 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.61 by $0.02. The business had revenue of $12.65 billion during the quarter, compared to analyst estimates of $12.45 billion. Uber Technologies had a return on equity of 59.96% and a net margin of 26.68%. Uber Technologies's revenue for the quarter was up 18.2% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.47 earnings per share. As a group, research analysts forecast that Uber Technologies, Inc. will post 2.54 EPS for the current fiscal year.

Insiders Place Their Bets

In other Uber Technologies news, CFO Prashanth Mahendra-Rajah sold 2,750 shares of the business's stock in a transaction that occurred on Monday, July 7th. The stock was sold at an average price of $95.00, for a total value of $261,250.00. Following the completion of the sale, the chief financial officer owned 21,975 shares in the company, valued at approximately $2,087,625. The trade was a 11.12% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Insiders own 3.84% of the company's stock.

Analyst Ratings Changes

A number of research firms have recently commented on UBER. Wall Street Zen cut Uber Technologies from a "buy" rating to a "hold" rating in a research note on Saturday. Stifel Nicolaus lifted their target price on Uber Technologies from $110.00 to $117.00 and gave the stock a "buy" rating in a research note on Tuesday, July 29th. Susquehanna lifted their target price on Uber Technologies from $100.00 to $105.00 and gave the stock a "positive" rating in a research note on Thursday, August 7th. Cantor Fitzgerald reiterated an "overweight" rating and set a $106.00 target price (up from $96.00) on shares of Uber Technologies in a research note on Wednesday, June 25th. Finally, Citigroup boosted their price objective on Uber Technologies from $92.00 to $102.00 and gave the company a "buy" rating in a research note on Thursday, May 8th. Eleven research analysts have rated the stock with a hold rating, twenty-nine have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $102.82.

Get Our Latest Research Report on UBER

Uber Technologies Company Profile

(

Free Report)

Uber Technologies, Inc develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia excluding China and Southeast Asia. It operates through three segments: Mobility, Delivery, and Freight. The Mobility segment connects consumers with a range of transportation modalities, such as ridesharing, carsharing, micromobility, rentals, public transit, taxis, and other modalities; and offers riders in a variety of vehicle types, as well as financial partnerships products and advertising services.

Featured Articles

Before you consider Uber Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uber Technologies wasn't on the list.

While Uber Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.