Summit Global Investments cut its position in shares of Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN - Free Report) by 72.6% in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 2,772 shares of the biopharmaceutical company's stock after selling 7,342 shares during the quarter. Summit Global Investments' holdings in Regeneron Pharmaceuticals were worth $1,758,000 as of its most recent SEC filing.

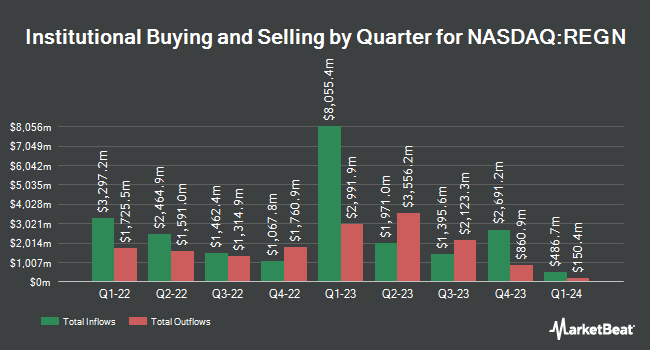

Other hedge funds have also modified their holdings of the company. Capital International Investors grew its stake in Regeneron Pharmaceuticals by 41.6% in the fourth quarter. Capital International Investors now owns 4,736,929 shares of the biopharmaceutical company's stock valued at $3,373,859,000 after purchasing an additional 1,390,534 shares in the last quarter. Geode Capital Management LLC lifted its holdings in Regeneron Pharmaceuticals by 6.8% during the 4th quarter. Geode Capital Management LLC now owns 2,427,630 shares of the biopharmaceutical company's stock worth $1,726,940,000 after purchasing an additional 155,369 shares during the last quarter. Dodge & Cox lifted its holdings in Regeneron Pharmaceuticals by 0.4% during the 4th quarter. Dodge & Cox now owns 2,321,316 shares of the biopharmaceutical company's stock worth $1,653,543,000 after purchasing an additional 9,381 shares during the last quarter. Price T Rowe Associates Inc. MD raised its holdings in Regeneron Pharmaceuticals by 63.5% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 2,085,447 shares of the biopharmaceutical company's stock valued at $1,485,527,000 after acquiring an additional 810,144 shares in the last quarter. Finally, Franklin Resources Inc. raised its holdings in Regeneron Pharmaceuticals by 7.9% in the 4th quarter. Franklin Resources Inc. now owns 2,045,210 shares of the biopharmaceutical company's stock valued at $1,456,864,000 after acquiring an additional 149,124 shares in the last quarter. 83.31% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several brokerages have recently issued reports on REGN. Canaccord Genuity Group upgraded Regeneron Pharmaceuticals from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, April 22nd. Leerink Partners upgraded Regeneron Pharmaceuticals from a "market perform" rating to an "outperform" rating and upped their price target for the company from $762.00 to $834.00 in a research report on Wednesday, February 5th. The Goldman Sachs Group reduced their price target on Regeneron Pharmaceuticals from $917.00 to $804.00 and set a "buy" rating on the stock in a research report on Wednesday, April 30th. Leerink Partnrs upgraded Regeneron Pharmaceuticals from a "hold" rating to a "strong-buy" rating in a report on Wednesday, February 5th. Finally, BMO Capital Markets cut their price target on Regeneron Pharmaceuticals from $800.00 to $600.00 and set an "outperform" rating on the stock in a report on Monday. One equities research analyst has rated the stock with a sell rating, six have given a hold rating, seventeen have assigned a buy rating and three have given a strong buy rating to the stock. Based on data from MarketBeat, Regeneron Pharmaceuticals presently has an average rating of "Moderate Buy" and a consensus price target of $847.40.

View Our Latest Report on Regeneron Pharmaceuticals

Regeneron Pharmaceuticals Stock Up 0.3%

NASDAQ REGN traded up $1.29 on Tuesday, reaching $492.10. The company had a trading volume of 929,967 shares, compared to its average volume of 1,126,206. Regeneron Pharmaceuticals, Inc. has a 52-week low of $481.58 and a 52-week high of $1,211.20. The stock has a market capitalization of $53.13 billion, a P/E ratio of 12.86, a P/E/G ratio of 2.34 and a beta of 0.43. The company's fifty day moving average is $581.26 and its 200 day moving average is $663.80. The company has a quick ratio of 3.95, a current ratio of 4.73 and a debt-to-equity ratio of 0.09.

Regeneron Pharmaceuticals (NASDAQ:REGN - Get Free Report) last announced its earnings results on Tuesday, April 29th. The biopharmaceutical company reported $8.22 earnings per share (EPS) for the quarter, missing the consensus estimate of $8.83 by ($0.61). Regeneron Pharmaceuticals had a net margin of 31.07% and a return on equity of 16.32%. The business had revenue of $3.03 billion for the quarter, compared to analysts' expectations of $3.40 billion. During the same period in the prior year, the business earned $9.55 earnings per share. The company's revenue for the quarter was down 3.7% compared to the same quarter last year. Sell-side analysts anticipate that Regeneron Pharmaceuticals, Inc. will post 35.92 earnings per share for the current fiscal year.

Regeneron Pharmaceuticals Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, June 6th. Stockholders of record on Tuesday, May 20th will be given a dividend of $0.88 per share. This represents a $3.52 annualized dividend and a dividend yield of 0.72%. The ex-dividend date is Tuesday, May 20th. Regeneron Pharmaceuticals's dividend payout ratio is presently 8.96%.

Regeneron Pharmaceuticals Company Profile

(

Free Report)

Regeneron Pharmaceuticals, Inc discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company's products include EYLEA injection to treat wet age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; diabetic retinopathy; neovascular glaucoma; and retinopathy of prematurity.

Featured Stories

Before you consider Regeneron Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regeneron Pharmaceuticals wasn't on the list.

While Regeneron Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.