Magnetar Financial LLC increased its position in Revolution Medicines, Inc. (NASDAQ:RVMD - Free Report) by 36,535.6% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 32,972 shares of the company's stock after acquiring an additional 32,882 shares during the period. Magnetar Financial LLC's holdings in Revolution Medicines were worth $1,166,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

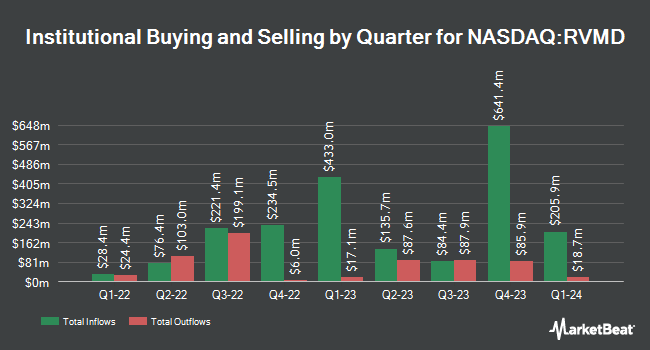

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in RVMD. Mirae Asset Global Investments Co. Ltd. raised its stake in shares of Revolution Medicines by 11.0% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 6,221 shares of the company's stock valued at $232,000 after buying an additional 615 shares during the last quarter. SG Americas Securities LLC boosted its holdings in shares of Revolution Medicines by 516.0% during the 1st quarter. SG Americas Securities LLC now owns 18,103 shares of the company's stock worth $640,000 after purchasing an additional 15,164 shares during the last quarter. PNC Financial Services Group Inc. boosted its holdings in shares of Revolution Medicines by 349.7% during the 1st quarter. PNC Financial Services Group Inc. now owns 4,524 shares of the company's stock worth $160,000 after purchasing an additional 3,518 shares during the last quarter. Baker BROS. Advisors LP boosted its holdings in shares of Revolution Medicines by 4.9% during the 4th quarter. Baker BROS. Advisors LP now owns 7,936,972 shares of the company's stock worth $347,163,000 after purchasing an additional 367,882 shares during the last quarter. Finally, Lunate Capital Ltd acquired a new position in shares of Revolution Medicines during the 1st quarter worth approximately $77,658,000. Hedge funds and other institutional investors own 94.34% of the company's stock.

Revolution Medicines Price Performance

Shares of RVMD traded up $0.24 during mid-day trading on Wednesday, reaching $39.77. 1,794,176 shares of the company's stock were exchanged, compared to its average volume of 1,873,605. Revolution Medicines, Inc. has a 52-week low of $29.17 and a 52-week high of $62.40. The company has a 50-day simple moving average of $37.20 and a two-hundred day simple moving average of $38.15. The company has a market cap of $7.43 billion, a price-to-earnings ratio of -8.84 and a beta of 1.12. The company has a quick ratio of 11.79, a current ratio of 11.79 and a debt-to-equity ratio of 0.13.

Revolution Medicines (NASDAQ:RVMD - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The company reported ($1.31) earnings per share for the quarter, missing analysts' consensus estimates of ($0.94) by ($0.37). During the same quarter in the prior year, the business posted ($0.81) EPS. The company's revenue for the quarter was up .0% on a year-over-year basis. On average, sell-side analysts predict that Revolution Medicines, Inc. will post -3.49 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Several analysts have recently commented on the stock. Guggenheim reaffirmed a "buy" rating and set a $80.00 price target on shares of Revolution Medicines in a research report on Wednesday, June 25th. Piper Sandler began coverage on shares of Revolution Medicines in a research note on Monday, August 18th. They set an "overweight" rating and a $75.00 target price for the company. Wedbush reiterated an "outperform" rating and set a $73.00 target price (up previously from $67.00) on shares of Revolution Medicines in a research note on Tuesday, June 24th. Oppenheimer boosted their target price on shares of Revolution Medicines from $70.00 to $75.00 and gave the stock an "outperform" rating in a research note on Thursday, May 8th. Finally, Lifesci Capital initiated coverage on shares of Revolution Medicines in a research note on Monday, August 18th. They issued an "outperform" rating and a $80.00 price objective for the company. Thirteen investment analysts have rated the stock with a Buy rating, Based on data from MarketBeat, Revolution Medicines presently has an average rating of "Buy" and a consensus price target of $69.92.

Get Our Latest Stock Analysis on RVMD

About Revolution Medicines

(

Free Report)

Revolution Medicines, Inc, a clinical-stage precision oncology company, develops novel targeted therapies for RAS-addicted cancers. The company's research and development pipeline comprises RAS(ON) inhibitors designed to be used as monotherapy in combination with other RAS(ON) inhibitors and/or in combination with RAS companion inhibitors or other therapeutic agents, and RAS companion inhibitors for combination treatment strategies.

Further Reading

Before you consider Revolution Medicines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Revolution Medicines wasn't on the list.

While Revolution Medicines currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.