Rhumbline Advisers reduced its stake in shares of Globalstar, Inc. (NASDAQ:GSAT - Free Report) by 92.6% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 69,613 shares of the company's stock after selling 870,978 shares during the quarter. Rhumbline Advisers owned about 0.05% of Globalstar worth $1,452,000 as of its most recent SEC filing.

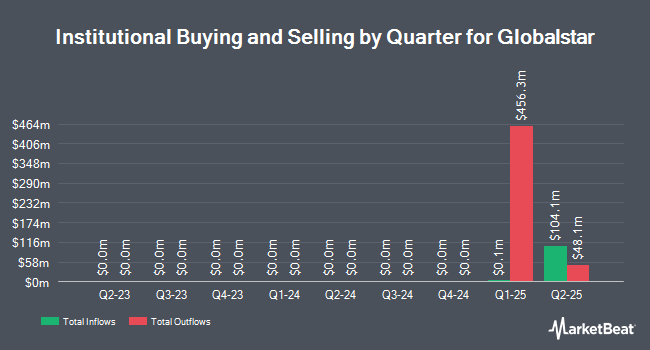

Separately, Acadian Asset Management LLC purchased a new stake in shares of Globalstar during the 1st quarter worth $99,000. 18.89% of the stock is currently owned by hedge funds and other institutional investors.

Globalstar Stock Performance

Globalstar stock traded up $1.19 during mid-day trading on Tuesday, reaching $37.25. 115,524 shares of the company were exchanged, compared to its average volume of 807,322. Globalstar, Inc. has a twelve month low of $15.00 and a twelve month high of $41.10. The company has a current ratio of 2.81, a quick ratio of 2.72 and a debt-to-equity ratio of 1.30. The stock has a 50-day moving average price of $28.33. The stock has a market capitalization of $4.72 billion, a price-to-earnings ratio of -82.78 and a beta of 1.00.

Globalstar (NASDAQ:GSAT - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The company reported $0.13 earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.09) by $0.22. Globalstar had a negative net margin of 17.80% and a negative return on equity of 1.17%. Globalstar has set its FY 2025 guidance at EPS.

Analysts Set New Price Targets

Several research analysts recently weighed in on GSAT shares. Wall Street Zen upgraded Globalstar from a "sell" rating to a "hold" rating in a research report on Monday, June 23rd. Zacks Research upgraded shares of Globalstar to a "strong-buy" rating in a research report on Monday, August 11th. One research analyst has rated the stock with a Strong Buy rating, Based on data from MarketBeat.com, the stock presently has an average rating of "Strong Buy".

Read Our Latest Stock Analysis on Globalstar

Insider Buying and Selling

In related news, VP Timothy Evan Taylor sold 26,334 shares of the company's stock in a transaction on Thursday, September 11th. The stock was sold at an average price of $30.57, for a total transaction of $805,030.38. Following the transaction, the vice president owned 320,244 shares of the company's stock, valued at $9,789,859.08. This represents a 7.60% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, CFO Rebecca Clary sold 5,359 shares of the business's stock in a transaction on Monday, September 15th. The stock was sold at an average price of $29.75, for a total transaction of $159,430.25. Following the sale, the chief financial officer owned 107,761 shares in the company, valued at $3,205,889.75. The trade was a 4.74% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 58,026 shares of company stock valued at $1,815,543. Company insiders own 60.76% of the company's stock.

About Globalstar

(

Free Report)

Globalstar, Inc provides mobile satellite services worldwide. The company offers duplex two-way voice and data products, including mobile voice and data satellite communications services and equipment for remote business continuity, recreational usage, safety, emergency preparedness and response, and other applications; fixed voice and data satellite communications services and equipment at industrial, commercial, and residential sites, as well as rural villages and ships; and data modem services and equipment.

Featured Articles

Before you consider Globalstar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globalstar wasn't on the list.

While Globalstar currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.