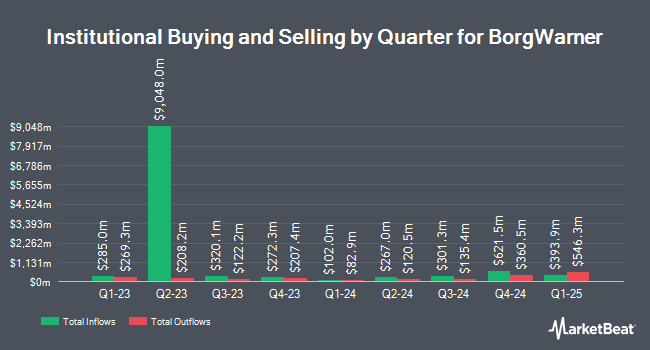

Rhumbline Advisers lifted its stake in shares of BorgWarner Inc. (NYSE:BWA - Free Report) by 39.0% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 556,066 shares of the auto parts company's stock after acquiring an additional 155,912 shares during the period. Rhumbline Advisers owned 0.25% of BorgWarner worth $15,931,000 as of its most recent SEC filing.

Several other large investors have also modified their holdings of BWA. Dimensional Fund Advisors LP raised its holdings in BorgWarner by 7.2% in the fourth quarter. Dimensional Fund Advisors LP now owns 11,284,040 shares of the auto parts company's stock valued at $358,720,000 after buying an additional 753,344 shares during the period. Invesco Ltd. raised its holdings in BorgWarner by 10.2% in the fourth quarter. Invesco Ltd. now owns 6,795,020 shares of the auto parts company's stock valued at $216,014,000 after buying an additional 628,930 shares during the period. Alliancebernstein L.P. raised its holdings in BorgWarner by 6.8% in the fourth quarter. Alliancebernstein L.P. now owns 5,981,196 shares of the auto parts company's stock valued at $190,142,000 after buying an additional 381,504 shares during the period. LSV Asset Management raised its holdings in BorgWarner by 22.5% in the fourth quarter. LSV Asset Management now owns 4,308,145 shares of the auto parts company's stock valued at $136,956,000 after buying an additional 792,100 shares during the period. Finally, Turtle Creek Asset Management Inc. raised its holdings in BorgWarner by 7.0% in the fourth quarter. Turtle Creek Asset Management Inc. now owns 4,078,780 shares of the auto parts company's stock valued at $129,664,000 after buying an additional 267,250 shares during the period. 95.67% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity

In other news, CAO Tonit M. Calaway sold 8,300 shares of the business's stock in a transaction on Monday, March 10th. The shares were sold at an average price of $30.07, for a total transaction of $249,581.00. Following the completion of the transaction, the chief accounting officer now owns 242,257 shares of the company's stock, valued at approximately $7,284,667.99. The trade was a 3.31% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, VP Isabelle Mckenzie sold 5,000 shares of the business's stock in a transaction on Friday, May 16th. The shares were sold at an average price of $33.25, for a total transaction of $166,250.00. Following the transaction, the vice president now directly owns 63,445 shares of the company's stock, valued at approximately $2,109,546.25. This trade represents a 7.31% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 41,036 shares of company stock valued at $1,326,404. 0.45% of the stock is currently owned by company insiders.

BorgWarner Stock Performance

BorgWarner stock opened at $32.31 on Friday. The company has a market cap of $7.10 billion, a PE ratio of 22.59, a P/E/G ratio of 0.77 and a beta of 1.10. The company has a fifty day moving average price of $29.69 and a two-hundred day moving average price of $30.75. The company has a debt-to-equity ratio of 0.66, a current ratio of 1.79 and a quick ratio of 1.45. BorgWarner Inc. has a 12 month low of $24.40 and a 12 month high of $37.29.

BorgWarner (NYSE:BWA - Get Free Report) last released its quarterly earnings data on Wednesday, May 7th. The auto parts company reported $1.11 EPS for the quarter, topping analysts' consensus estimates of $0.98 by $0.13. The firm had revenue of $3.52 billion during the quarter, compared to the consensus estimate of $3.39 billion. BorgWarner had a net margin of 2.40% and a return on equity of 15.93%. The firm's revenue was down 2.2% on a year-over-year basis. During the same quarter in the previous year, the company posted $1.03 earnings per share. Research analysts expect that BorgWarner Inc. will post 4.28 earnings per share for the current year.

BorgWarner Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, June 16th. Stockholders of record on Monday, June 2nd will be issued a dividend of $0.11 per share. This represents a $0.44 annualized dividend and a dividend yield of 1.36%. BorgWarner's dividend payout ratio (DPR) is 35.20%.

Analyst Ratings Changes

Several research analysts recently commented on BWA shares. Piper Sandler restated an "overweight" rating and issued a $37.00 price target (up previously from $36.00) on shares of BorgWarner in a report on Thursday, May 22nd. BNP Paribas upgraded shares of BorgWarner from a "neutral" rating to an "outperform" rating and set a $36.00 price objective on the stock in a research note on Tuesday, March 18th. Wall Street Zen upgraded shares of BorgWarner from a "hold" rating to a "buy" rating in a research note on Thursday, April 24th. Barclays dropped their price objective on shares of BorgWarner from $42.00 to $35.00 and set an "overweight" rating on the stock in a research note on Tuesday, April 15th. Finally, TD Cowen lowered shares of BorgWarner from a "buy" rating to a "hold" rating and set a $31.00 price objective on the stock. in a research note on Friday, March 7th. Seven research analysts have rated the stock with a hold rating and eleven have issued a buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $37.73.

Check Out Our Latest Stock Analysis on BorgWarner

BorgWarner Company Profile

(

Free Report)

BorgWarner Inc, together with its subsidiaries, provides solutions for combustion, hybrid, and electric vehicles worldwide. It offers turbochargers, eBoosters, eTurbos, timing systems, emissions systems, thermal systems, gasoline ignition technology, smart remote actuators, powertrain sensors, cabin heaters, battery modules and systems, battery heaters, and battery charging.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BorgWarner, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BorgWarner wasn't on the list.

While BorgWarner currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report