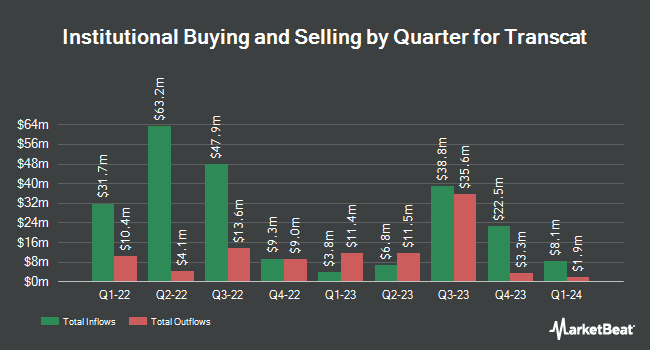

Riverbridge Partners LLC lessened its position in Transcat, Inc. (NASDAQ:TRNS - Free Report) by 7.4% in the first quarter, according to its most recent disclosure with the SEC. The firm owned 226,820 shares of the scientific and technical instruments company's stock after selling 18,221 shares during the period. Riverbridge Partners LLC owned approximately 2.44% of Transcat worth $16,887,000 as of its most recent filing with the SEC.

A number of other hedge funds have also recently added to or reduced their stakes in the company. Conestoga Capital Advisors LLC grew its stake in Transcat by 5.8% in the first quarter. Conestoga Capital Advisors LLC now owns 957,254 shares of the scientific and technical instruments company's stock valued at $71,268,000 after acquiring an additional 52,328 shares during the period. Neuberger Berman Group LLC grew its stake in Transcat by 1.8% in the fourth quarter. Neuberger Berman Group LLC now owns 873,985 shares of the scientific and technical instruments company's stock valued at $92,415,000 after acquiring an additional 15,723 shares during the period. Champlain Investment Partners LLC grew its stake in Transcat by 35.7% in the fourth quarter. Champlain Investment Partners LLC now owns 555,650 shares of the scientific and technical instruments company's stock valued at $58,754,000 after acquiring an additional 146,150 shares during the period. T. Rowe Price Investment Management Inc. grew its stake in Transcat by 178.0% in the fourth quarter. T. Rowe Price Investment Management Inc. now owns 518,597 shares of the scientific and technical instruments company's stock valued at $54,837,000 after acquiring an additional 332,064 shares during the period. Finally, Geode Capital Management LLC lifted its holdings in shares of Transcat by 0.9% in the fourth quarter. Geode Capital Management LLC now owns 219,354 shares of the scientific and technical instruments company's stock valued at $23,200,000 after purchasing an additional 1,881 shares in the last quarter. Institutional investors and hedge funds own 98.34% of the company's stock.

Wall Street Analyst Weigh In

TRNS has been the topic of a number of recent research reports. Wall Street Zen upgraded Transcat from a "sell" rating to a "hold" rating in a report on Wednesday, May 28th. HC Wainwright restated a "buy" rating and issued a $116.00 target price (up previously from $106.00) on shares of Transcat in a report on Wednesday, May 21st. Three investment analysts have rated the stock with a hold rating and two have given a buy rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $114.00.

Get Our Latest Analysis on TRNS

Transcat Stock Down 0.3%

Shares of TRNS stock traded down $0.27 during trading hours on Monday, reaching $80.27. The company had a trading volume of 73,392 shares, compared to its average volume of 87,880. Transcat, Inc. has a 12 month low of $67.56 and a 12 month high of $147.12. The company has a debt-to-equity ratio of 0.11, a current ratio of 2.29 and a quick ratio of 1.87. The business has a fifty day simple moving average of $82.66 and a 200-day simple moving average of $86.02. The company has a market cap of $748.12 million, a price-to-earnings ratio of 51.46 and a beta of 0.75.

Transcat (NASDAQ:TRNS - Get Free Report) last issued its quarterly earnings results on Monday, May 19th. The scientific and technical instruments company reported $0.64 EPS for the quarter, missing analysts' consensus estimates of $0.66 by ($0.02). The business had revenue of $77.13 million for the quarter, compared to the consensus estimate of $76.40 million. Transcat had a return on equity of 6.47% and a net margin of 5.21%. The company's quarterly revenue was up 8.8% compared to the same quarter last year. On average, research analysts expect that Transcat, Inc. will post 2.3 earnings per share for the current fiscal year.

Transcat Profile

(

Free Report)

Transcat, Inc provides calibration and laboratory instrument services in the United States, Canada, and internationally. It operates through two segments: Service and Distribution. The Service segment offers calibration, repair, inspection, analytical qualification, preventative maintenance, consulting, and other related services.

Recommended Stories

Before you consider Transcat, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transcat wasn't on the list.

While Transcat currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.