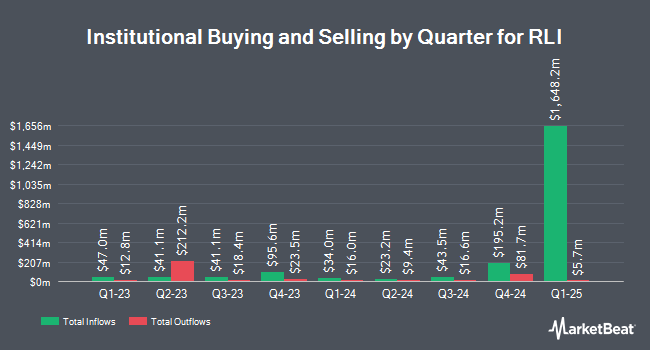

Palisade Capital Management LP increased its holdings in RLI Corp. (NYSE:RLI - Free Report) by 89.4% in the 1st quarter, according to its most recent 13F filing with the SEC. The firm owned 574,807 shares of the insurance provider's stock after buying an additional 271,260 shares during the period. RLI comprises approximately 1.3% of Palisade Capital Management LP's holdings, making the stock its 8th biggest position. Palisade Capital Management LP owned 0.63% of RLI worth $46,174,000 as of its most recent SEC filing.

Other institutional investors have also modified their holdings of the company. Vanguard Group Inc. increased its position in RLI by 0.9% in the fourth quarter. Vanguard Group Inc. now owns 4,608,243 shares of the insurance provider's stock worth $759,577,000 after buying an additional 41,884 shares during the period. Neuberger Berman Group LLC grew its position in shares of RLI by 1.5% during the fourth quarter. Neuberger Berman Group LLC now owns 1,331,526 shares of the insurance provider's stock worth $219,475,000 after acquiring an additional 19,695 shares during the last quarter. Geode Capital Management LLC increased its holdings in shares of RLI by 12.8% in the 4th quarter. Geode Capital Management LLC now owns 1,024,518 shares of the insurance provider's stock worth $168,907,000 after acquiring an additional 116,088 shares during the period. Dimensional Fund Advisors LP lifted its position in RLI by 0.8% in the 4th quarter. Dimensional Fund Advisors LP now owns 941,185 shares of the insurance provider's stock valued at $155,136,000 after purchasing an additional 7,609 shares during the last quarter. Finally, Port Capital LLC boosted its stake in RLI by 0.9% during the 4th quarter. Port Capital LLC now owns 766,668 shares of the insurance provider's stock valued at $126,370,000 after purchasing an additional 6,680 shares during the period. Institutional investors own 77.89% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages have commented on RLI. JMP Securities restated a "market perform" rating on shares of RLI in a research note on Thursday, April 24th. Keefe, Bruyette & Woods decreased their price objective on RLI from $95.00 to $85.00 and set an "outperform" rating for the company in a report on Wednesday, April 9th. Wall Street Zen raised RLI from a "sell" rating to a "hold" rating in a research note on Tuesday, May 6th. Finally, Compass Point lowered RLI from a "strong-buy" rating to a "hold" rating in a research report on Friday, April 25th. One research analyst has rated the stock with a sell rating, five have assigned a hold rating and two have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Hold" and an average target price of $78.60.

Get Our Latest Report on RLI

RLI Price Performance

Shares of RLI stock traded up $1.27 on Friday, hitting $71.70. The company had a trading volume of 559,230 shares, compared to its average volume of 387,894. RLI Corp. has a 52 week low of $68.50 and a 52 week high of $91.15. The company has a debt-to-equity ratio of 0.06, a current ratio of 0.35 and a quick ratio of 0.35. The company has a market cap of $6.58 billion, a PE ratio of 23.59 and a beta of 0.67. The business has a 50-day simple moving average of $73.94 and a 200-day simple moving average of $76.04.

RLI (NYSE:RLI - Get Free Report) last released its earnings results on Wednesday, April 23rd. The insurance provider reported $0.92 earnings per share for the quarter, topping analysts' consensus estimates of $0.88 by $0.04. The firm had revenue of $36.73 million during the quarter, compared to the consensus estimate of $442.20 million. RLI had a return on equity of 16.26% and a net margin of 16.22%. The firm's revenue for the quarter was down 8.3% compared to the same quarter last year. During the same period in the prior year, the firm posted $0.95 earnings per share. Research analysts expect that RLI Corp. will post 3.08 EPS for the current fiscal year.

RLI Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, June 20th. Stockholders of record on Friday, May 30th were paid a $0.16 dividend. This represents a $0.64 dividend on an annualized basis and a dividend yield of 0.89%. The ex-dividend date of this dividend was Friday, May 30th. This is an increase from RLI's previous quarterly dividend of $0.15. RLI's payout ratio is currently 21.05%.

RLI Company Profile

(

Free Report)

RLI Corp., an insurance holding company, underwrites property and casualty insurance. Its Casualty segment provides commercial and personal coverage products; and general liability products, such as coverage for third-party liability of commercial insureds, including manufacturers, contractors, apartments, and mercantile.

Read More

Before you consider RLI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RLI wasn't on the list.

While RLI currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.