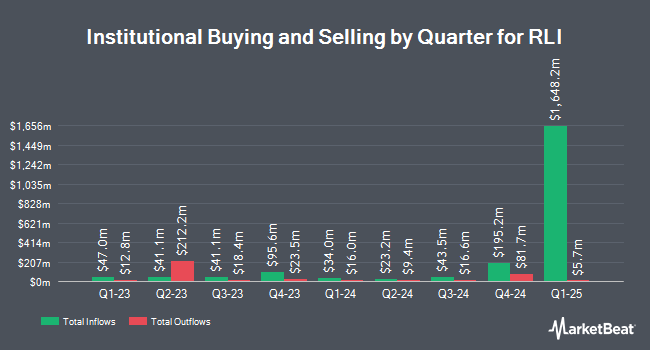

Bruce & Co. Inc. raised its position in RLI Corp. (NYSE:RLI - Free Report) by 100.0% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 40,800 shares of the insurance provider's stock after purchasing an additional 20,400 shares during the quarter. RLI comprises 1.1% of Bruce & Co. Inc.'s investment portfolio, making the stock its 20th biggest position. Bruce & Co. Inc.'s holdings in RLI were worth $3,277,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds also recently bought and sold shares of the company. Martingale Asset Management L P boosted its holdings in RLI by 111.0% in the 1st quarter. Martingale Asset Management L P now owns 24,184 shares of the insurance provider's stock valued at $1,943,000 after purchasing an additional 12,722 shares during the last quarter. T. Rowe Price Investment Management Inc. increased its position in shares of RLI by 155.7% during the first quarter. T. Rowe Price Investment Management Inc. now owns 1,488,514 shares of the insurance provider's stock valued at $119,573,000 after acquiring an additional 906,375 shares during the last quarter. Erste Asset Management GmbH increased its position in shares of RLI by 95.6% during the first quarter. Erste Asset Management GmbH now owns 90,979 shares of the insurance provider's stock valued at $7,281,000 after acquiring an additional 44,465 shares during the last quarter. Hsbc Holdings PLC increased its position in shares of RLI by 255.2% during the first quarter. Hsbc Holdings PLC now owns 11,321 shares of the insurance provider's stock valued at $909,000 after acquiring an additional 8,134 shares during the last quarter. Finally, Quantbot Technologies LP acquired a new stake in shares of RLI during the first quarter valued at about $1,158,000. 77.89% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Separately, Wall Street Zen upgraded shares of RLI from a "sell" rating to a "hold" rating in a research report on Saturday, July 26th. Two research analysts have rated the stock with a Buy rating, four have issued a Hold rating and one has assigned a Sell rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $78.60.

View Our Latest Stock Report on RLI

RLI Trading Up 0.2%

Shares of RLI traded up $0.1550 during trading on Friday, reaching $68.5550. 320,389 shares of the company traded hands, compared to its average volume of 610,004. RLI Corp. has a twelve month low of $65.14 and a twelve month high of $91.14. The stock has a market cap of $6.30 billion, a PE ratio of 19.64 and a beta of 0.66. The stock has a 50-day simple moving average of $69.37 and a 200-day simple moving average of $73.53. The company has a quick ratio of 0.35, a current ratio of 0.35 and a debt-to-equity ratio of 0.06.

RLI (NYSE:RLI - Get Free Report) last announced its quarterly earnings data on Monday, July 21st. The insurance provider reported $0.84 earnings per share for the quarter, beating analysts' consensus estimates of $0.75 by $0.09. The firm had revenue of $562.28 million during the quarter, compared to analysts' expectations of $445.55 million. RLI had a net margin of 17.81% and a return on equity of 15.82%. The business's quarterly revenue was up 20.0% compared to the same quarter last year. During the same quarter in the previous year, the business posted $1.72 earnings per share. On average, analysts anticipate that RLI Corp. will post 3.08 earnings per share for the current year.

RLI Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, September 19th. Shareholders of record on Friday, August 29th will be paid a $0.16 dividend. The ex-dividend date is Friday, August 29th. This represents a $0.64 annualized dividend and a dividend yield of 0.9%. RLI's payout ratio is 18.34%.

Insider Activity at RLI

In other RLI news, COO Jennifer L. Klobnak purchased 3,000 shares of the company's stock in a transaction on Thursday, July 24th. The stock was acquired at an average price of $69.15 per share, for a total transaction of $207,450.00. Following the completion of the purchase, the chief operating officer directly owned 98,450 shares in the company, valued at approximately $6,807,817.50. The trade was a 3.14% increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 2.16% of the stock is currently owned by company insiders.

RLI Company Profile

(

Free Report)

RLI Corp., an insurance holding company, underwrites property and casualty insurance. Its Casualty segment provides commercial and personal coverage products; and general liability products, such as coverage for third-party liability of commercial insureds, including manufacturers, contractors, apartments, and mercantile.

Read More

Before you consider RLI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RLI wasn't on the list.

While RLI currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.