Royal Bank of Canada lessened its holdings in shares of Compass Diversified Holdings (NYSE:CODI - Free Report) by 14.6% during the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 629,710 shares of the financial services provider's stock after selling 107,453 shares during the period. Royal Bank of Canada owned 0.84% of Compass Diversified worth $11,758,000 as of its most recent SEC filing.

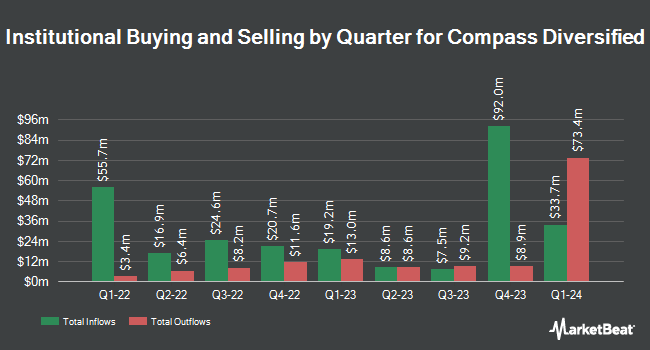

A number of other hedge funds have also bought and sold shares of CODI. State of Wyoming bought a new position in Compass Diversified in the 1st quarter worth approximately $51,000. Gamco Investors INC. ET AL grew its stake in Compass Diversified by 38.5% in the first quarter. Gamco Investors INC. ET AL now owns 36,359 shares of the financial services provider's stock valued at $679,000 after purchasing an additional 10,108 shares during the last quarter. AlphaQuest LLC grew its stake in Compass Diversified by 1,009.2% in the first quarter. AlphaQuest LLC now owns 15,951 shares of the financial services provider's stock valued at $298,000 after purchasing an additional 14,513 shares during the last quarter. BI Asset Management Fondsmaeglerselskab A S acquired a new stake in Compass Diversified in the first quarter worth about $95,000. Finally, Quantbot Technologies LP lifted its holdings in shares of Compass Diversified by 148.6% during the first quarter. Quantbot Technologies LP now owns 27,289 shares of the financial services provider's stock worth $509,000 after purchasing an additional 16,311 shares during the period. Hedge funds and other institutional investors own 72.73% of the company's stock.

Analyst Ratings Changes

CODI has been the subject of several research analyst reports. Wall Street Zen downgraded Compass Diversified from a "buy" rating to a "hold" rating in a research note on Friday, August 22nd. Jefferies Financial Group lowered Compass Diversified to a "hold" rating in a research report on Friday, June 6th. Two analysts have rated the stock with a Buy rating and two have given a Hold rating to the company. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $26.00.

Get Our Latest Report on Compass Diversified

Compass Diversified Stock Down 1.9%

CODI traded down $0.14 on Wednesday, reaching $7.16. The company's stock had a trading volume of 971,011 shares, compared to its average volume of 623,239. The company has a debt-to-equity ratio of 1.54, a current ratio of 4.07 and a quick ratio of 1.57. The business's 50 day moving average is $6.95 and its 200 day moving average is $10.74. Compass Diversified Holdings has a 1 year low of $5.98 and a 1 year high of $24.32. The stock has a market cap of $538.94 million, a price-to-earnings ratio of -5.60 and a beta of 1.04.

Compass Diversified Company Profile

(

Free Report)

Compass Diversified is a private equity firm specializing in add on acquisitions, buyouts, industry consolidation, recapitalization, late stage and middle market investments. It seeks to invest in niche industrial or branded consumer companies, manufacturing, distribution, consumer products, business services sector, healthcare, safety & security, electronic components, food and foodservice.

Featured Articles

Before you consider Compass Diversified, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Compass Diversified wasn't on the list.

While Compass Diversified currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.