Royce & Associates LP increased its holdings in shares of Alkami Technology, Inc. (NASDAQ:ALKT - Free Report) by 38.9% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 298,542 shares of the company's stock after acquiring an additional 83,532 shares during the quarter. Royce & Associates LP owned about 0.29% of Alkami Technology worth $7,837,000 as of its most recent SEC filing.

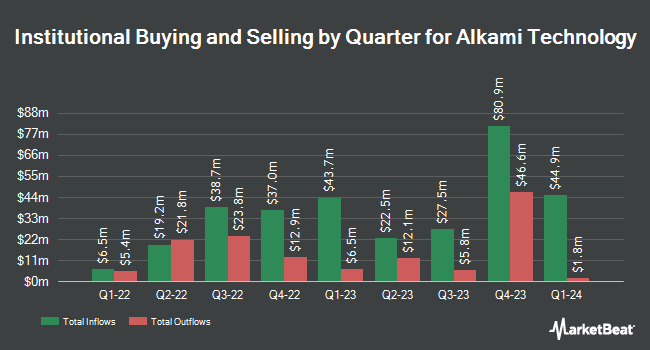

A number of other institutional investors have also made changes to their positions in ALKT. Perkins Coie Trust Co increased its holdings in shares of Alkami Technology by 62.5% during the 1st quarter. Perkins Coie Trust Co now owns 1,300 shares of the company's stock worth $34,000 after acquiring an additional 500 shares during the last quarter. Versant Capital Management Inc acquired a new position in shares of Alkami Technology during the 1st quarter worth approximately $36,000. Amalgamated Bank increased its holdings in shares of Alkami Technology by 50.8% during the 1st quarter. Amalgamated Bank now owns 2,091 shares of the company's stock worth $55,000 after acquiring an additional 704 shares during the last quarter. NBC Securities Inc. increased its holdings in shares of Alkami Technology by 114,550.0% during the 1st quarter. NBC Securities Inc. now owns 2,293 shares of the company's stock worth $60,000 after acquiring an additional 2,291 shares during the last quarter. Finally, Quarry LP acquired a new position in shares of Alkami Technology during the 4th quarter worth approximately $61,000. 54.97% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling at Alkami Technology

In other Alkami Technology news, CFO W Bryan Hill sold 20,365 shares of the stock in a transaction dated Monday, June 2nd. The stock was sold at an average price of $28.36, for a total value of $577,551.40. Following the completion of the transaction, the chief financial officer directly owned 430,255 shares in the company, valued at approximately $12,202,031.80. This trade represents a 4.52% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Joseph P. Payne bought 8,200 shares of the company's stock in a transaction on Thursday, May 15th. The stock was purchased at an average price of $30.46 per share, with a total value of $249,772.00. Following the completion of the transaction, the director directly owned 21,128 shares of the company's stock, valued at approximately $643,558.88. The trade was a 63.43% increase in their position. The disclosure for this purchase can be found here. Over the last three months, insiders sold 27,690 shares of company stock worth $785,288. 18.10% of the stock is currently owned by insiders.

Alkami Technology Price Performance

NASDAQ:ALKT traded down $0.19 during trading hours on Wednesday, hitting $26.43. The company's stock had a trading volume of 191,039 shares, compared to its average volume of 1,091,469. The stock has a fifty day simple moving average of $28.93 and a 200-day simple moving average of $29.16. The company has a market capitalization of $2.72 billion, a P/E ratio of -69.48 and a beta of 0.59. The company has a debt-to-equity ratio of 1.23, a current ratio of 2.75 and a quick ratio of 2.75. Alkami Technology, Inc. has a twelve month low of $21.70 and a twelve month high of $42.29.

Analyst Ratings Changes

ALKT has been the topic of a number of research reports. JMP Securities reaffirmed a "market outperform" rating and issued a $46.00 price objective on shares of Alkami Technology in a report on Thursday, May 1st. Lake Street Capital reduced their target price on Alkami Technology from $47.00 to $41.00 and set a "buy" rating on the stock in a report on Thursday, May 1st. Needham & Company LLC reduced their target price on Alkami Technology from $54.00 to $40.00 and set a "buy" rating on the stock in a report on Thursday, May 1st. Barclays reduced their target price on Alkami Technology from $35.00 to $30.00 and set an "equal weight" rating on the stock in a report on Monday, April 14th. Finally, JPMorgan Chase & Co. began coverage on Alkami Technology in a report on Wednesday, June 18th. They set an "overweight" rating and a $40.00 target price on the stock. Two equities research analysts have rated the stock with a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $39.25.

Read Our Latest Analysis on Alkami Technology

Alkami Technology Company Profile

(

Free Report)

Alkami Technology, Inc offers cloud-based digital banking solutions in the United States. The company's Alkami Platform allows financial institutions to onboard and engage new users, accelerate revenues, and enhance operational efficiency, with the support of a proprietary, cloud-based, and multi-tenant architecture.

Featured Stories

Before you consider Alkami Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alkami Technology wasn't on the list.

While Alkami Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.