Royce & Associates LP boosted its holdings in shares of Ichor Holdings, Ltd. (NASDAQ:ICHR - Free Report) by 7.9% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 932,925 shares of the technology company's stock after acquiring an additional 68,680 shares during the period. Royce & Associates LP owned approximately 2.73% of Ichor worth $21,093,000 as of its most recent filing with the Securities and Exchange Commission.

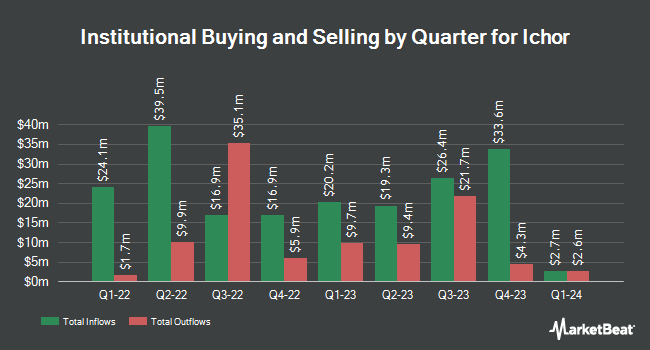

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. Universal Beteiligungs und Servicegesellschaft mbH lifted its holdings in Ichor by 139.3% during the first quarter. Universal Beteiligungs und Servicegesellschaft mbH now owns 109,505 shares of the technology company's stock worth $2,476,000 after acquiring an additional 63,744 shares in the last quarter. Y Intercept Hong Kong Ltd lifted its holdings in shares of Ichor by 11.2% in the first quarter. Y Intercept Hong Kong Ltd now owns 10,525 shares of the technology company's stock valued at $238,000 after purchasing an additional 1,061 shares in the last quarter. Jackson Creek Investment Advisors LLC bought a new stake in shares of Ichor in the first quarter valued at about $1,111,000. Tectonic Advisors LLC lifted its position in Ichor by 4.6% during the 1st quarter. Tectonic Advisors LLC now owns 37,236 shares of the technology company's stock worth $842,000 after buying an additional 1,643 shares in the last quarter. Finally, Cerity Partners LLC boosted its stake in shares of Ichor by 5.9% during the 1st quarter. Cerity Partners LLC now owns 9,521 shares of the technology company's stock worth $215,000 after buying an additional 533 shares during the last quarter. 94.81% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several analysts recently issued reports on the company. TD Cowen dropped their target price on Ichor from $38.00 to $28.00 and set a "buy" rating on the stock in a report on Tuesday, May 6th. B. Riley reiterated a "buy" rating and set a $30.00 target price (up previously from $23.00) on shares of Ichor in a report on Friday, July 11th. DA Davidson dropped their target price on Ichor from $50.00 to $45.00 and set a "buy" rating on the stock in a report on Tuesday, May 6th. Wall Street Zen downgraded Ichor from a "hold" rating to a "sell" rating in a research report on Thursday, April 10th. Finally, Needham & Company LLC reaffirmed a "hold" rating on shares of Ichor in a research report on Tuesday, May 6th. One research analyst has rated the stock with a sell rating, two have assigned a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $32.67.

View Our Latest Report on Ichor

Insiders Place Their Bets

In related news, CEO Jeff Andreson acquired 10,000 shares of the firm's stock in a transaction that occurred on Thursday, May 8th. The stock was acquired at an average cost of $16.86 per share, for a total transaction of $168,600.00. Following the completion of the acquisition, the chief executive officer directly owned 285,594 shares of the company's stock, valued at approximately $4,815,114.84. This trade represents a 3.63% increase in their position. The acquisition was disclosed in a filing with the SEC, which is available at the SEC website. 1.90% of the stock is owned by insiders.

Ichor Price Performance

NASDAQ ICHR traded up $0.90 on Monday, hitting $21.56. 69,766 shares of the company's stock were exchanged, compared to its average volume of 389,572. The stock has a 50-day moving average of $19.53 and a 200-day moving average of $23.21. The company has a current ratio of 3.09, a quick ratio of 1.32 and a debt-to-equity ratio of 0.17. Ichor Holdings, Ltd. has a 52 week low of $15.33 and a 52 week high of $36.48. The stock has a market cap of $735.63 million, a price-to-earnings ratio of -44.95 and a beta of 1.80.

Ichor (NASDAQ:ICHR - Get Free Report) last announced its quarterly earnings results on Monday, May 5th. The technology company reported $0.12 EPS for the quarter, missing analysts' consensus estimates of $0.26 by ($0.14). Ichor had a negative net margin of 1.84% and a negative return on equity of 0.63%. The firm had revenue of $244.47 million during the quarter, compared to the consensus estimate of $244.95 million. During the same quarter in the previous year, the company posted ($0.09) earnings per share. The firm's revenue was up 21.4% on a year-over-year basis. Analysts expect that Ichor Holdings, Ltd. will post 1.01 earnings per share for the current year.

About Ichor

(

Free Report)

Ichor Holdings, Ltd. engages in the design, engineering, and manufacture of fluid delivery subsystems and components for semiconductor capital equipment in the United States and internationally. It primarily offers gas and chemical delivery systems and subsystems that are used in the manufacturing of semiconductor devices.

Featured Articles

Before you consider Ichor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ichor wasn't on the list.

While Ichor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.