Royce & Associates LP lessened its stake in shares of Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS - Free Report) by 11.9% during the 1st quarter, according to its most recent disclosure with the SEC. The institutional investor owned 771,454 shares of the aerospace company's stock after selling 104,326 shares during the period. Royce & Associates LP owned about 0.50% of Kratos Defense & Security Solutions worth $22,904,000 as of its most recent filing with the SEC.

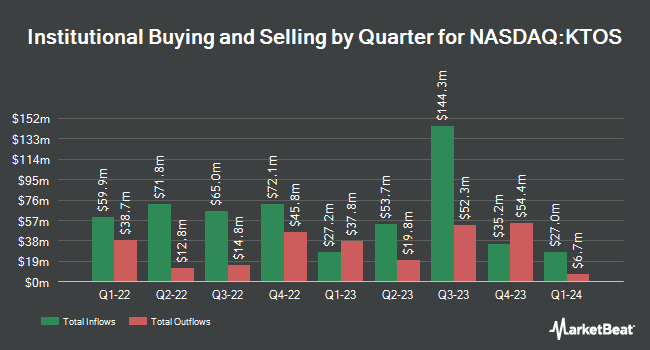

Several other institutional investors and hedge funds have also bought and sold shares of the stock. Montag A & Associates Inc. raised its stake in Kratos Defense & Security Solutions by 3.8% in the first quarter. Montag A & Associates Inc. now owns 12,449 shares of the aerospace company's stock valued at $370,000 after buying an additional 450 shares during the period. Salem Investment Counselors Inc. raised its stake in Kratos Defense & Security Solutions by 5.6% in the first quarter. Salem Investment Counselors Inc. now owns 8,975 shares of the aerospace company's stock valued at $266,000 after buying an additional 475 shares during the period. Summit Investment Advisors Inc. raised its stake in Kratos Defense & Security Solutions by 3.3% in the fourth quarter. Summit Investment Advisors Inc. now owns 15,479 shares of the aerospace company's stock valued at $408,000 after buying an additional 490 shares during the period. Moran Wealth Management LLC raised its stake in Kratos Defense & Security Solutions by 3.0% in the first quarter. Moran Wealth Management LLC now owns 17,441 shares of the aerospace company's stock valued at $518,000 after buying an additional 506 shares during the period. Finally, KBC Group NV raised its stake in Kratos Defense & Security Solutions by 9.5% in the first quarter. KBC Group NV now owns 6,993 shares of the aerospace company's stock valued at $208,000 after buying an additional 607 shares during the period. Institutional investors own 75.92% of the company's stock.

Analyst Ratings Changes

Several analysts have issued reports on the company. Royal Bank Of Canada upped their price objective on Kratos Defense & Security Solutions from $38.00 to $50.00 and gave the company an "outperform" rating in a research note on Thursday, July 3rd. Wall Street Zen lowered Kratos Defense & Security Solutions from a "hold" rating to a "sell" rating in a research note on Thursday, May 22nd. Cantor Fitzgerald reaffirmed an "overweight" rating on shares of Kratos Defense & Security Solutions in a research report on Friday, July 18th. Noble Financial reaffirmed an "outperform" rating on shares of Kratos Defense & Security Solutions in a research report on Monday, July 14th. Finally, Truist Financial upped their target price on Kratos Defense & Security Solutions from $38.00 to $52.00 and gave the company a "buy" rating in a research report on Friday, June 27th. One investment analyst has rated the stock with a sell rating, two have issued a hold rating and eleven have given a buy rating to the company. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $50.08.

View Our Latest Report on Kratos Defense & Security Solutions

Kratos Defense & Security Solutions Price Performance

NASDAQ KTOS traded up $1.11 on Friday, hitting $59.77. 2,454,880 shares of the company's stock were exchanged, compared to its average volume of 5,779,339. The stock has a 50-day moving average of $44.20 and a 200-day moving average of $35.80. The company has a current ratio of 2.84, a quick ratio of 2.26 and a debt-to-equity ratio of 0.17. Kratos Defense & Security Solutions, Inc. has a 52 week low of $17.91 and a 52 week high of $61.43. The stock has a market cap of $9.17 billion, a price-to-earnings ratio of 459.80 and a beta of 1.06.

Kratos Defense & Security Solutions (NASDAQ:KTOS - Get Free Report) last released its earnings results on Wednesday, May 7th. The aerospace company reported $0.12 earnings per share for the quarter, topping the consensus estimate of $0.09 by $0.03. Kratos Defense & Security Solutions had a return on equity of 3.85% and a net margin of 1.68%. The firm had revenue of $302.60 million during the quarter, compared to analysts' expectations of $292.25 million. During the same period in the prior year, the company earned $0.11 earnings per share. The company's quarterly revenue was up 9.2% on a year-over-year basis. Analysts expect that Kratos Defense & Security Solutions, Inc. will post 0.31 earnings per share for the current year.

Insider Buying and Selling

In other news, insider Jonah Adelman sold 40,000 shares of the stock in a transaction on Tuesday, May 13th. The stock was sold at an average price of $33.76, for a total value of $1,350,400.00. Following the completion of the transaction, the insider directly owned 39,348 shares in the company, valued at approximately $1,328,388.48. This represents a 50.41% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Steven S. Fendley sold 15,000 shares of the stock in a transaction on Wednesday, May 21st. The shares were sold at an average price of $34.37, for a total value of $515,550.00. Following the completion of the transaction, the insider owned 384,492 shares of the company's stock, valued at $13,214,990.04. The trade was a 3.75% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 151,572 shares of company stock worth $5,586,226 in the last ninety days. Insiders own 2.37% of the company's stock.

About Kratos Defense & Security Solutions

(

Free Report)

Kratos Defense & Security Solutions, Inc engages in the provision of mission critical products, services and solutions for United States national security priorities. It operates through the Kratos Government Solutions (KGS) and Unmanned Systems (US) segments. The KGS segment consists of an aggregation of KGS operating segments, including microwave electronic products, space, satellite and cyber, training solutions.

Featured Articles

Before you consider Kratos Defense & Security Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kratos Defense & Security Solutions wasn't on the list.

While Kratos Defense & Security Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.