RPG Investment Advisory LLC increased its holdings in Fortinet, Inc. (NASDAQ:FTNT - Free Report) by 99.6% during the 1st quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 421,606 shares of the software maker's stock after acquiring an additional 210,371 shares during the quarter. Fortinet makes up 2.9% of RPG Investment Advisory LLC's portfolio, making the stock its 6th biggest position. RPG Investment Advisory LLC owned 0.06% of Fortinet worth $40,584,000 as of its most recent SEC filing.

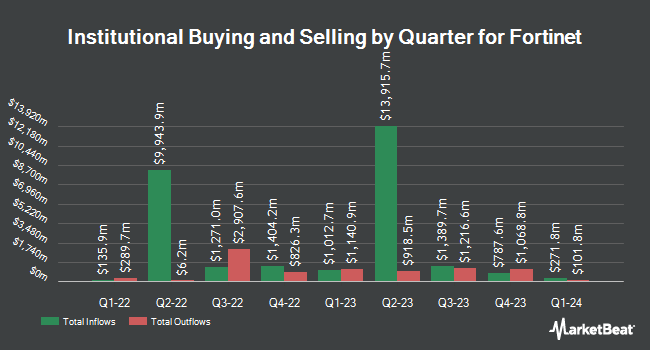

Several other institutional investors have also modified their holdings of the business. Vanguard Group Inc. lifted its stake in shares of Fortinet by 5.2% in the first quarter. Vanguard Group Inc. now owns 71,662,404 shares of the software maker's stock worth $6,898,223,000 after acquiring an additional 3,546,934 shares in the last quarter. Invesco Ltd. lifted its stake in shares of Fortinet by 2.2% in the first quarter. Invesco Ltd. now owns 8,570,528 shares of the software maker's stock worth $824,999,000 after acquiring an additional 181,835 shares in the last quarter. Northern Trust Corp lifted its stake in shares of Fortinet by 0.8% in the first quarter. Northern Trust Corp now owns 6,519,558 shares of the software maker's stock worth $627,573,000 after acquiring an additional 49,238 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its stake in shares of Fortinet by 3.5% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 5,990,190 shares of the software maker's stock worth $565,953,000 after acquiring an additional 202,259 shares in the last quarter. Finally, Goldman Sachs Group Inc. increased its holdings in Fortinet by 8.3% in the first quarter. Goldman Sachs Group Inc. now owns 5,106,259 shares of the software maker's stock valued at $491,528,000 after buying an additional 389,718 shares during the last quarter. Institutional investors and hedge funds own 83.71% of the company's stock.

Insiders Place Their Bets

In other news, CEO Ken Xie sold 158,486 shares of the stock in a transaction on Monday, August 4th. The stock was sold at an average price of $98.48, for a total transaction of $15,607,701.28. Following the completion of the sale, the chief executive officer owned 51,391,879 shares in the company, valued at approximately $5,061,072,243.92. This represents a 0.31% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, VP Michael Xie sold 476,596 shares of the stock in a transaction on Monday, August 4th. The shares were sold at an average price of $98.48, for a total value of $46,935,174.08. Following the sale, the vice president owned 9,730,560 shares of the company's stock, valued at $958,265,548.80. This trade represents a 4.67% decrease in their position. The disclosure for this sale can be found here. 17.20% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

FTNT has been the subject of several research analyst reports. Morgan Stanley lowered Fortinet from an "overweight" rating to a "reduce" rating and lowered their price objective for the company from $110.00 to $78.00 in a report on Thursday, August 7th. KeyCorp lowered Fortinet from an "overweight" rating to a "sector weight" rating in a report on Thursday, August 7th. Barclays lowered their price objective on Fortinet from $110.00 to $90.00 and set an "equal weight" rating for the company in a report on Thursday, August 7th. Mizuho lowered their price objective on Fortinet from $87.00 to $75.00 and set an "underperform" rating for the company in a report on Thursday, August 7th. Finally, Citigroup reissued a "neutral" rating and issued a $85.00 price objective (down from $110.00) on shares of Fortinet in a report on Monday. Two analysts have rated the stock with a Strong Buy rating, eight have given a Buy rating, twenty-five have given a Hold rating and two have assigned a Sell rating to the company. According to MarketBeat, Fortinet has an average rating of "Hold" and an average price target of $97.40.

Check Out Our Latest Stock Report on FTNT

Fortinet Stock Down 2.3%

NASDAQ:FTNT opened at $77.75 on Friday. The company has a current ratio of 1.33, a quick ratio of 1.24 and a debt-to-equity ratio of 0.24. The stock has a 50 day moving average of $97.40 and a 200-day moving average of $100.31. The firm has a market capitalization of $59.58 billion, a PE ratio of 30.98, a price-to-earnings-growth ratio of 3.02 and a beta of 1.07. Fortinet, Inc. has a 52 week low of $70.12 and a 52 week high of $114.82.

Fortinet (NASDAQ:FTNT - Get Free Report) last issued its quarterly earnings data on Wednesday, August 6th. The software maker reported $0.64 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.59 by $0.05. The business had revenue of $1.63 billion during the quarter, compared to the consensus estimate of $1.63 billion. Fortinet had a return on equity of 111.46% and a net margin of 30.60%.The business's revenue was up 13.6% on a year-over-year basis. During the same period in the previous year, the firm posted $0.57 earnings per share. Analysts predict that Fortinet, Inc. will post 2.09 EPS for the current year.

Fortinet Company Profile

(

Free Report)

Fortinet, Inc provides cybersecurity and convergence of networking and security solutions worldwide. It offers secure networking solutions focus on the convergence of networking and security; network firewall solutions that consist of FortiGate data centers, hyperscale, and distributed firewalls, as well as encrypted applications; wireless LAN solutions; and secure connectivity solutions, including FortiSwitch secure ethernet switches, FortiAP wireless local area network access points, FortiExtender 5G connectivity gateways, and other products.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fortinet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortinet wasn't on the list.

While Fortinet currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report