RR Advisors LLC bought a new stake in shares of Cipher Mining Inc. (NASDAQ:CIFR - Free Report) during the first quarter, according to the company in its most recent filing with the SEC. The institutional investor bought 269,000 shares of the company's stock, valued at approximately $619,000. Cipher Mining comprises about 0.1% of RR Advisors LLC's holdings, making the stock its 27th biggest position. RR Advisors LLC owned about 0.07% of Cipher Mining at the end of the most recent reporting period.

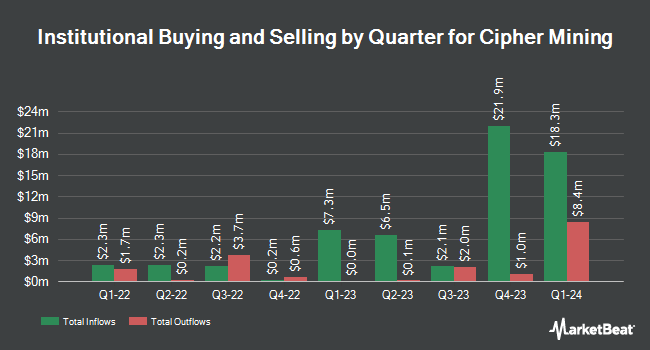

Several other hedge funds also recently bought and sold shares of the stock. American Century Companies Inc. boosted its stake in shares of Cipher Mining by 5.8% during the first quarter. American Century Companies Inc. now owns 481,571 shares of the company's stock valued at $1,108,000 after acquiring an additional 26,530 shares during the last quarter. HighTower Advisors LLC boosted its stake in shares of Cipher Mining by 309.4% during the 1st quarter. HighTower Advisors LLC now owns 73,810 shares of the company's stock worth $170,000 after purchasing an additional 55,782 shares during the last quarter. Swiss National Bank boosted its stake in shares of Cipher Mining by 4.2% during the 1st quarter. Swiss National Bank now owns 471,700 shares of the company's stock worth $1,085,000 after purchasing an additional 18,900 shares during the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. grew its holdings in shares of Cipher Mining by 11.2% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 42,701 shares of the company's stock worth $98,000 after buying an additional 4,287 shares in the last quarter. Finally, Deutsche Bank AG raised its position in shares of Cipher Mining by 3.9% in the first quarter. Deutsche Bank AG now owns 201,203 shares of the company's stock valued at $463,000 after buying an additional 7,526 shares during the last quarter. Hedge funds and other institutional investors own 12.26% of the company's stock.

Insider Activity

In other Cipher Mining news, major shareholder Holding Ltd V3 sold 500,000 shares of the business's stock in a transaction dated Monday, July 28th. The stock was sold at an average price of $6.19, for a total transaction of $3,095,000.00. Following the transaction, the insider owned 91,378,292 shares in the company, valued at $565,631,627.48. The trade was a 0.54% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, major shareholder Top Holdco B.V. Bitfury sold 667,010 shares of the stock in a transaction dated Monday, July 14th. The shares were sold at an average price of $6.11, for a total value of $4,075,431.10. Following the completion of the sale, the insider owned 93,667,437 shares of the company's stock, valued at approximately $572,308,040.07. This trade represents a 0.71% decrease in their position. The disclosure for this sale can be found here. Insiders sold 5,466,662 shares of company stock worth $33,020,046 over the last three months. 2.89% of the stock is currently owned by corporate insiders.

Cipher Mining Trading Down 1.1%

CIFR traded down $0.0650 on Wednesday, reaching $5.6950. 13,493,810 shares of the company's stock were exchanged, compared to its average volume of 21,113,414. Cipher Mining Inc. has a twelve month low of $1.86 and a twelve month high of $7.77. The company's 50 day moving average is $5.23 and its 200-day moving average is $4.14. The company has a debt-to-equity ratio of 0.23, a quick ratio of 4.18 and a current ratio of 4.18. The company has a market cap of $2.24 billion, a price-to-earnings ratio of -13.22 and a beta of 2.73.

Cipher Mining (NASDAQ:CIFR - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The company reported ($0.12) earnings per share (EPS) for the quarter, hitting the consensus estimate of ($0.12). Cipher Mining had a negative net margin of 96.95% and a negative return on equity of 21.71%. The company had revenue of $43.57 million during the quarter, compared to the consensus estimate of $51.89 million. Equities analysts predict that Cipher Mining Inc. will post -0.31 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of analysts recently issued reports on the stock. Canaccord Genuity Group raised their target price on shares of Cipher Mining from $8.00 to $9.00 and gave the stock a "buy" rating in a research report on Tuesday. HC Wainwright restated a "buy" rating on shares of Cipher Mining in a report on Tuesday, May 6th. Macquarie lifted their price objective on Cipher Mining from $6.00 to $8.00 and gave the company an "outperform" rating in a research report on Friday, August 8th. Rosenblatt Securities reiterated a "buy" rating and set a $5.50 target price on shares of Cipher Mining in a research report on Wednesday, May 7th. Finally, Jones Trading started coverage on Cipher Mining in a report on Monday, July 21st. They issued a "hold" rating for the company. One equities research analyst has rated the stock with a Strong Buy rating, nine have given a Buy rating and two have assigned a Hold rating to the company. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $7.67.

Read Our Latest Report on Cipher Mining

Cipher Mining Profile

(

Free Report)

Cipher Mining Inc, together with its subsidiaries, engages in the development and operation of industrial scale bitcoin mining data centers in the United States. The company was incorporated in 2020 and is based in New York, New York. Cipher Mining Inc operates as a subsidiary of Bitfury Holding B.V.

Featured Stories

Before you consider Cipher Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cipher Mining wasn't on the list.

While Cipher Mining currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.