Russell Investments Group Ltd. lowered its holdings in shares of CAVA Group, Inc. (NYSE:CAVA - Free Report) by 17.6% in the 1st quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 53,554 shares of the company's stock after selling 11,413 shares during the quarter. Russell Investments Group Ltd.'s holdings in CAVA Group were worth $4,628,000 as of its most recent filing with the Securities & Exchange Commission.

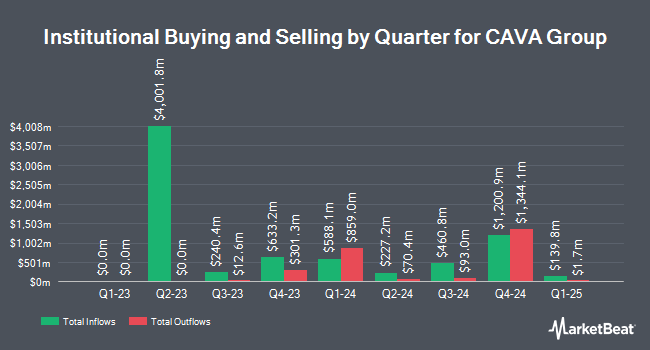

Other institutional investors have also recently made changes to their positions in the company. Trillium Asset Management LLC bought a new stake in CAVA Group during the first quarter valued at approximately $4,367,000. AGF Management Ltd. grew its position in shares of CAVA Group by 8.5% during the 1st quarter. AGF Management Ltd. now owns 98,381 shares of the company's stock valued at $8,501,000 after acquiring an additional 7,679 shares during the period. Financial Engines Advisors L.L.C. grew its position in shares of CAVA Group by 3.4% during the 1st quarter. Financial Engines Advisors L.L.C. now owns 23,934 shares of the company's stock valued at $2,068,000 after acquiring an additional 797 shares during the period. Independent Advisor Alliance increased its stake in shares of CAVA Group by 6.0% in the 1st quarter. Independent Advisor Alliance now owns 36,782 shares of the company's stock worth $3,178,000 after purchasing an additional 2,074 shares in the last quarter. Finally, Nuveen LLC bought a new position in CAVA Group in the 1st quarter worth $72,800,000. Institutional investors own 73.15% of the company's stock.

Insider Activity

In other CAVA Group news, insider Jennifer Somers sold 2,861 shares of the firm's stock in a transaction that occurred on Monday, June 16th. The stock was sold at an average price of $75.16, for a total transaction of $215,032.76. Following the completion of the transaction, the insider owned 137,048 shares in the company, valued at $10,300,527.68. This trade represents a 2.04% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, insider Theodoros Xenohristos sold 3,062 shares of the company's stock in a transaction that occurred on Monday, June 16th. The stock was sold at an average price of $75.16, for a total value of $230,139.92. Following the sale, the insider directly owned 350,209 shares in the company, valued at $26,321,708.44. This trade represents a 0.87% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 48,360 shares of company stock valued at $3,634,738. 6.80% of the stock is owned by corporate insiders.

Analyst Ratings Changes

CAVA has been the subject of several recent research reports. Cfra Research raised CAVA Group to a "strong-buy" rating in a report on Thursday, August 14th. UBS Group cut their price target on CAVA Group from $96.00 to $75.00 and set a "neutral" rating for the company in a report on Wednesday, August 13th. Robert W. Baird set a $95.00 price target on CAVA Group in a report on Wednesday, August 13th. Bank of America cut their price target on CAVA Group from $121.00 to $100.00 and set a "buy" rating for the company in a report on Wednesday, August 13th. Finally, Sanford C. Bernstein set a $74.00 price target on shares of CAVA Group in a report on Wednesday, August 13th. One equities research analyst has rated the stock with a Strong Buy rating, eleven have given a Buy rating and seven have assigned a Hold rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $99.47.

View Our Latest Report on CAVA

CAVA Group Stock Performance

Shares of CAVA Group stock traded up $1.0510 on Friday, hitting $68.3810. 3,322,547 shares of the company traded hands, compared to its average volume of 6,136,702. CAVA Group, Inc. has a 52 week low of $65.70 and a 52 week high of $172.43. The business has a 50-day simple moving average of $81.98 and a 200 day simple moving average of $88.25. The stock has a market capitalization of $7.93 billion, a P/E ratio of 57.46, a price-to-earnings-growth ratio of 3.43 and a beta of 2.65.

CAVA Group (NYSE:CAVA - Get Free Report) last posted its earnings results on Tuesday, August 12th. The company reported $0.16 earnings per share for the quarter, beating the consensus estimate of $0.13 by $0.03. The company had revenue of $280.62 million during the quarter, compared to analysts' expectations of $285.65 million. CAVA Group had a net margin of 12.98% and a return on equity of 9.83%. CAVA Group's quarterly revenue was up 20.2% on a year-over-year basis. During the same period last year, the company posted $0.17 earnings per share. Research analysts expect that CAVA Group, Inc. will post 0.5 earnings per share for the current year.

About CAVA Group

(

Free Report)

CAVA Group, Inc owns and operates a chain of restaurants under the CAVA brand in the United States. The company also offers dips, spreads, and dressings through grocery stores. In addition, the company provides online and mobile ordering platforms. Cava Group, Inc was founded in 2006 and is headquartered in Washington, the District of Columbia.

Featured Stories

Before you consider CAVA Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CAVA Group wasn't on the list.

While CAVA Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.