Russell Investments Group Ltd. raised its holdings in shares of Scholar Rock Holding Corporation (NASDAQ:SRRK - Free Report) by 250,491.8% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 182,932 shares of the company's stock after acquiring an additional 182,859 shares during the period. Russell Investments Group Ltd. owned approximately 0.19% of Scholar Rock worth $5,881,000 as of its most recent SEC filing.

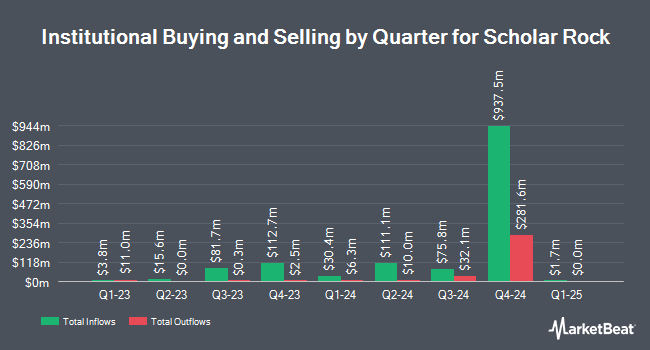

Several other hedge funds have also recently added to or reduced their stakes in the business. Price T Rowe Associates Inc. MD raised its stake in Scholar Rock by 7.3% during the 4th quarter. Price T Rowe Associates Inc. MD now owns 9,283,421 shares of the company's stock valued at $401,231,000 after acquiring an additional 629,315 shares in the last quarter. Vanguard Group Inc. raised its stake in Scholar Rock by 2.1% during the 1st quarter. Vanguard Group Inc. now owns 4,845,205 shares of the company's stock valued at $155,773,000 after acquiring an additional 101,723 shares in the last quarter. Bellevue Group AG raised its stake in Scholar Rock by 16.2% during the 4th quarter. Bellevue Group AG now owns 2,510,690 shares of the company's stock valued at $108,512,000 after acquiring an additional 349,487 shares in the last quarter. Fairmount Funds Management LLC bought a new stake in Scholar Rock during the 4th quarter valued at $84,839,000. Finally, Wellington Management Group LLP raised its stake in Scholar Rock by 763.8% during the 4th quarter. Wellington Management Group LLP now owns 1,725,622 shares of the company's stock valued at $74,581,000 after acquiring an additional 1,525,845 shares in the last quarter. Institutional investors own 91.08% of the company's stock.

Wall Street Analyst Weigh In

SRRK has been the topic of several recent analyst reports. Jefferies Financial Group initiated coverage on Scholar Rock in a research note on Thursday, August 21st. They set a "buy" rating and a $50.00 target price on the stock. Cantor Fitzgerald initiated coverage on Scholar Rock in a research note on Thursday, July 17th. They set an "overweight" rating on the stock. Raymond James Financial set a $53.00 target price on Scholar Rock and gave the company a "strong-buy" rating in a research note on Wednesday, July 30th. BMO Capital Markets lowered their price target on Scholar Rock from $57.00 to $45.00 and set an "outperform" rating on the stock in a research report on Thursday, August 7th. Finally, Wedbush reiterated an "outperform" rating and set a $50.00 price target on shares of Scholar Rock in a research report on Wednesday, June 18th. Two research analysts have rated the stock with a Strong Buy rating and eight have issued a Buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Buy" and an average target price of $45.75.

Check Out Our Latest Stock Analysis on SRRK

Scholar Rock Price Performance

Shares of NASDAQ SRRK traded up $0.45 during mid-day trading on Tuesday, reaching $33.78. The company had a trading volume of 1,407,855 shares, compared to its average volume of 1,950,398. The company has a current ratio of 6.33, a quick ratio of 6.33 and a debt-to-equity ratio of 0.21. The stock has a market cap of $3.25 billion, a PE ratio of -11.61 and a beta of 0.48. The company has a 50-day moving average price of $35.79 and a two-hundred day moving average price of $33.70. Scholar Rock Holding Corporation has a 1-year low of $6.76 and a 1-year high of $46.98.

Scholar Rock (NASDAQ:SRRK - Get Free Report) last issued its earnings results on Wednesday, August 6th. The company reported ($0.98) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.66) by ($0.32). During the same period last year, the business posted ($0.60) earnings per share. On average, equities analysts anticipate that Scholar Rock Holding Corporation will post -2.42 earnings per share for the current year.

Insiders Place Their Bets

In related news, Director Jeffrey S. Flier sold 20,316 shares of Scholar Rock stock in a transaction on Monday, June 23rd. The stock was sold at an average price of $32.24, for a total value of $654,987.84. Following the transaction, the director directly owned 24,070 shares in the company, valued at $776,016.80. The trade was a 45.77% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Kristina Burow sold 5,400 shares of Scholar Rock stock in a transaction on Thursday, May 29th. The stock was sold at an average price of $29.72, for a total value of $160,488.00. Following the completion of the transaction, the director owned 21,071 shares in the company, valued at $626,230.12. The trade was a 20.40% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 93,654 shares of company stock worth $3,101,811. Corporate insiders own 13.30% of the company's stock.

Scholar Rock Profile

(

Free Report)

Scholar Rock Holding Corporation, a biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role. The company develops Apitegromab, an inhibitor of the activation of myostatin that is in Phase 3 clinical trial for the treatment of spinal muscular atrophy; and SRK-181, which has completed Phase 1 clinical trials for the treatment of cancers that are resistant to checkpoint inhibitor therapies, such as anti-PD-1 or anti-PD-L1 antibody therapies.

Further Reading

Before you consider Scholar Rock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Scholar Rock wasn't on the list.

While Scholar Rock currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.