RWC Asset Management LLP trimmed its holdings in HP Inc. (NYSE:HPQ - Free Report) by 9.5% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 4,000,866 shares of the computer maker's stock after selling 418,930 shares during the quarter. HP makes up about 5.7% of RWC Asset Management LLP's holdings, making the stock its biggest position. RWC Asset Management LLP owned 0.42% of HP worth $110,784,000 as of its most recent SEC filing.

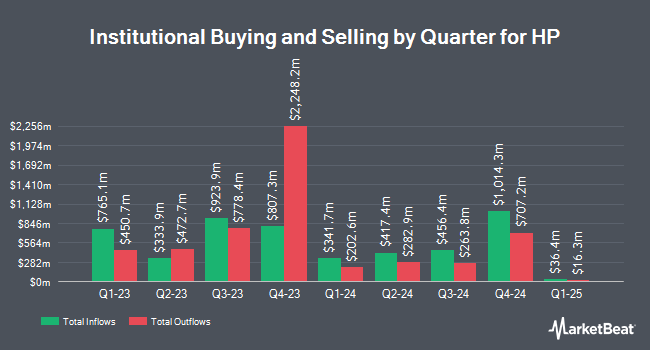

A number of other institutional investors have also modified their holdings of the business. ARK Investment Management LLC grew its position in HP by 2.0% in the 1st quarter. ARK Investment Management LLC now owns 102,721 shares of the computer maker's stock valued at $2,844,000 after buying an additional 1,976 shares during the last quarter. Empirical Finance LLC grew its position in HP by 1.6% in the 1st quarter. Empirical Finance LLC now owns 69,114 shares of the computer maker's stock valued at $1,914,000 after buying an additional 1,057 shares during the last quarter. Valley Wealth Managers Inc. grew its position in HP by 3.3% in the 1st quarter. Valley Wealth Managers Inc. now owns 98,868 shares of the computer maker's stock valued at $2,738,000 after buying an additional 3,180 shares during the last quarter. HB Wealth Management LLC grew its position in HP by 3.9% in the 1st quarter. HB Wealth Management LLC now owns 64,001 shares of the computer maker's stock valued at $1,772,000 after buying an additional 2,405 shares during the last quarter. Finally, GLOBALT Investments LLC GA grew its position in HP by 1.0% in the 1st quarter. GLOBALT Investments LLC GA now owns 178,965 shares of the computer maker's stock valued at $4,956,000 after buying an additional 1,779 shares during the last quarter. 77.53% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of equities analysts recently weighed in on HPQ shares. Wells Fargo & Company lowered their price objective on shares of HP from $35.00 to $25.00 and set an "underweight" rating on the stock in a research report on Thursday, May 29th. Bank of America lowered their price objective on shares of HP from $35.00 to $33.00 and set a "neutral" rating on the stock in a research report on Wednesday, May 28th. Morgan Stanley lowered their price objective on shares of HP from $29.00 to $26.00 and set an "equal weight" rating on the stock in a research report on Thursday, May 29th. Barclays set a $28.00 target price on shares of HP and gave the stock an "equal weight" rating in a research report on Thursday, May 29th. Finally, Citigroup lowered their price target on shares of HP from $29.00 to $27.50 and set a "neutral" rating on the stock in a research note on Thursday, May 29th. One research analyst has rated the stock with a sell rating, twelve have assigned a hold rating and three have issued a buy rating to the stock. According to MarketBeat, HP currently has a consensus rating of "Hold" and a consensus target price of $29.54.

View Our Latest Report on HPQ

HP Stock Down 0.1%

Shares of HP stock traded down $0.03 on Friday, hitting $25.67. The company's stock had a trading volume of 6,327,158 shares, compared to its average volume of 7,062,307. HP Inc. has a 52-week low of $21.21 and a 52-week high of $39.79. The firm has a fifty day moving average price of $25.54 and a 200-day moving average price of $27.85. The company has a market capitalization of $24.11 billion, a P/E ratio of 9.91, a price-to-earnings-growth ratio of 2.08 and a beta of 1.27.

HP (NYSE:HPQ - Get Free Report) last released its quarterly earnings data on Wednesday, May 28th. The computer maker reported $0.71 EPS for the quarter, missing the consensus estimate of $0.80 by ($0.09). HP had a negative return on equity of 244.99% and a net margin of 4.64%. The business had revenue of $13.22 billion during the quarter, compared to analysts' expectations of $13.09 billion. During the same quarter in the prior year, the firm earned $0.82 earnings per share. HP's quarterly revenue was up 3.3% on a year-over-year basis. As a group, analysts expect that HP Inc. will post 3.56 earnings per share for the current year.

HP Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, October 1st. Shareholders of record on Wednesday, September 10th will be issued a $0.2894 dividend. The ex-dividend date of this dividend is Wednesday, September 10th. This represents a $1.16 dividend on an annualized basis and a yield of 4.51%. HP's dividend payout ratio (DPR) is 44.79%.

About HP

(

Free Report)

HP Inc provides products, technologies, software, solutions, and services to individual consumers, small- and medium-sized businesses, and large enterprises, including customers in the government, health, and education sectors worldwide. It operates through Personal Systems and Printing segments. The Personal Systems segment offers commercial personal computers (PCs), consumer PCs, workstations, thin clients, commercial tablets and mobility devices, retail point-of-sale systems, displays and other related accessories, software, support, and services for the commercial and consumer markets.

Featured Articles

Before you consider HP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HP wasn't on the list.

While HP currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.