RWC Asset Management LLP trimmed its holdings in shares of Ambev S.A. (NYSE:ABEV - Free Report) by 4.3% during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 12,497,391 shares of the company's stock after selling 566,165 shares during the quarter. Ambev accounts for about 1.5% of RWC Asset Management LLP's investment portfolio, making the stock its 18th biggest position. RWC Asset Management LLP owned approximately 0.08% of Ambev worth $29,119,000 as of its most recent SEC filing.

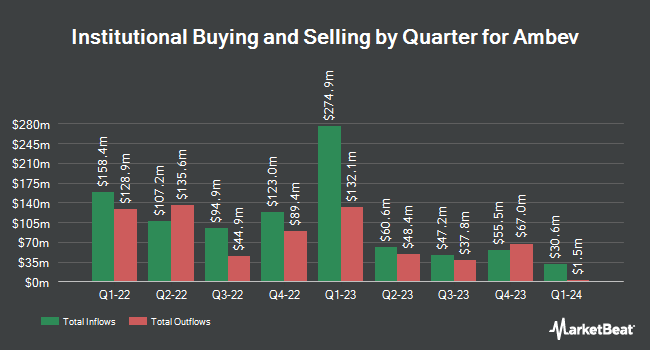

Other institutional investors and hedge funds also recently made changes to their positions in the company. Commonwealth Equity Services LLC lifted its position in shares of Ambev by 9.1% in the 4th quarter. Commonwealth Equity Services LLC now owns 108,271 shares of the company's stock worth $200,000 after buying an additional 9,040 shares during the last quarter. Envestnet Portfolio Solutions Inc. raised its holdings in Ambev by 19.7% during the fourth quarter. Envestnet Portfolio Solutions Inc. now owns 95,427 shares of the company's stock worth $177,000 after purchasing an additional 15,718 shares in the last quarter. American Century Companies Inc. increased its position in shares of Ambev by 6.4% during the 4th quarter. American Century Companies Inc. now owns 2,232,357 shares of the company's stock valued at $4,130,000 after purchasing an additional 135,132 shares during the period. LPL Financial LLC grew its holdings in Ambev by 36.8% during the fourth quarter. LPL Financial LLC now owns 808,204 shares of the company's stock worth $1,495,000 after acquiring an additional 217,527 shares during the period. Finally, EntryPoint Capital LLC acquired a new stake in Ambev during the 4th quarter valued at $277,000. 8.13% of the stock is currently owned by hedge funds and other institutional investors.

Ambev Stock Performance

Shares of ABEV traded down $0.12 during midday trading on Thursday, reaching $2.19. 50,727,767 shares of the stock were exchanged, compared to its average volume of 33,707,691. Ambev S.A. has a twelve month low of $1.76 and a twelve month high of $2.63. The company has a quick ratio of 0.80, a current ratio of 1.11 and a debt-to-equity ratio of 0.02. The stock's 50 day simple moving average is $2.42 and its 200 day simple moving average is $2.26. The company has a market cap of $34.43 billion, a P/E ratio of 13.66, a PEG ratio of 2.48 and a beta of 0.74.

Ambev (NYSE:ABEV - Get Free Report) last released its earnings results on Thursday, August 7th. The company reported $0.03 EPS for the quarter, missing the consensus estimate of $0.04 by ($0.01). Ambev had a net margin of 15.76% and a return on equity of 14.74%. On average, sell-side analysts expect that Ambev S.A. will post 0.18 earnings per share for the current year.

Ambev Cuts Dividend

The firm also recently announced a -- dividend, which was paid on Thursday, July 17th. Stockholders of record on Monday, May 19th were paid a $0.0219 dividend. The ex-dividend date was Monday, May 19th. This represents a dividend yield of 5%. Ambev's payout ratio is 68.75%.

Analyst Ratings Changes

Several equities research analysts recently weighed in on ABEV shares. Morgan Stanley lowered Ambev from an "equal weight" rating to an "underweight" rating in a report on Monday, April 7th. Wall Street Zen initiated coverage on shares of Ambev in a report on Wednesday, April 23rd. They set a "buy" rating on the stock. Barclays raised their price objective on Ambev from $2.00 to $2.50 and gave the company an "equal weight" rating in a report on Monday, May 12th. Finally, UBS Group upped their target price on shares of Ambev from $2.60 to $2.70 and gave the company a "neutral" rating in a report on Wednesday, June 4th. One analyst has rated the stock with a sell rating, four have issued a hold rating and one has issued a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $2.60.

View Our Latest Research Report on ABEV

About Ambev

(

Free Report)

Ambev SA, through its subsidiaries, engages in the production, distribution, and sale of beer, draft beer, carbonated soft drinks, malt and food, other alcoholic beverages, and non-alcoholic and non-carbonated products in Brazil, Central America and Caribbean, Latin America South, and Canada. It offers beer primarily under the Skol, Brahma, Antarctica, Brahva, Budweiser, Bud Light, Beck, Leffe, Hoegaarden, Balboa ICE, Balboa, Atlas Golden Light, Atlas, Bucanero, Cristal, Mayabe, Presidente, Presidente Light, Brahma Light, Bohemia, The One, Corona, Modelo Especial, Stella Artois, Quilmes Clásica, Paceña, Taquiña, Huari, Becker, Cusqueña, Michelob Ultra, Busch, Pilsen, Ouro Fino, Bud 66, Banks, Deputy, Patricia, Labatt Blue, Alexander Keith's, and Kokanee brands.

Further Reading

Before you consider Ambev, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ambev wasn't on the list.

While Ambev currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report