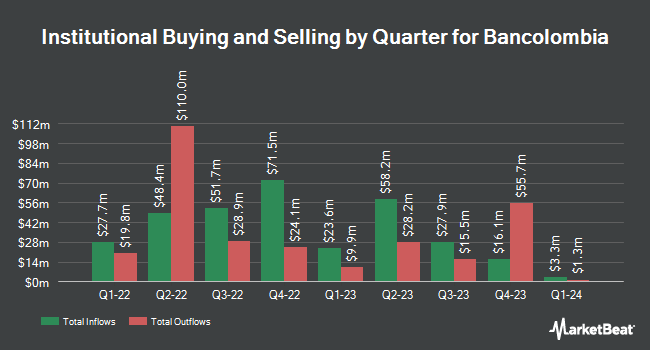

RWC Asset Management LLP purchased a new position in shares of BanColombia S.A. (NYSE:CIB - Free Report) in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 311,853 shares of the bank's stock, valued at approximately $12,536,000. RWC Asset Management LLP owned about 0.13% of BanColombia as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds have also bought and sold shares of CIB. Vanguard Group Inc. increased its position in shares of BanColombia by 0.6% in the 4th quarter. Vanguard Group Inc. now owns 3,099,224 shares of the bank's stock valued at $97,657,000 after acquiring an additional 19,499 shares during the period. Arrowstreet Capital Limited Partnership boosted its holdings in BanColombia by 12.3% in the 4th quarter. Arrowstreet Capital Limited Partnership now owns 928,679 shares of the bank's stock worth $29,263,000 after buying an additional 102,015 shares during the last quarter. Itau Unibanco Holding S.A. purchased a new position in shares of BanColombia in the fourth quarter valued at approximately $24,801,000. JPMorgan Chase & Co. lifted its stake in shares of BanColombia by 40.0% in the 4th quarter. JPMorgan Chase & Co. now owns 484,281 shares of the bank's stock valued at $15,260,000 after purchasing an additional 138,461 shares during the last quarter. Finally, Dimensional Fund Advisors LP grew its holdings in shares of BanColombia by 4.1% during the 4th quarter. Dimensional Fund Advisors LP now owns 365,603 shares of the bank's stock worth $11,523,000 after purchasing an additional 14,293 shares during the period.

BanColombia Price Performance

BanColombia stock traded down $0.34 during mid-day trading on Thursday, reaching $43.37. The company had a trading volume of 90,397 shares, compared to its average volume of 398,379. The company has a debt-to-equity ratio of 0.26, a current ratio of 1.00 and a quick ratio of 1.00. The stock's 50-day simple moving average is $43.84 and its 200-day simple moving average is $41.37. BanColombia S.A. has a 1 year low of $30.25 and a 1 year high of $46.81. The company has a market capitalization of $10.43 billion, a P/E ratio of 6.94, a P/E/G ratio of 0.96 and a beta of 0.93.

Analyst Ratings Changes

Separately, UBS Group reiterated a "neutral" rating and set a $38.00 target price (up previously from $35.00) on shares of BanColombia in a research note on Monday, June 2nd. Three equities research analysts have rated the stock with a sell rating, one has issued a hold rating and one has given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus target price of $39.00.

Get Our Latest Stock Analysis on BanColombia

About BanColombia

(

Free Report)

Bancolombia SA, together with its subsidiaries, provides banking products and services in Colombia and internationally. The company operates through nine segments: Banking Colombia, Banking Panama, Banking El Salvador, Banking Guatemala, Trust, Investment Banking, Brokerage, International Banking, and All Other.

Featured Stories

Before you consider BanColombia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BanColombia wasn't on the list.

While BanColombia currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.