Vestmark Advisory Solutions Inc. grew its stake in Saia, Inc. (NASDAQ:SAIA - Free Report) by 91.8% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 17,398 shares of the transportation company's stock after buying an additional 8,329 shares during the period. Vestmark Advisory Solutions Inc. owned 0.07% of Saia worth $6,079,000 as of its most recent filing with the Securities and Exchange Commission.

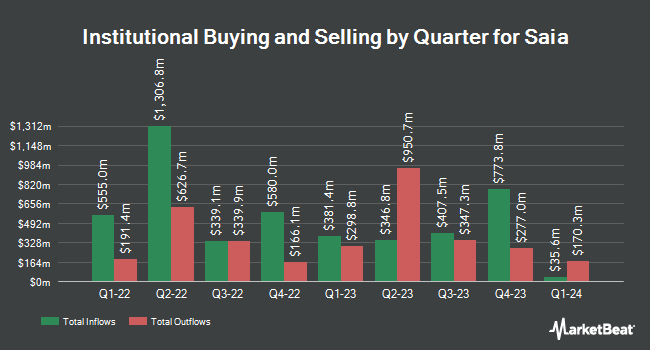

Several other hedge funds also recently modified their holdings of SAIA. Golden State Wealth Management LLC lifted its stake in shares of Saia by 127.0% during the 1st quarter. Golden State Wealth Management LLC now owns 84 shares of the transportation company's stock valued at $29,000 after buying an additional 47 shares in the last quarter. NBC Securities Inc. purchased a new stake in Saia during the first quarter valued at about $43,000. Group One Trading LLC increased its holdings in shares of Saia by 114.4% in the fourth quarter. Group One Trading LLC now owns 243 shares of the transportation company's stock worth $111,000 after buying an additional 1,934 shares during the period. Picton Mahoney Asset Management purchased a new position in shares of Saia during the first quarter valued at approximately $135,000. Finally, GAMMA Investing LLC increased its position in shares of Saia by 20.2% during the first quarter. GAMMA Investing LLC now owns 441 shares of the transportation company's stock valued at $154,000 after buying an additional 74 shares during the period.

Wall Street Analysts Forecast Growth

A number of research firms have recently commented on SAIA. Raymond James Financial set a $310.00 price target on shares of Saia and gave the company an "outperform" rating in a report on Monday, April 28th. Evercore ISI boosted their target price on shares of Saia from $297.00 to $345.00 and gave the stock an "outperform" rating in a report on Monday, July 28th. BMO Capital Markets cut Saia from an "outperform" rating to a "market perform" rating and decreased their price objective for the stock from $455.00 to $285.00 in a report on Friday, April 25th. Deutsche Bank Aktiengesellschaft cut shares of Saia from a "buy" rating to a "hold" rating and set a $273.00 target price on the stock. in a research report on Thursday, May 1st. Finally, Morgan Stanley set a $250.00 price target on Saia in a report on Friday, April 25th. One analyst has rated the stock with a Strong Buy rating, nine have issued a Buy rating and ten have issued a Hold rating to the company. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $347.16.

Check Out Our Latest Analysis on SAIA

Saia Trading Up 4.4%

Shares of SAIA traded up $12.9350 during trading hours on Tuesday, hitting $308.6750. 529,692 shares of the stock traded hands, compared to its average volume of 650,589. The firm has a market capitalization of $8.22 billion, a PE ratio of 28.57, a price-to-earnings-growth ratio of 13.81 and a beta of 1.99. The business has a fifty day moving average of $288.73 and a 200-day moving average of $326.40. The company has a current ratio of 1.49, a quick ratio of 1.49 and a debt-to-equity ratio of 0.13. Saia, Inc. has a 1-year low of $229.12 and a 1-year high of $624.55.

Saia (NASDAQ:SAIA - Get Free Report) last posted its quarterly earnings data on Friday, July 25th. The transportation company reported $2.67 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.39 by $0.28. The company had revenue of $817.12 million for the quarter, compared to the consensus estimate of $826.59 million. Saia had a net margin of 8.96% and a return on equity of 12.42%. The firm's revenue was down .7% compared to the same quarter last year. During the same period last year, the company earned $3.83 earnings per share. Analysts expect that Saia, Inc. will post 15.46 EPS for the current year.

Saia Profile

(

Free Report)

Saia, Inc, together with its subsidiaries, operates as a transportation company in North America. The company provides less-than-truckload services for shipments between 100 and 10,000 pounds; and other value-added services, including non-asset truckload, expedited, and logistics services. It also offers other value-added services, including non-asset truckload, expedited, and logistics services.

Recommended Stories

Before you consider Saia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Saia wasn't on the list.

While Saia currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.