Kingswood Wealth Advisors LLC increased its holdings in shares of San Juan Basin Royalty Trust (NYSE:SJT - Free Report) by 74.1% during the second quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 485,815 shares of the oil and gas producer's stock after buying an additional 206,780 shares during the period. Kingswood Wealth Advisors LLC owned about 1.04% of San Juan Basin Royalty Trust worth $2,900,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

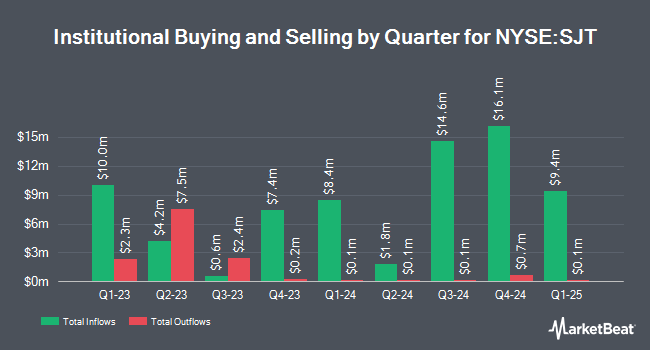

A number of other hedge funds and other institutional investors have also modified their holdings of SJT. Atlas Wealth Partners LLC lifted its stake in San Juan Basin Royalty Trust by 21.2% in the first quarter. Atlas Wealth Partners LLC now owns 24,300 shares of the oil and gas producer's stock valued at $134,000 after buying an additional 4,250 shares during the last quarter. Financial Gravity Asset Management Inc. acquired a new position in shares of San Juan Basin Royalty Trust in the 1st quarter worth approximately $35,000. Westfuller Advisors LLC bought a new stake in San Juan Basin Royalty Trust during the 1st quarter valued at $63,000. Fonville Wealth Management LLC bought a new stake in shares of San Juan Basin Royalty Trust in the 1st quarter worth $102,000. Finally, State of Wyoming raised its position in shares of San Juan Basin Royalty Trust by 36.5% during the first quarter. State of Wyoming now owns 78,628 shares of the oil and gas producer's stock worth $435,000 after purchasing an additional 21,012 shares during the period. 10.42% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Separately, Weiss Ratings restated a "sell (d)" rating on shares of San Juan Basin Royalty Trust in a research report on Saturday, September 27th. One equities research analyst has rated the stock with a Sell rating, According to MarketBeat, the company has a consensus rating of "Sell".

View Our Latest Report on San Juan Basin Royalty Trust

San Juan Basin Royalty Trust Trading Down 0.9%

NYSE:SJT opened at $6.41 on Tuesday. San Juan Basin Royalty Trust has a 52 week low of $3.66 and a 52 week high of $7.22. The firm has a 50-day moving average price of $5.87 and a two-hundred day moving average price of $5.97.

About San Juan Basin Royalty Trust

(

Free Report)

San Juan Basin Royalty Trust operates as an express trust in Texas. The company has a 75% net overriding royalty interest in Southland's oil and natural gas interests in properties located in the San Juan Basin in northwestern New Mexico. It also owns subject interests consist of working interests, royalty interests, overriding royalty interests, and other contractual rights in 119,000 net-producing acres in San Juan, Rio Arriba, and Sandoval Counties of northwestern New Mexico.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider San Juan Basin Royalty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and San Juan Basin Royalty Trust wasn't on the list.

While San Juan Basin Royalty Trust currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.