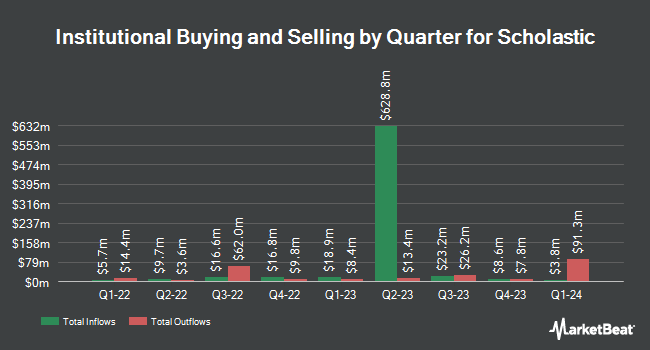

Teacher Retirement System of Texas reduced its stake in shares of Scholastic Corporation (NASDAQ:SCHL - Free Report) by 81.5% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 13,634 shares of the company's stock after selling 60,119 shares during the quarter. Teacher Retirement System of Texas' holdings in Scholastic were worth $257,000 as of its most recent SEC filing.

Other large investors also recently added to or reduced their stakes in the company. Charles Schwab Investment Management Inc. grew its stake in shares of Scholastic by 13.1% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 568,206 shares of the company's stock valued at $12,120,000 after buying an additional 66,027 shares during the last quarter. Royce & Associates LP boosted its holdings in shares of Scholastic by 12.3% in the fourth quarter. Royce & Associates LP now owns 47,391 shares of the company's stock valued at $1,011,000 after purchasing an additional 5,197 shares during the period. American Century Companies Inc. boosted its holdings in shares of Scholastic by 10.4% in the fourth quarter. American Century Companies Inc. now owns 621,852 shares of the company's stock valued at $13,264,000 after purchasing an additional 58,483 shares during the period. Sei Investments Co. boosted its holdings in shares of Scholastic by 65.0% in the fourth quarter. Sei Investments Co. now owns 111,703 shares of the company's stock valued at $2,383,000 after purchasing an additional 44,004 shares during the period. Finally, KLP Kapitalforvaltning AS purchased a new stake in shares of Scholastic in the fourth quarter valued at approximately $96,000. 82.57% of the stock is owned by institutional investors.

Scholastic Stock Up 3.4%

Scholastic stock traded up $0.75 during mid-day trading on Wednesday, reaching $22.58. 243,079 shares of the company were exchanged, compared to its average volume of 288,758. The business has a fifty day moving average of $19.59 and a 200 day moving average of $19.30. The company has a debt-to-equity ratio of 0.29, a quick ratio of 0.79 and a current ratio of 1.23. The firm has a market cap of $634.50 million, a P/E ratio of 37.63 and a beta of 1.08. Scholastic Corporation has a 12-month low of $15.77 and a 12-month high of $34.18.

Scholastic Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, September 15th. Investors of record on Friday, August 29th will be given a $0.20 dividend. This represents a $0.80 annualized dividend and a dividend yield of 3.54%. The ex-dividend date of this dividend is Friday, August 29th. Scholastic's payout ratio is 133.33%.

Scholastic Company Profile

(

Free Report)

Scholastic Corporation publishes and distributes children's books worldwide. It operates in three segments: Children's Book Publishing and Distribution, Education Solutions, and International. The Children's Book Publishing and Distribution segment engages in publication and distribution of children's print, digital, and audio books, as well as media and interactive products through its school reading events and trade channel; and operation of school-based book clubs and book fairs in the United States.

Further Reading

Before you consider Scholastic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Scholastic wasn't on the list.

While Scholastic currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.