Schwartz Investment Counsel Inc. reduced its position in shares of TE Connectivity Ltd. (NYSE:TEL - Free Report) by 52.1% during the second quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 3,500 shares of the electronics maker's stock after selling 3,800 shares during the period. Schwartz Investment Counsel Inc.'s holdings in TE Connectivity were worth $590,000 at the end of the most recent quarter.

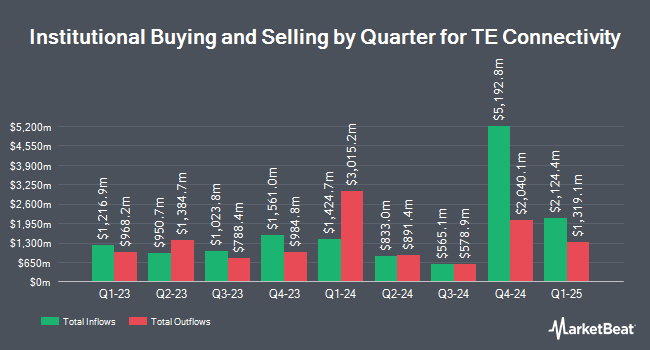

Several other hedge funds have also added to or reduced their stakes in TEL. Vanguard Group Inc. raised its position in TE Connectivity by 17.0% in the first quarter. Vanguard Group Inc. now owns 37,881,410 shares of the electronics maker's stock worth $5,353,401,000 after acquiring an additional 5,502,415 shares during the period. Valeo Financial Advisors LLC raised its position in TE Connectivity by 39,846.0% in the second quarter. Valeo Financial Advisors LLC now owns 1,775,598 shares of the electronics maker's stock worth $299,490,000 after acquiring an additional 1,771,153 shares during the period. Nuveen LLC bought a new stake in TE Connectivity in the first quarter worth about $174,700,000. Wellington Management Group LLP raised its position in TE Connectivity by 17.2% in the first quarter. Wellington Management Group LLP now owns 7,459,195 shares of the electronics maker's stock worth $1,054,133,000 after acquiring an additional 1,097,035 shares during the period. Finally, Ameriprise Financial Inc. raised its position in TE Connectivity by 17.1% in the first quarter. Ameriprise Financial Inc. now owns 6,563,527 shares of the electronics maker's stock worth $927,571,000 after acquiring an additional 960,276 shares during the period. Institutional investors own 91.43% of the company's stock.

TE Connectivity Stock Performance

TE Connectivity stock opened at $226.12 on Tuesday. The firm's 50 day simple moving average is $212.98 and its 200 day simple moving average is $181.09. The company has a current ratio of 1.52, a quick ratio of 0.96 and a debt-to-equity ratio of 0.39. The firm has a market capitalization of $66.81 billion, a PE ratio of 46.82, a price-to-earnings-growth ratio of 2.41 and a beta of 1.26. TE Connectivity Ltd. has a 1-year low of $116.30 and a 1-year high of $226.96.

TE Connectivity (NYSE:TEL - Get Free Report) last posted its earnings results on Wednesday, July 23rd. The electronics maker reported $2.27 earnings per share for the quarter, topping analysts' consensus estimates of $2.08 by $0.19. The business had revenue of $4.53 billion for the quarter, compared to analyst estimates of $4.30 billion. TE Connectivity had a net margin of 8.78% and a return on equity of 20.22%. TE Connectivity's revenue was up 13.9% on a year-over-year basis. During the same quarter in the prior year, the firm posted $1.91 EPS. TE Connectivity has set its Q4 2025 guidance at 2.270-2.270 EPS. As a group, analysts expect that TE Connectivity Ltd. will post 8.05 earnings per share for the current fiscal year.

TE Connectivity Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, December 12th. Investors of record on Friday, November 21st will be issued a dividend of $0.71 per share. This represents a $2.84 dividend on an annualized basis and a yield of 1.3%. The ex-dividend date of this dividend is Friday, November 21st. TE Connectivity's dividend payout ratio is 58.80%.

Insider Activity at TE Connectivity

In other TE Connectivity news, EVP John S. Jenkins sold 45,850 shares of the business's stock in a transaction that occurred on Monday, July 28th. The shares were sold at an average price of $209.33, for a total value of $9,597,780.50. Following the completion of the transaction, the executive vice president owned 24,625 shares of the company's stock, valued at $5,154,751.25. The trade was a 65.06% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider Aaron Kyle Stucki sold 52,900 shares of the business's stock in a transaction that occurred on Wednesday, July 23rd. The stock was sold at an average price of $192.78, for a total transaction of $10,198,062.00. Following the completion of the transaction, the insider directly owned 23,667 shares of the company's stock, valued at approximately $4,562,524.26. This represents a 69.09% decrease in their position. The disclosure for this sale can be found here. Insiders sold 124,545 shares of company stock worth $25,040,158 in the last 90 days. 0.90% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

Several analysts have commented on the stock. Bank of America lifted their price objective on shares of TE Connectivity from $168.00 to $190.00 and gave the stock a "buy" rating in a research report on Thursday, July 10th. Citigroup lifted their target price on shares of TE Connectivity from $230.00 to $250.00 and gave the stock a "buy" rating in a research note on Wednesday, September 24th. Evercore ISI lifted their target price on shares of TE Connectivity from $225.00 to $250.00 and gave the stock an "outperform" rating in a research note on Monday. Robert W. Baird lifted their target price on shares of TE Connectivity from $222.00 to $238.00 and gave the stock an "outperform" rating in a research note on Friday, October 10th. Finally, JPMorgan Chase & Co. lifted their target price on shares of TE Connectivity from $186.00 to $204.00 and gave the stock a "neutral" rating in a research note on Thursday, July 24th. Two research analysts have rated the stock with a Strong Buy rating, eight have assigned a Buy rating and six have given a Hold rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $222.00.

Read Our Latest Research Report on TE Connectivity

TE Connectivity Company Profile

(

Free Report)

TE Connectivity Ltd., together with its subsidiaries, manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the AsiaPacific, and the Americas. The company operates through three segments: Transportation Solutions, Industrial Solutions, and Communications Solutions.

Featured Articles

Want to see what other hedge funds are holding TEL? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for TE Connectivity Ltd. (NYSE:TEL - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TE Connectivity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TE Connectivity wasn't on the list.

While TE Connectivity currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report