SCS Capital Management LLC acquired a new stake in Antero Midstream Corporation (NYSE:AM - Free Report) during the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm acquired 13,953 shares of the pipeline company's stock, valued at approximately $251,000.

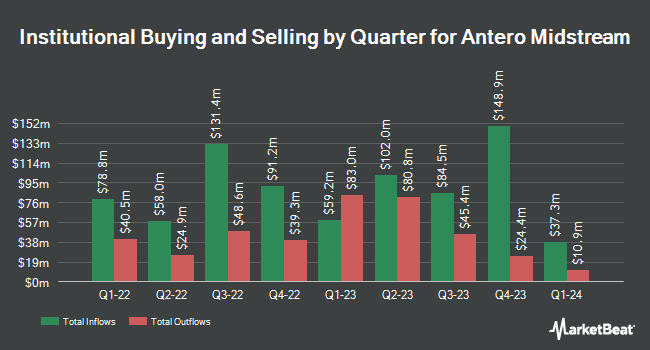

A number of other hedge funds have also added to or reduced their stakes in the company. Invesco Ltd. increased its stake in Antero Midstream by 2.0% in the first quarter. Invesco Ltd. now owns 30,631,765 shares of the pipeline company's stock valued at $551,372,000 after acquiring an additional 586,966 shares during the last quarter. Tortoise Capital Advisors L.L.C. grew its stake in shares of Antero Midstream by 31.7% during the first quarter. Tortoise Capital Advisors L.L.C. now owns 9,311,881 shares of the pipeline company's stock worth $167,614,000 after buying an additional 2,242,283 shares during the last quarter. Dimensional Fund Advisors LP grew its stake in shares of Antero Midstream by 0.4% during the first quarter. Dimensional Fund Advisors LP now owns 9,147,525 shares of the pipeline company's stock worth $164,653,000 after buying an additional 34,596 shares during the last quarter. Bank of New York Mellon Corp grew its stake in shares of Antero Midstream by 5.2% during the first quarter. Bank of New York Mellon Corp now owns 5,991,546 shares of the pipeline company's stock worth $107,848,000 after buying an additional 295,432 shares during the last quarter. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its stake in shares of Antero Midstream by 17.6% during the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 4,662,358 shares of the pipeline company's stock worth $83,922,000 after buying an additional 697,234 shares during the last quarter. 53.97% of the stock is owned by institutional investors.

Insider Buying and Selling at Antero Midstream

In related news, insider Sheri Pearce sold 39,155 shares of the company's stock in a transaction dated Wednesday, August 20th. The shares were sold at an average price of $17.51, for a total value of $685,604.05. Following the sale, the insider owned 106,489 shares in the company, valued at $1,864,622.39. This represents a 26.88% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. 0.86% of the stock is owned by corporate insiders.

Antero Midstream Stock Up 0.6%

AM traded up $0.12 during midday trading on Thursday, hitting $18.64. The company had a trading volume of 912,173 shares, compared to its average volume of 3,026,789. Antero Midstream Corporation has a 52 week low of $14.22 and a 52 week high of $19.08. The company has a quick ratio of 1.03, a current ratio of 1.03 and a debt-to-equity ratio of 1.45. The company has a market capitalization of $8.92 billion, a price-to-earnings ratio of 19.62 and a beta of 0.92. The stock's 50 day moving average price is $17.88 and its 200 day moving average price is $17.78.

Antero Midstream (NYSE:AM - Get Free Report) last posted its earnings results on Wednesday, July 30th. The pipeline company reported $0.26 earnings per share for the quarter, topping analysts' consensus estimates of $0.24 by $0.02. Antero Midstream had a net margin of 39.53% and a return on equity of 21.67%. The company had revenue of $305.47 million for the quarter, compared to analyst estimates of $292.70 million. During the same quarter in the prior year, the business posted $0.23 EPS. The firm's revenue was up 13.2% compared to the same quarter last year. On average, research analysts anticipate that Antero Midstream Corporation will post 0.95 earnings per share for the current fiscal year.

Antero Midstream Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Wednesday, August 6th. Investors of record on Wednesday, July 23rd were issued a $0.225 dividend. This represents a $0.90 dividend on an annualized basis and a dividend yield of 4.8%. The ex-dividend date was Wednesday, July 23rd. Antero Midstream's dividend payout ratio is currently 94.74%.

Wall Street Analyst Weigh In

AM has been the topic of a number of research reports. Wells Fargo & Company boosted their target price on shares of Antero Midstream from $17.00 to $19.00 and gave the stock an "equal weight" rating in a research note on Friday, August 1st. Zacks Research upgraded shares of Antero Midstream from a "hold" rating to a "strong-buy" rating in a report on Thursday, August 21st. Morgan Stanley lifted their price target on shares of Antero Midstream from $17.00 to $19.00 and gave the stock an "underweight" rating in a report on Wednesday, August 6th. The Goldman Sachs Group lifted their price target on shares of Antero Midstream from $15.50 to $17.50 and gave the stock a "neutral" rating in a report on Monday, August 18th. Finally, Wall Street Zen upgraded shares of Antero Midstream from a "hold" rating to a "buy" rating in a report on Saturday, August 2nd. One research analyst has rated the stock with a Strong Buy rating, two have given a Hold rating and one has assigned a Sell rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $18.50.

View Our Latest Research Report on Antero Midstream

Antero Midstream Profile

(

Free Report)

Antero Midstream Corporation owns, operates, and develops midstream energy assets in the Appalachian Basin. It operates in two segments, Gathering and Processing, and Water Handling. The Gathering and Processing segment includes a network of gathering pipelines and compressor stations that collects and processes production from Antero Resources' wells in West Virginia and Ohio.

Featured Articles

Before you consider Antero Midstream, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Midstream wasn't on the list.

While Antero Midstream currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.