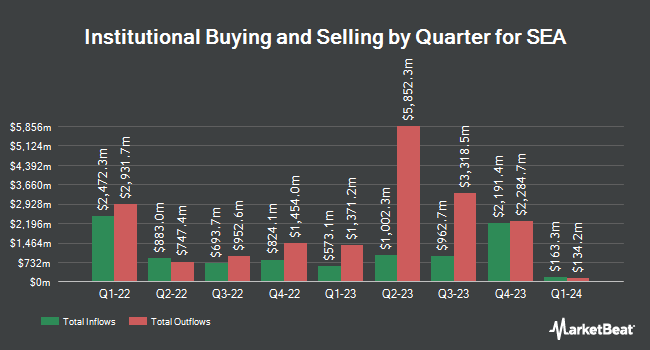

Keystone Investors PTE Ltd. lowered its position in Sea Limited Sponsored ADR (NYSE:SE - Free Report) by 11.7% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 823,565 shares of the Internet company based in Singapore's stock after selling 109,069 shares during the quarter. SEA accounts for 15.1% of Keystone Investors PTE Ltd.'s investment portfolio, making the stock its 2nd biggest position. Keystone Investors PTE Ltd. owned 0.14% of SEA worth $107,467,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in SE. Cambridge Investment Research Advisors Inc. increased its position in shares of SEA by 42.0% during the first quarter. Cambridge Investment Research Advisors Inc. now owns 17,409 shares of the Internet company based in Singapore's stock worth $2,272,000 after acquiring an additional 5,153 shares during the last quarter. Sequoia Financial Advisors LLC increased its position in shares of SEA by 8.6% during the first quarter. Sequoia Financial Advisors LLC now owns 3,536 shares of the Internet company based in Singapore's stock worth $461,000 after acquiring an additional 279 shares during the last quarter. Brucke Financial Inc. purchased a new stake in shares of SEA during the fourth quarter worth about $211,000. Sowell Financial Services LLC purchased a new stake in shares of SEA during the first quarter worth about $216,000. Finally, Assenagon Asset Management S.A. increased its position in shares of SEA by 10.9% during the first quarter. Assenagon Asset Management S.A. now owns 4,839 shares of the Internet company based in Singapore's stock worth $631,000 after acquiring an additional 476 shares during the last quarter. Institutional investors and hedge funds own 59.53% of the company's stock.

Analysts Set New Price Targets

SE has been the subject of several research analyst reports. Loop Capital reissued a "buy" rating and issued a $190.00 price objective (up from $165.00) on shares of SEA in a report on Thursday, May 29th. Barclays lifted their target price on SEA from $182.00 to $200.00 and gave the company an "overweight" rating in a research note on Thursday, May 15th. Wall Street Zen downgraded SEA from a "buy" rating to a "hold" rating in a research note on Saturday, July 12th. Wedbush restated an "outperform" rating on shares of SEA in a research note on Wednesday, May 14th. Finally, Sanford C. Bernstein restated an "outperform" rating and issued a $170.00 target price on shares of SEA in a research note on Wednesday, May 14th. Four equities research analysts have rated the stock with a hold rating, eight have given a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat.com, SEA presently has a consensus rating of "Moderate Buy" and an average price target of $159.82.

Read Our Latest Stock Report on SE

SEA Price Performance

Shares of NYSE:SE traded down $1.11 during trading on Friday, reaching $147.75. The company had a trading volume of 3,845,296 shares, compared to its average volume of 4,109,078. The firm's fifty day moving average is $156.64 and its 200 day moving average is $140.75. The company has a debt-to-equity ratio of 0.18, a quick ratio of 1.49 and a current ratio of 1.51. The firm has a market capitalization of $87.04 billion, a PE ratio of 104.05 and a beta of 1.58. Sea Limited Sponsored ADR has a twelve month low of $62.40 and a twelve month high of $172.65.

SEA (NYSE:SE - Get Free Report) last announced its earnings results on Tuesday, May 13th. The Internet company based in Singapore reported $0.65 EPS for the quarter, missing the consensus estimate of $0.93 by ($0.28). The firm had revenue of $4.84 billion for the quarter, compared to the consensus estimate of $4.90 billion. SEA had a return on equity of 10.74% and a net margin of 4.87%. SEA's revenue for the quarter was up 29.6% on a year-over-year basis. During the same period in the previous year, the firm earned ($0.04) EPS. On average, equities analysts forecast that Sea Limited Sponsored ADR will post 0.74 EPS for the current year.

About SEA

(

Free Report)

Sea Ltd. is an internet and mobile platform company, which engages in the provision of online gaming services. It operates through the following segments: Digital Entertainment, E-Commerce, and Digital Financial Services. The Digital Entertainment segment offers and develops mobile and PC online games.

Recommended Stories

Before you consider SEA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEA wasn't on the list.

While SEA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.