Sei Investments Co. cut its holdings in The Andersons, Inc. (NASDAQ:ANDE - Free Report) by 26.2% in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 51,737 shares of the basic materials company's stock after selling 18,391 shares during the quarter. Sei Investments Co. owned approximately 0.15% of Andersons worth $2,096,000 at the end of the most recent reporting period.

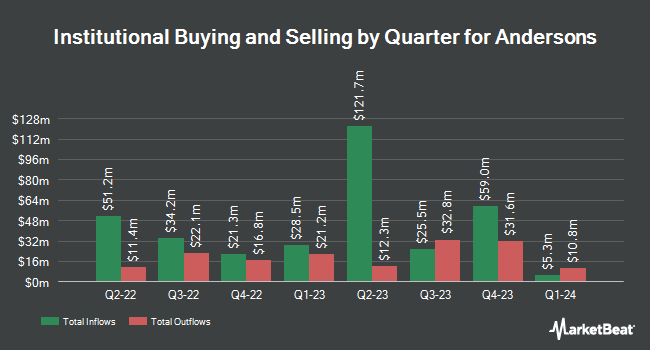

Other hedge funds and other institutional investors also recently made changes to their positions in the company. GAMMA Investing LLC increased its stake in shares of Andersons by 426.2% in the first quarter. GAMMA Investing LLC now owns 1,805 shares of the basic materials company's stock valued at $77,000 after buying an additional 1,462 shares in the last quarter. Point72 Hong Kong Ltd acquired a new stake in shares of Andersons in the fourth quarter valued at $189,000. Mutual of America Capital Management LLC acquired a new stake in shares of Andersons in the first quarter valued at $201,000. 1492 Capital Management LLC acquired a new stake in shares of Andersons in the first quarter valued at $208,000. Finally, Sherbrooke Park Advisers LLC acquired a new stake in Andersons in the fourth quarter worth about $212,000. 87.06% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of brokerages recently commented on ANDE. BMO Capital Markets started coverage on Andersons in a research report on Tuesday, May 6th. They issued a "market perform" rating and a $45.00 price objective for the company. Wall Street Zen cut Andersons from a "buy" rating to a "hold" rating in a research note on Thursday, May 15th. Finally, Lake Street Capital dropped their price objective on Andersons from $70.00 to $55.00 and set a "buy" rating on the stock in a research note on Thursday, May 8th. Two research analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company's stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $51.67.

Read Our Latest Report on ANDE

Andersons Price Performance

Shares of ANDE stock traded up $0.2750 on Thursday, hitting $38.5550. 45,604 shares of the company's stock were exchanged, compared to its average volume of 322,184. The company has a debt-to-equity ratio of 0.36, a current ratio of 2.01 and a quick ratio of 1.30. The stock has a market cap of $1.32 billion, a P/E ratio of 16.43 and a beta of 0.75. The Andersons, Inc. has a 12 month low of $31.03 and a 12 month high of $51.58. The company has a 50 day moving average of $37.14 and a 200 day moving average of $38.46.

Andersons (NASDAQ:ANDE - Get Free Report) last posted its earnings results on Monday, August 4th. The basic materials company reported $0.24 EPS for the quarter, missing the consensus estimate of $0.53 by ($0.29). Andersons had a net margin of 0.70% and a return on equity of 5.28%. The firm had revenue of $3.14 billion during the quarter, compared to the consensus estimate of $2.86 billion. During the same quarter in the prior year, the business posted $1.05 earnings per share. Andersons's revenue for the quarter was up 12.2% compared to the same quarter last year. On average, equities research analysts predict that The Andersons, Inc. will post 3.11 EPS for the current year.

Andersons Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Tuesday, July 22nd. Investors of record on Tuesday, July 1st were paid a dividend of $0.195 per share. The ex-dividend date of this dividend was Tuesday, July 1st. This represents a $0.78 annualized dividend and a yield of 2.0%. Andersons's dividend payout ratio (DPR) is currently 33.19%.

Andersons Company Profile

(

Free Report)

The Andersons, Inc operates in trade, renewables, and nutrient and industrial sectors in the United States, Canada, Mexico, Egypt, Switzerland, and internationally. It operates through three segments: Trade, Renewables, and Nutrient & Industrial. The company's Trade segment operates grain elevators; stores commodities; and provides grain marketing, risk management, and origination services, as well as sells commodities, such as corn, soybeans, wheat, oats, ethanol, and corn oil.

See Also

Before you consider Andersons, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Andersons wasn't on the list.

While Andersons currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.