Sequoia Financial Advisors LLC lifted its stake in United Airlines Holdings Inc (NASDAQ:UAL - Free Report) by 94.4% in the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 5,939 shares of the transportation company's stock after purchasing an additional 2,884 shares during the period. Sequoia Financial Advisors LLC's holdings in United Airlines were worth $473,000 at the end of the most recent reporting period.

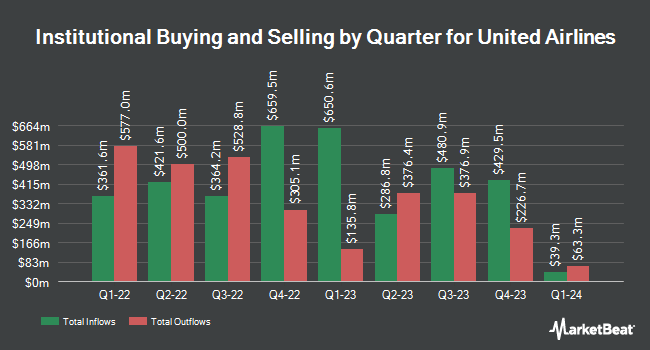

A number of other institutional investors have also bought and sold shares of the business. Vanguard Group Inc. increased its stake in United Airlines by 1.1% in the 1st quarter. Vanguard Group Inc. now owns 36,961,616 shares of the transportation company's stock worth $2,552,200,000 after buying an additional 413,753 shares in the last quarter. Dimensional Fund Advisors LP increased its stake in United Airlines by 2.1% in the 1st quarter. Dimensional Fund Advisors LP now owns 6,010,293 shares of the transportation company's stock worth $415,011,000 after buying an additional 125,284 shares in the last quarter. Pacer Advisors Inc. increased its stake in United Airlines by 10,777.6% in the 1st quarter. Pacer Advisors Inc. now owns 5,068,103 shares of the transportation company's stock worth $349,953,000 after buying an additional 5,021,511 shares in the last quarter. Invesco Ltd. increased its stake in United Airlines by 26.1% in the 1st quarter. Invesco Ltd. now owns 4,661,186 shares of the transportation company's stock worth $321,855,000 after buying an additional 964,388 shares in the last quarter. Finally, Alyeska Investment Group L.P. increased its stake in United Airlines by 86.4% in the 1st quarter. Alyeska Investment Group L.P. now owns 3,985,560 shares of the transportation company's stock worth $275,203,000 after buying an additional 1,847,884 shares in the last quarter. Hedge funds and other institutional investors own 69.69% of the company's stock.

United Airlines Stock Up 2.2%

Shares of NASDAQ:UAL opened at $101.29 on Tuesday. The company has a current ratio of 0.67, a quick ratio of 0.61 and a debt-to-equity ratio of 1.45. United Airlines Holdings Inc has a 12 month low of $52.00 and a 12 month high of $116.00. The company has a 50-day moving average price of $101.90 and a 200 day moving average price of $86.52. The company has a market cap of $32.79 billion, a price-to-earnings ratio of 10.15, a PEG ratio of 1.16 and a beta of 1.45.

United Airlines (NASDAQ:UAL - Get Free Report) last announced its quarterly earnings results on Wednesday, October 15th. The transportation company reported $2.78 EPS for the quarter, beating analysts' consensus estimates of $2.65 by $0.13. United Airlines had a net margin of 5.64% and a return on equity of 26.94%. The firm had revenue of $15.23 billion during the quarter, compared to the consensus estimate of $15.31 billion. During the same quarter last year, the firm earned $3.33 EPS. The firm's revenue for the quarter was up 2.6% compared to the same quarter last year. United Airlines has set its Q4 2025 guidance at 3.000-3.500 EPS. As a group, equities research analysts predict that United Airlines Holdings Inc will post 12.96 earnings per share for the current year.

Analyst Ratings Changes

A number of equities research analysts have issued reports on UAL shares. Jefferies Financial Group increased their price target on United Airlines from $115.00 to $125.00 and gave the stock a "buy" rating in a research note on Wednesday, October 1st. Morgan Stanley reiterated an "overweight" rating and issued a $140.00 price target on shares of United Airlines in a research note on Friday. Bank of America increased their price target on United Airlines from $90.00 to $108.00 and gave the stock a "buy" rating in a research note on Friday, July 18th. Wall Street Zen upgraded United Airlines from a "hold" rating to a "buy" rating in a research report on Saturday. Finally, Evercore ISI raised their price objective on United Airlines from $105.00 to $135.00 and gave the company an "outperform" rating in a research report on Monday, September 29th. Two analysts have rated the stock with a Strong Buy rating, thirteen have assigned a Buy rating and two have issued a Hold rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average price target of $126.08.

Get Our Latest Stock Report on UAL

Insider Buying and Selling at United Airlines

In related news, President Brett J. Hart sold 24,772 shares of the stock in a transaction dated Friday, July 25th. The shares were sold at an average price of $89.50, for a total value of $2,217,094.00. Following the completion of the transaction, the president owned 283,638 shares of the company's stock, valued at approximately $25,385,601. This trade represents a 8.03% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, EVP Kate Gebo sold 29,953 shares of the stock in a transaction dated Tuesday, August 12th. The shares were sold at an average price of $97.59, for a total transaction of $2,923,113.27. Following the completion of the transaction, the executive vice president directly owned 45,496 shares of the company's stock, valued at approximately $4,439,954.64. The trade was a 39.70% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 86,791 shares of company stock worth $8,147,918 in the last 90 days. 0.63% of the stock is currently owned by insiders.

United Airlines Profile

(

Free Report)

United Airlines Holdings, Inc, through its subsidiaries, provides air transportation services in North America, Asia, Europe, Africa, the Pacific, the Middle East, and Latin America. The company transports people and cargo through its mainline and regional fleets. It also offers catering, ground handling, flight academy, and maintenance services for third parties.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider United Airlines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Airlines wasn't on the list.

While United Airlines currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report