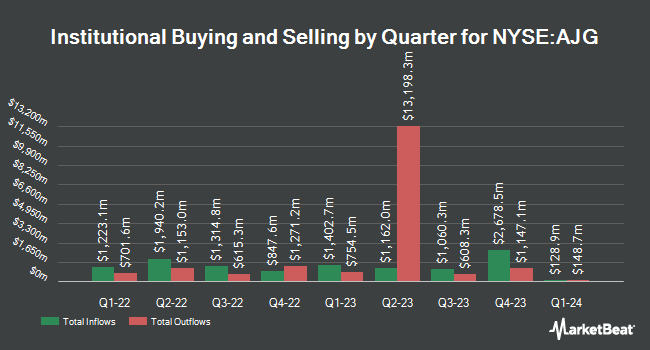

Sequoia Financial Advisors LLC grew its position in Arthur J. Gallagher & Co. (NYSE:AJG - Free Report) by 4.3% during the 2nd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 121,783 shares of the financial services provider's stock after acquiring an additional 4,992 shares during the quarter. Sequoia Financial Advisors LLC's holdings in Arthur J. Gallagher & Co. were worth $38,985,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also made changes to their positions in the company. HWG Holdings LP purchased a new position in shares of Arthur J. Gallagher & Co. in the first quarter valued at approximately $25,000. AlphaQuest LLC purchased a new position in Arthur J. Gallagher & Co. during the first quarter worth approximately $33,000. Saudi Central Bank purchased a new position in Arthur J. Gallagher & Co. during the first quarter worth approximately $34,000. Centennial Bank AR purchased a new position in Arthur J. Gallagher & Co. during the first quarter worth approximately $38,000. Finally, Golden State Wealth Management LLC lifted its position in Arthur J. Gallagher & Co. by 2,750.0% during the first quarter. Golden State Wealth Management LLC now owns 114 shares of the financial services provider's stock worth $39,000 after buying an additional 110 shares in the last quarter. Hedge funds and other institutional investors own 85.53% of the company's stock.

Insiders Place Their Bets

In other news, CFO Douglas K. Howell sold 8,000 shares of Arthur J. Gallagher & Co. stock in a transaction on Monday, September 22nd. The stock was sold at an average price of $299.54, for a total value of $2,396,320.00. Following the completion of the sale, the chief financial officer directly owned 100,777 shares of the company's stock, valued at approximately $30,186,742.58. The trade was a 7.35% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, VP Scott R. Hudson sold 12,855 shares of Arthur J. Gallagher & Co. stock in a transaction on Monday, September 8th. The shares were sold at an average price of $297.60, for a total value of $3,825,648.00. Following the completion of the sale, the vice president directly owned 85,920 shares of the company's stock, valued at $25,569,792. The trade was a 13.01% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 29,855 shares of company stock valued at $8,916,928 over the last ninety days. Insiders own 1.30% of the company's stock.

Analyst Upgrades and Downgrades

AJG has been the topic of a number of analyst reports. Keefe, Bruyette & Woods lifted their price objective on Arthur J. Gallagher & Co. from $288.00 to $298.00 and gave the stock a "market perform" rating in a research report on Friday, September 19th. Cantor Fitzgerald upgraded Arthur J. Gallagher & Co. to a "strong-buy" rating in a research report on Wednesday, August 13th. Barclays reduced their price objective on Arthur J. Gallagher & Co. from $346.00 to $327.00 and set an "equal weight" rating on the stock in a research report on Monday, July 7th. UBS Group lifted their price objective on Arthur J. Gallagher & Co. from $322.00 to $329.00 and gave the stock a "neutral" rating in a research report on Friday, September 19th. Finally, Weiss Ratings reissued a "buy (b-)" rating on shares of Arthur J. Gallagher & Co. in a research note on Wednesday, October 8th. One investment analyst has rated the stock with a Strong Buy rating, seven have assigned a Buy rating and eight have assigned a Hold rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $331.43.

View Our Latest Stock Report on AJG

Arthur J. Gallagher & Co. Trading Down 0.2%

Shares of NYSE AJG opened at $301.75 on Monday. Arthur J. Gallagher & Co. has a twelve month low of $275.56 and a twelve month high of $351.23. The company has a current ratio of 1.36, a quick ratio of 1.36 and a debt-to-equity ratio of 0.52. The stock has a fifty day simple moving average of $299.11 and a 200-day simple moving average of $315.45. The stock has a market capitalization of $77.37 billion, a PE ratio of 42.86 and a beta of 0.73.

Arthur J. Gallagher & Co. (NYSE:AJG - Get Free Report) last issued its quarterly earnings data on Thursday, July 31st. The financial services provider reported $2.33 earnings per share for the quarter, missing analysts' consensus estimates of $2.36 by ($0.03). Arthur J. Gallagher & Co. had a net margin of 14.54% and a return on equity of 13.17%. The firm had revenue of $3.18 billion during the quarter, compared to analyst estimates of $3.20 billion. During the same period in the previous year, the firm posted $2.29 earnings per share. The company's quarterly revenue was up 16.0% compared to the same quarter last year. On average, equities analysts forecast that Arthur J. Gallagher & Co. will post 11.54 earnings per share for the current year.

Arthur J. Gallagher & Co. Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, September 19th. Stockholders of record on Friday, September 5th were paid a $0.65 dividend. The ex-dividend date of this dividend was Friday, September 5th. This represents a $2.60 dividend on an annualized basis and a dividend yield of 0.9%. Arthur J. Gallagher & Co.'s payout ratio is presently 36.93%.

About Arthur J. Gallagher & Co.

(

Free Report)

Arthur J. Gallagher & Co engages in the provision of insurance brokerage, reinsurance brokerage, consulting, and third-party claims settlement and administration services. It operates through the following segments: Brokerage, Risk Management, and Corporate. The Brokerage segment consists of retail and wholesale insurance brokerage operations.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Arthur J. Gallagher & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arthur J. Gallagher & Co. wasn't on the list.

While Arthur J. Gallagher & Co. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.