SG Americas Securities LLC bought a new stake in shares of Allegro MicroSystems, Inc. (NASDAQ:ALGM - Free Report) in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund bought 32,030 shares of the company's stock, valued at approximately $805,000.

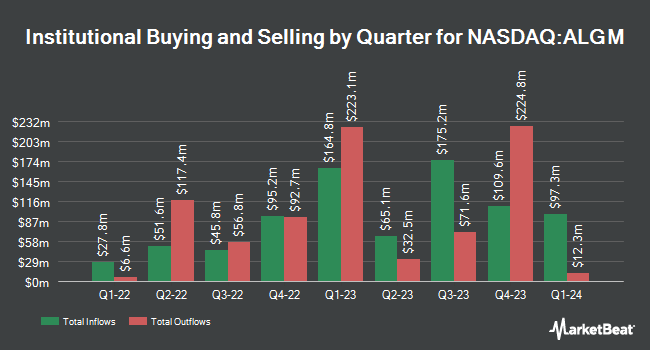

Other hedge funds have also added to or reduced their stakes in the company. UMB Bank n.a. grew its holdings in Allegro MicroSystems by 68.6% during the 1st quarter. UMB Bank n.a. now owns 1,420 shares of the company's stock valued at $36,000 after buying an additional 578 shares in the last quarter. TD Waterhouse Canada Inc. purchased a new position in Allegro MicroSystems during the 4th quarter valued at about $40,000. Venturi Wealth Management LLC purchased a new position in Allegro MicroSystems during the 4th quarter valued at about $47,000. Quarry LP purchased a new position in Allegro MicroSystems during the 4th quarter valued at about $79,000. Finally, GAMMA Investing LLC grew its holdings in Allegro MicroSystems by 144.3% during the 1st quarter. GAMMA Investing LLC now owns 4,155 shares of the company's stock valued at $104,000 after buying an additional 2,454 shares in the last quarter. Hedge funds and other institutional investors own 56.45% of the company's stock.

Analysts Set New Price Targets

A number of research analysts have weighed in on the company. Bank of America began coverage on Allegro MicroSystems in a report on Monday, June 16th. They set a "buy" rating and a $38.00 target price for the company. Morgan Stanley boosted their price objective on Allegro MicroSystems from $23.00 to $25.00 and gave the stock an "equal weight" rating in a report on Monday, June 9th. Mizuho boosted their price objective on Allegro MicroSystems from $28.00 to $31.00 and gave the stock an "outperform" rating in a report on Monday, March 24th. UBS Group boosted their price objective on Allegro MicroSystems from $25.00 to $35.00 and gave the stock a "buy" rating in a report on Monday, June 16th. Finally, Barclays boosted their price objective on Allegro MicroSystems from $22.00 to $23.00 and gave the stock an "overweight" rating in a report on Friday, May 9th. One analyst has rated the stock with a hold rating and seven have given a buy rating to the company's stock. Based on data from MarketBeat, Allegro MicroSystems has an average rating of "Moderate Buy" and an average target price of $30.00.

Read Our Latest Stock Analysis on Allegro MicroSystems

Allegro MicroSystems Price Performance

NASDAQ:ALGM traded up $0.92 during mid-day trading on Monday, reaching $31.88. The stock had a trading volume of 1,347,291 shares, compared to its average volume of 2,616,801. The firm has a 50 day moving average price of $24.51 and a two-hundred day moving average price of $24.18. The stock has a market capitalization of $5.89 billion, a P/E ratio of -81.74 and a beta of 1.67. Allegro MicroSystems, Inc. has a one year low of $16.38 and a one year high of $33.26. The company has a debt-to-equity ratio of 0.37, a quick ratio of 2.66 and a current ratio of 4.30.

Allegro MicroSystems (NASDAQ:ALGM - Get Free Report) last released its earnings results on Thursday, May 8th. The company reported $0.06 earnings per share for the quarter, topping analysts' consensus estimates of $0.05 by $0.01. The company had revenue of $192.82 million during the quarter, compared to the consensus estimate of $185.35 million. Allegro MicroSystems had a positive return on equity of 1.04% and a negative net margin of 10.07%. Allegro MicroSystems's quarterly revenue was down 19.9% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.25 EPS. As a group, analysts expect that Allegro MicroSystems, Inc. will post 0.01 earnings per share for the current year.

About Allegro MicroSystems

(

Free Report)

Allegro MicroSystems, Inc, together with its subsidiaries, designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific analog power ICs for motion control and energy-efficient systems. Its products include magnetic sensor ICs, such as position, speed, and current sensor ICs; and power ICs comprising motor driver ICs, regulator and LED driver ICs, and isolated gate drivers.

See Also

Before you consider Allegro MicroSystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegro MicroSystems wasn't on the list.

While Allegro MicroSystems currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.