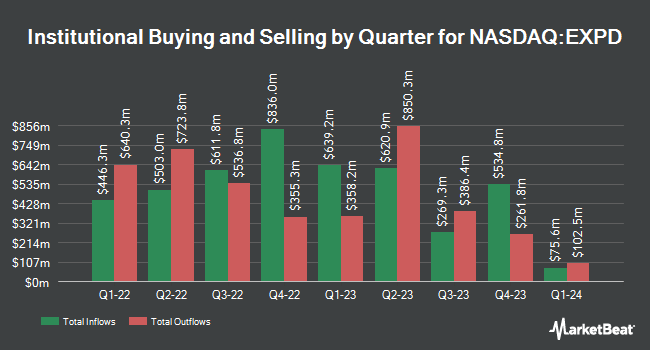

Shell Asset Management Co. increased its holdings in Expeditors International of Washington, Inc. (NASDAQ:EXPD - Free Report) by 40.4% in the second quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 33,620 shares of the transportation company's stock after buying an additional 9,678 shares during the period. Shell Asset Management Co.'s holdings in Expeditors International of Washington were worth $3,841,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other large investors also recently bought and sold shares of EXPD. Alpine Bank Wealth Management bought a new position in Expeditors International of Washington in the first quarter worth approximately $26,000. Zions Bancorporation National Association UT bought a new position in Expeditors International of Washington in the first quarter worth approximately $30,000. Garde Capital Inc. bought a new position in Expeditors International of Washington in the first quarter worth approximately $37,000. Ransom Advisory Ltd bought a new position in Expeditors International of Washington in the first quarter worth approximately $41,000. Finally, Twin Tree Management LP bought a new position in Expeditors International of Washington in the first quarter worth approximately $42,000. Institutional investors own 94.02% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts recently commented on the stock. Barclays increased their target price on shares of Expeditors International of Washington from $105.00 to $110.00 and gave the company an "underweight" rating in a research report on Thursday, September 11th. Truist Financial increased their target price on shares of Expeditors International of Washington from $105.00 to $110.00 and gave the company a "hold" rating in a research report on Monday, June 30th. JPMorgan Chase & Co. increased their target price on shares of Expeditors International of Washington from $105.00 to $107.00 and gave the company an "underweight" rating in a research report on Tuesday, July 8th. Baird R W raised shares of Expeditors International of Washington to a "hold" rating in a research report on Tuesday, July 1st. Finally, Robert W. Baird initiated coverage on shares of Expeditors International of Washington in a research report on Tuesday, July 1st. They set a "neutral" rating and a $124.00 target price for the company. Seven research analysts have rated the stock with a Hold rating and five have issued a Sell rating to the stock. Based on data from MarketBeat.com, Expeditors International of Washington currently has a consensus rating of "Reduce" and a consensus target price of $114.78.

Get Our Latest Stock Analysis on Expeditors International of Washington

Insider Buying and Selling at Expeditors International of Washington

In other news, VP Jeffrey F. Dickerman sold 1,470 shares of the stock in a transaction on Thursday, August 7th. The shares were sold at an average price of $118.05, for a total value of $173,533.50. Following the sale, the vice president owned 7,651 shares in the company, valued at $903,200.55. This represents a 16.12% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. 0.69% of the stock is owned by insiders.

Expeditors International of Washington Trading Down 1.2%

Shares of Expeditors International of Washington stock opened at $122.17 on Wednesday. Expeditors International of Washington, Inc. has a 12-month low of $100.47 and a 12-month high of $129.15. The firm has a market capitalization of $16.58 billion, a price-to-earnings ratio of 21.36, a PEG ratio of 5.00 and a beta of 1.09. The firm's 50 day simple moving average is $120.64 and its two-hundred day simple moving average is $115.74.

About Expeditors International of Washington

(

Free Report)

Expeditors International of Washington, Inc, together with its subsidiaries, provides logistics services worldwide. The company offers airfreight services, such as air freight consolidation and forwarding; ocean freight and ocean services, including ocean freight consolidation, direct ocean forwarding, and order management; customs brokerage, import, intra-continental ground transportation and delivery, and warehousing and distribution services; and customs clearance, purchase order management, vendor consolidation, time-definite transportation services, temperature-controlled transit, cargo insurance, specialized cargo monitoring and tracking, and other supply chain solutions.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Expeditors International of Washington, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expeditors International of Washington wasn't on the list.

While Expeditors International of Washington currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.