Shell Asset Management Co. lifted its stake in Energy Fuels Inc (NYSEAMERICAN:UUUU - Free Report) by 149.2% during the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 753,703 shares of the company's stock after buying an additional 451,250 shares during the quarter. Shell Asset Management Co. owned about 0.38% of Energy Fuels worth $4,334,000 as of its most recent filing with the Securities & Exchange Commission.

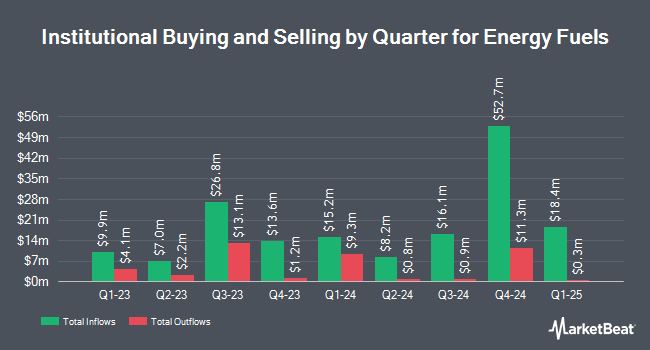

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the business. Alps Advisors Inc. raised its stake in Energy Fuels by 29.0% during the 1st quarter. Alps Advisors Inc. now owns 15,933,699 shares of the company's stock valued at $59,433,000 after purchasing an additional 3,584,798 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its stake in Energy Fuels by 10.8% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 12,670,863 shares of the company's stock valued at $46,927,000 after purchasing an additional 1,231,484 shares during the period. Kingstone Capital Partners Texas LLC bought a new stake in Energy Fuels during the 2nd quarter valued at approximately $29,525,000. MMCAP International Inc. SPC raised its stake in Energy Fuels by 47.7% during the 1st quarter. MMCAP International Inc. SPC now owns 2,220,525 shares of the company's stock valued at $8,283,000 after purchasing an additional 716,714 shares during the period. Finally, Vident Advisory LLC raised its stake in Energy Fuels by 22.8% during the 1st quarter. Vident Advisory LLC now owns 2,068,860 shares of the company's stock valued at $7,717,000 after purchasing an additional 384,257 shares during the period. Institutional investors own 48.24% of the company's stock.

Insider Buying and Selling

In other news, EVP Timothy James Carstens sold 250,000 shares of Energy Fuels stock in a transaction that occurred on Friday, August 8th. The stock was sold at an average price of $10.44, for a total value of $2,610,000.00. Following the completion of the transaction, the executive vice president owned 267,029 shares in the company, valued at approximately $2,787,782.76. The trade was a 48.35% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director J. Birks Bovaird sold 10,000 shares of Energy Fuels stock in a transaction that occurred on Friday, September 19th. The stock was sold at an average price of $14.85, for a total value of $148,500.00. Following the completion of the transaction, the director owned 195,617 shares of the company's stock, valued at approximately $2,904,912.45. This trade represents a 4.86% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 618,724 shares of company stock worth $6,782,959 in the last 90 days. Company insiders own 1.92% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages recently issued reports on UUUU. Roth Capital downgraded Energy Fuels from a "buy" rating to a "neutral" rating and set a $6.00 target price on the stock. in a research note on Friday, July 11th. B. Riley initiated coverage on Energy Fuels in a research note on Wednesday, July 23rd. They issued a "buy" rating and a $9.00 price objective on the stock. Finally, HC Wainwright lifted their price objective on Energy Fuels from $12.00 to $16.25 and gave the stock a "buy" rating in a research note on Wednesday, September 17th. One equities research analyst has rated the stock with a Strong Buy rating, two have issued a Buy rating and one has given a Hold rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Buy" and an average price target of $9.25.

Read Our Latest Analysis on Energy Fuels

Energy Fuels Price Performance

NYSEAMERICAN:UUUU opened at $17.59 on Wednesday. Energy Fuels Inc has a 1 year low of $3.20 and a 1 year high of $19.01. The stock's 50 day simple moving average is $12.34 and its two-hundred day simple moving average is $7.82. The company has a market cap of $3.91 billion, a price-to-earnings ratio of -35.90 and a beta of 1.79.

Energy Fuels (NYSEAMERICAN:UUUU - Get Free Report) last announced its earnings results on Wednesday, August 6th. The company reported ($0.10) EPS for the quarter, missing analysts' consensus estimates of ($0.04) by ($0.06). The company had revenue of $4.21 million during the quarter. Energy Fuels had a negative return on equity of 17.41% and a negative net margin of 143.05%.Energy Fuels's revenue was up –51.7% on a year-over-year basis. As a group, analysts anticipate that Energy Fuels Inc will post -0.1 EPS for the current year.

Energy Fuels Profile

(

Free Report)

Energy Fuels Inc, together with its subsidiaries, engages in the extraction, recovery, recycling, exploration, permitting, evaluation, and sale of uranium mineral properties in the United States. The company produces and sells vanadium pentoxide, rare earth elements, and heavy mineral sands, such as ilmenite, rutile, zircon, and monazite.

See Also

Want to see what other hedge funds are holding UUUU? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Energy Fuels Inc (NYSEAMERICAN:UUUU - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Energy Fuels, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Energy Fuels wasn't on the list.

While Energy Fuels currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.