Siemens Fonds Invest GmbH acquired a new position in The Mosaic Company (NYSE:MOS - Free Report) during the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 9,100 shares of the basic materials company's stock, valued at approximately $224,000.

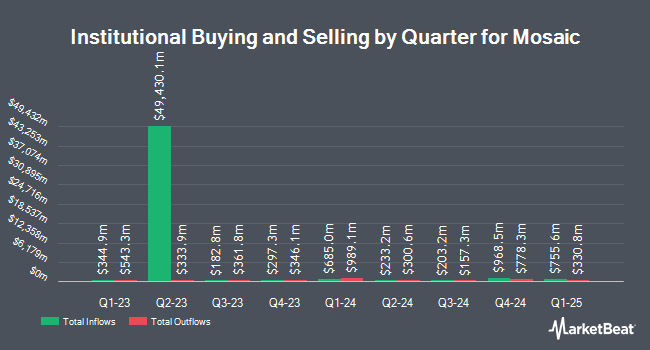

Other hedge funds have also recently added to or reduced their stakes in the company. Brooklyn Investment Group increased its holdings in Mosaic by 110.8% in the fourth quarter. Brooklyn Investment Group now owns 1,117 shares of the basic materials company's stock worth $27,000 after buying an additional 587 shares during the last quarter. R Squared Ltd acquired a new position in Mosaic in the fourth quarter worth approximately $33,000. Tobam acquired a new position in Mosaic in the fourth quarter worth approximately $38,000. Heck Capital Advisors LLC acquired a new position in Mosaic in the fourth quarter worth approximately $41,000. Finally, Ethos Financial Group LLC acquired a new position in Mosaic in the fourth quarter worth approximately $55,000. Institutional investors and hedge funds own 77.54% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms recently commented on MOS. Piper Sandler restated a "neutral" rating and issued a $30.00 price objective on shares of Mosaic in a report on Thursday, March 27th. Wall Street Zen raised Mosaic from a "hold" rating to a "buy" rating in a research report on Thursday. Royal Bank of Canada raised Mosaic from a "sector perform" rating to an "outperform" rating and upped their target price for the stock from $30.00 to $40.00 in a research report on Thursday, May 8th. The Goldman Sachs Group began coverage on Mosaic in a research report on Thursday, March 13th. They set a "buy" rating and a $31.00 target price for the company. Finally, Scotiabank reaffirmed an "outperform" rating on shares of Mosaic in a research report on Wednesday, May 14th. Six equities research analysts have rated the stock with a hold rating, seven have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, Mosaic currently has an average rating of "Moderate Buy" and a consensus target price of $34.58.

Get Our Latest Analysis on MOS

Mosaic Stock Performance

Shares of MOS stock traded up $0.12 during trading hours on Friday, reaching $35.13. 2,932,756 shares of the company's stock were exchanged, compared to its average volume of 4,708,614. The Mosaic Company has a fifty-two week low of $22.36 and a fifty-two week high of $35.96. The stock has a market capitalization of $11.14 billion, a P/E ratio of 31.09, a P/E/G ratio of 1.42 and a beta of 1.09. The business has a fifty day moving average price of $29.00 and a 200-day moving average price of $27.06. The company has a quick ratio of 0.49, a current ratio of 1.19 and a debt-to-equity ratio of 0.27.

Mosaic (NYSE:MOS - Get Free Report) last issued its quarterly earnings results on Tuesday, May 6th. The basic materials company reported $0.49 EPS for the quarter, topping analysts' consensus estimates of $0.45 by $0.04. Mosaic had a return on equity of 6.00% and a net margin of 3.24%. The company had revenue of $2.62 billion during the quarter, compared to analyst estimates of $2.70 billion. During the same period in the previous year, the company earned $0.65 earnings per share. The company's quarterly revenue was down 2.2% compared to the same quarter last year. Analysts predict that The Mosaic Company will post 2.04 EPS for the current fiscal year.

Mosaic Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, June 19th. Stockholders of record on Thursday, June 5th will be issued a dividend of $0.22 per share. The ex-dividend date of this dividend is Thursday, June 5th. This represents a $0.88 dividend on an annualized basis and a dividend yield of 2.50%. Mosaic's dividend payout ratio (DPR) is presently 75.86%.

Mosaic Company Profile

(

Free Report)

The Mosaic Company, through its subsidiaries, produces and markets concentrated phosphate and potash crop nutrients in North America and internationally. The company operates through three segments: Phosphates, Potash, and Mosaic Fertilizantes. It owns and operates mines, which produce concentrated phosphate crop nutrients, such as diammonium phosphate, monoammonium phosphate, and ammoniated phosphate products; and phosphate-based animal feed ingredients primarily under the Biofos and Nexfos brand names, as well as produces a double sulfate of potash magnesia product under K-Mag brand name.

Recommended Stories

Before you consider Mosaic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mosaic wasn't on the list.

While Mosaic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.