Silver Coast Investments LLC trimmed its position in shares of Altria Group, Inc. (NYSE:MO - Free Report) by 37.2% during the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 7,041 shares of the company's stock after selling 4,174 shares during the period. Silver Coast Investments LLC's holdings in Altria Group were worth $423,000 at the end of the most recent quarter.

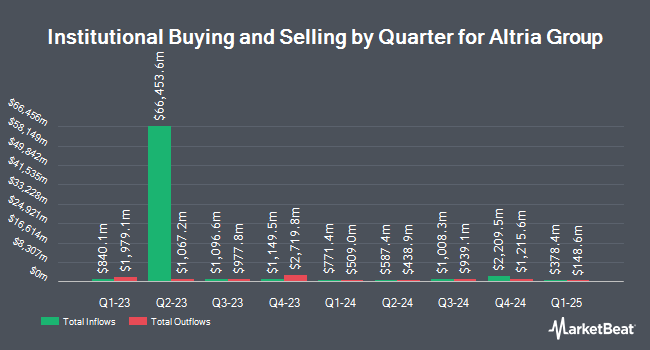

Several other large investors also recently modified their holdings of MO. Earned Wealth Advisors LLC acquired a new position in Altria Group during the 1st quarter worth $205,000. Allianz SE lifted its stake in shares of Altria Group by 7.1% in the 1st quarter. Allianz SE now owns 14,670 shares of the company's stock valued at $880,000 after purchasing an additional 970 shares during the period. Commonwealth Equity Services LLC increased its position in shares of Altria Group by 3.9% in the 1st quarter. Commonwealth Equity Services LLC now owns 1,497,572 shares of the company's stock valued at $89,884,000 after buying an additional 56,416 shares in the last quarter. Heritage Trust Co increased its position in shares of Altria Group by 15.6% in the 1st quarter. Heritage Trust Co now owns 141,932 shares of the company's stock valued at $8,519,000 after buying an additional 19,188 shares in the last quarter. Finally, Argent Trust Co increased its holdings in Altria Group by 5.5% during the 1st quarter. Argent Trust Co now owns 57,609 shares of the company's stock worth $3,458,000 after purchasing an additional 2,993 shares in the last quarter. 57.41% of the stock is currently owned by institutional investors.

Altria Group Stock Up 1.0%

Shares of NYSE MO traded up $0.66 during midday trading on Friday, reaching $64.21. 5,383,980 shares of the company were exchanged, compared to its average volume of 9,165,341. The stock's 50-day moving average price is $59.64 and its 200-day moving average price is $57.70. The stock has a market cap of $107.87 billion, a P/E ratio of 12.42, a PEG ratio of 3.40 and a beta of 0.59. Altria Group, Inc. has a one year low of $48.86 and a one year high of $64.35.

Altria Group (NYSE:MO - Get Free Report) last issued its quarterly earnings results on Wednesday, July 30th. The company reported $1.44 EPS for the quarter, topping analysts' consensus estimates of $1.37 by $0.07. The company had revenue of $5.29 billion for the quarter, compared to analyst estimates of $5.21 billion. Altria Group had a net margin of 37.24% and a negative return on equity of 295.26%. Altria Group's revenue was up .2% compared to the same quarter last year. During the same quarter in the previous year, the business earned $1.31 earnings per share. On average, equities research analysts anticipate that Altria Group, Inc. will post 5.32 EPS for the current year.

Altria Group Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Thursday, July 10th. Shareholders of record on Monday, June 16th were given a dividend of $1.02 per share. The ex-dividend date of this dividend was Monday, June 16th. This represents a $4.08 dividend on an annualized basis and a yield of 6.4%. Altria Group's dividend payout ratio is 78.92%.

Wall Street Analyst Weigh In

MO has been the subject of a number of research reports. Stifel Nicolaus increased their target price on Altria Group from $63.00 to $65.00 and gave the stock a "buy" rating in a report on Thursday, July 31st. Wall Street Zen downgraded shares of Altria Group from a "buy" rating to a "hold" rating in a research note on Thursday, May 1st. Citigroup raised their price objective on shares of Altria Group from $52.00 to $55.00 and gave the stock a "neutral" rating in a research report on Friday, April 25th. Morgan Stanley raised their price objective on shares of Altria Group from $57.00 to $62.00 and gave the stock an "equal weight" rating in a research report on Thursday, July 31st. Finally, Needham & Company LLC upgraded shares of Altria Group to a "hold" rating in a research report on Thursday, May 22nd. Two equities research analysts have rated the stock with a sell rating, six have given a hold rating and two have issued a buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $59.13.

Read Our Latest Research Report on MO

Altria Group Company Profile

(

Free Report)

Altria Group, Inc, through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States. The company offers cigarettes primarily under the Marlboro brand; large cigars and pipe tobacco under the Black & Mild brand; moist smokeless tobacco and snus products under the Copenhagen, Skoal, Red Seal, and Husky brands; oral nicotine pouches under the on! brand; and e-vapor products under the NJOY ACE brand.

Recommended Stories

Before you consider Altria Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altria Group wasn't on the list.

While Altria Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.