Skandinaviska Enskilda Banken AB publ reduced its holdings in Applied Materials, Inc. (NASDAQ:AMAT - Free Report) by 16.0% during the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 549,188 shares of the manufacturing equipment provider's stock after selling 104,601 shares during the quarter. Skandinaviska Enskilda Banken AB publ owned about 0.07% of Applied Materials worth $79,704,000 at the end of the most recent quarter.

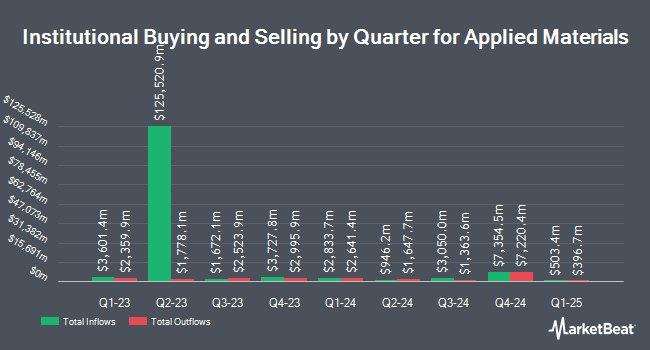

A number of other large investors have also recently made changes to their positions in the business. Drive Wealth Management LLC grew its position in shares of Applied Materials by 3.8% in the 1st quarter. Drive Wealth Management LLC now owns 2,847 shares of the manufacturing equipment provider's stock worth $413,000 after buying an additional 104 shares during the last quarter. Caliber Wealth Management LLC KS bought a new stake in shares of Applied Materials in the 1st quarter worth approximately $203,000. Pacer Advisors Inc. grew its position in shares of Applied Materials by 2,401.0% in the 1st quarter. Pacer Advisors Inc. now owns 3,066,817 shares of the manufacturing equipment provider's stock worth $445,056,000 after buying an additional 2,944,193 shares during the last quarter. Assetmark Inc. lifted its stake in shares of Applied Materials by 10.4% in the 1st quarter. Assetmark Inc. now owns 243,315 shares of the manufacturing equipment provider's stock valued at $35,310,000 after purchasing an additional 22,862 shares during the period. Finally, Cetera Investment Advisers lifted its stake in shares of Applied Materials by 8.7% in the 1st quarter. Cetera Investment Advisers now owns 253,043 shares of the manufacturing equipment provider's stock valued at $36,722,000 after purchasing an additional 20,222 shares during the period. 80.56% of the stock is currently owned by institutional investors.

Insider Buying and Selling at Applied Materials

In other Applied Materials news, CAO Adam Sanders sold 562 shares of the company's stock in a transaction that occurred on Tuesday, June 24th. The shares were sold at an average price of $178.60, for a total value of $100,373.20. Following the completion of the transaction, the chief accounting officer directly owned 5,300 shares in the company, valued at $946,580. This represents a 9.59% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 0.24% of the stock is currently owned by insiders.

Analyst Ratings Changes

A number of research analysts have recently commented on AMAT shares. Raymond James Financial restated an "outperform" rating and issued a $200.00 target price (down previously from $225.00) on shares of Applied Materials in a research note on Friday, May 16th. Barclays lowered their target price on Applied Materials from $190.00 to $160.00 and set an "equal weight" rating for the company in a research note on Tuesday, April 22nd. Rothschild & Co Redburn cut Applied Materials from a "buy" rating to a "neutral" rating and set a $200.00 target price for the company. in a research note on Monday, July 7th. Redburn Atlantic cut Applied Materials from a "strong-buy" rating to a "hold" rating and lowered their target price for the company from $225.00 to $200.00 in a research note on Monday, July 7th. Finally, Cantor Fitzgerald set a $220.00 target price on Applied Materials and gave the company an "overweight" rating in a research note on Tuesday, June 24th. Nine investment analysts have rated the stock with a hold rating and seventeen have issued a buy rating to the company's stock. According to data from MarketBeat.com, Applied Materials has an average rating of "Moderate Buy" and an average target price of $204.74.

Read Our Latest Analysis on AMAT

Applied Materials Stock Performance

Shares of AMAT traded down $2.43 during trading hours on Friday, hitting $185.69. The stock had a trading volume of 6,580,937 shares, compared to its average volume of 6,161,150. The company has a debt-to-equity ratio of 0.29, a current ratio of 2.46 and a quick ratio of 1.76. Applied Materials, Inc. has a 12 month low of $123.74 and a 12 month high of $215.70. The firm has a market capitalization of $149.02 billion, a PE ratio of 22.59, a PEG ratio of 2.09 and a beta of 1.69. The stock has a fifty day moving average price of $177.59 and a 200 day moving average price of $166.59.

Applied Materials (NASDAQ:AMAT - Get Free Report) last issued its quarterly earnings data on Thursday, May 15th. The manufacturing equipment provider reported $2.39 EPS for the quarter, topping the consensus estimate of $2.31 by $0.08. Applied Materials had a return on equity of 40.15% and a net margin of 24.06%. The company had revenue of $7.10 billion during the quarter, compared to analyst estimates of $7.12 billion. During the same quarter in the previous year, the company posted $2.09 earnings per share. Applied Materials's revenue was up 6.8% compared to the same quarter last year. Analysts anticipate that Applied Materials, Inc. will post 9.38 EPS for the current year.

Applied Materials Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, September 11th. Stockholders of record on Thursday, August 21st will be given a dividend of $0.46 per share. The ex-dividend date is Thursday, August 21st. This represents a $1.84 dividend on an annualized basis and a dividend yield of 0.99%. Applied Materials's payout ratio is currently 22.38%.

Applied Materials Company Profile

(

Free Report)

Applied Materials, Inc engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries. The company operates through three segments: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets. The Semiconductor Systems segment develops, manufactures, and sells various manufacturing equipment that is used to fabricate semiconductor chips or integrated circuits.

Featured Stories

Before you consider Applied Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Materials wasn't on the list.

While Applied Materials currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.