Skandinaviska Enskilda Banken AB publ increased its position in shares of BridgeBio Pharma, Inc. (NASDAQ:BBIO - Free Report) by 42.3% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 59,061 shares of the company's stock after acquiring an additional 17,547 shares during the period. Skandinaviska Enskilda Banken AB publ's holdings in BridgeBio Pharma were worth $2,042,000 as of its most recent filing with the Securities and Exchange Commission.

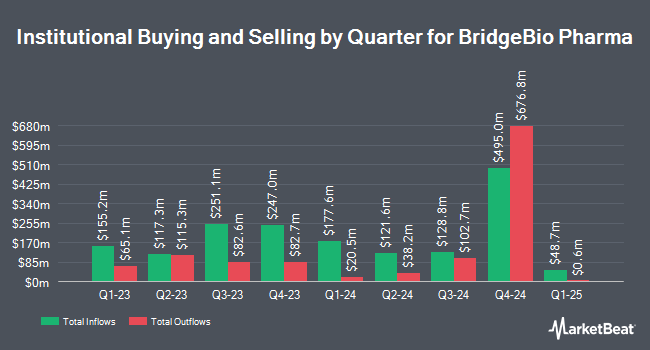

Several other large investors have also made changes to their positions in BBIO. GAMMA Investing LLC lifted its stake in BridgeBio Pharma by 71.0% in the 1st quarter. GAMMA Investing LLC now owns 920 shares of the company's stock valued at $32,000 after purchasing an additional 382 shares during the last quarter. Itau Unibanco Holding S.A. bought a new position in BridgeBio Pharma in the 4th quarter valued at approximately $41,000. Sterling Capital Management LLC lifted its stake in BridgeBio Pharma by 554.6% in the 4th quarter. Sterling Capital Management LLC now owns 1,787 shares of the company's stock valued at $49,000 after purchasing an additional 1,514 shares during the last quarter. GF Fund Management CO. LTD. bought a new position in BridgeBio Pharma in the 4th quarter valued at approximately $109,000. Finally, CWM LLC raised its stake in shares of BridgeBio Pharma by 12.8% during the first quarter. CWM LLC now owns 5,261 shares of the company's stock valued at $182,000 after acquiring an additional 598 shares during the last quarter. Institutional investors and hedge funds own 99.85% of the company's stock.

Insider Buying and Selling at BridgeBio Pharma

In related news, major shareholder Genetic Disorder L.P. Kkr sold 6,000,000 shares of the business's stock in a transaction dated Monday, May 12th. The shares were sold at an average price of $34.20, for a total transaction of $205,200,000.00. Following the transaction, the insider directly owned 13,260,971 shares in the company, valued at approximately $453,525,208.20. The trade was a 31.15% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Hannah Valantine sold 4,292 shares of the business's stock in a transaction dated Tuesday, June 10th. The stock was sold at an average price of $40.00, for a total transaction of $171,680.00. Following the transaction, the director owned 1,764 shares in the company, valued at approximately $70,560. This trade represents a 70.87% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 9,750,155 shares of company stock valued at $369,080,403 in the last quarter. 18.20% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

Several equities analysts have recently issued reports on the stock. Citigroup raised their price target on shares of BridgeBio Pharma from $58.00 to $67.00 and gave the company a "buy" rating in a research note on Friday, July 11th. Piper Sandler raised their price target on shares of BridgeBio Pharma from $63.00 to $68.00 and gave the company an "overweight" rating in a research note on Monday, July 14th. Scotiabank raised their price target on shares of BridgeBio Pharma from $52.00 to $55.00 and gave the company a "sector outperform" rating in a research note on Wednesday, April 30th. HC Wainwright raised their price target on shares of BridgeBio Pharma from $53.00 to $56.00 and gave the company a "buy" rating in a research note on Monday, June 9th. Finally, Raymond James Financial initiated coverage on shares of BridgeBio Pharma in a research note on Wednesday. They set an "outperform" rating and a $56.00 price target for the company. One analyst has rated the stock with a sell rating and seventeen have issued a buy rating to the company's stock. According to data from MarketBeat.com, BridgeBio Pharma has a consensus rating of "Moderate Buy" and an average price target of $61.18.

Get Our Latest Stock Analysis on BBIO

BridgeBio Pharma Price Performance

Shares of NASDAQ BBIO traded up $0.28 during mid-day trading on Friday, reaching $47.55. 819,300 shares of the company's stock traded hands, compared to its average volume of 2,970,394. The stock has a market cap of $9.03 billion, a P/E ratio of -13.50 and a beta of 1.15. The business has a 50-day simple moving average of $42.02 and a 200 day simple moving average of $36.97. BridgeBio Pharma, Inc. has a 1-year low of $21.72 and a 1-year high of $48.68.

BridgeBio Pharma (NASDAQ:BBIO - Get Free Report) last released its quarterly earnings results on Tuesday, April 29th. The company reported ($0.88) earnings per share for the quarter, topping the consensus estimate of ($1.00) by $0.12. The firm had revenue of $36.74 million for the quarter, compared to analysts' expectations of $57.14 million. During the same quarter last year, the firm posted ($0.20) earnings per share. The firm's revenue for the quarter was down 44.8% compared to the same quarter last year. Equities research analysts anticipate that BridgeBio Pharma, Inc. will post -3.67 earnings per share for the current fiscal year.

BridgeBio Pharma Profile

(

Free Report)

BridgeBio Pharma, Inc, a commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers. Its products in development programs include AG10, a next-generation oral small molecule near-complete TTR stabilizer that is in Phase 3 clinical trial for the treatment of TTR amyloidosis, or transthyretin amyloid cardiomyopathy (ATTR-CM); low-dose infigratinib, an oral FGFR1-3 selective tyrosine kinase inhibitor, which is in Phase 3 double-blinded, placebo-controlled pivotal study for the treatment option for children with achondroplasia; and BBP-631, an AAV5 gene transfer product candidate that is in Phase 1/2 clinical trial for the treatment of congenital adrenal hyperplasia, or CAH, driven by 21-hydroxylase deficiency, or 21OHD.

Read More

Before you consider BridgeBio Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BridgeBio Pharma wasn't on the list.

While BridgeBio Pharma currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.