Skandinaviska Enskilda Banken AB publ reduced its position in shares of QUALCOMM Incorporated (NASDAQ:QCOM - Free Report) by 9.0% during the first quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 1,073,186 shares of the wireless technology company's stock after selling 105,679 shares during the quarter. QUALCOMM comprises about 0.8% of Skandinaviska Enskilda Banken AB publ's portfolio, making the stock its 24th biggest position. Skandinaviska Enskilda Banken AB publ owned approximately 0.10% of QUALCOMM worth $164,810,000 at the end of the most recent reporting period.

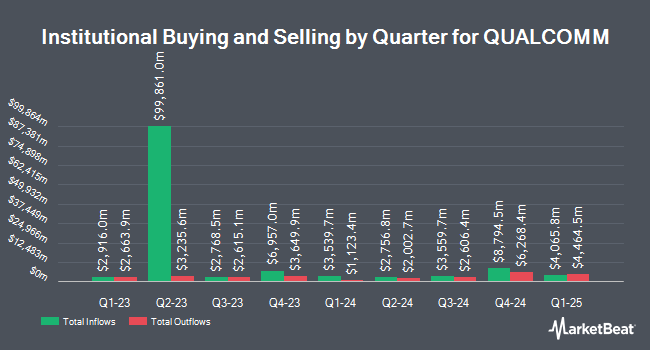

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. Banque Transatlantique SA purchased a new stake in shares of QUALCOMM during the fourth quarter valued at approximately $26,000. Atlantic Edge Private Wealth Management LLC increased its position in shares of QUALCOMM by 70.0% during the first quarter. Atlantic Edge Private Wealth Management LLC now owns 170 shares of the wireless technology company's stock valued at $26,000 after acquiring an additional 70 shares during the last quarter. WFA Asset Management Corp purchased a new stake in shares of QUALCOMM during the first quarter valued at approximately $27,000. Sunbeam Capital Management LLC purchased a new stake in shares of QUALCOMM during the fourth quarter valued at approximately $29,000. Finally, Mascagni Wealth Management Inc. purchased a new stake in shares of QUALCOMM during the fourth quarter valued at approximately $30,000. 74.35% of the stock is owned by hedge funds and other institutional investors.

QUALCOMM Stock Down 0.3%

Shares of QCOM traded down $0.44 during mid-day trading on Friday, reaching $158.40. The company had a trading volume of 4,805,669 shares, compared to its average volume of 7,220,092. QUALCOMM Incorporated has a 52 week low of $120.80 and a 52 week high of $182.64. The company has a market capitalization of $173.92 billion, a price-to-earnings ratio of 16.13, a price-to-earnings-growth ratio of 2.05 and a beta of 1.26. The firm has a 50-day moving average price of $154.60 and a 200 day moving average price of $155.03. The company has a debt-to-equity ratio of 0.48, a quick ratio of 2.08 and a current ratio of 2.73.

QUALCOMM (NASDAQ:QCOM - Get Free Report) last announced its earnings results on Wednesday, April 30th. The wireless technology company reported $2.85 earnings per share for the quarter, beating analysts' consensus estimates of $2.82 by $0.03. The business had revenue of $10.98 billion during the quarter, compared to analyst estimates of $10.58 billion. QUALCOMM had a net margin of 26.11% and a return on equity of 40.11%. The company's quarterly revenue was up 17.0% compared to the same quarter last year. During the same period in the previous year, the business earned $2.44 EPS. On average, sell-side analysts forecast that QUALCOMM Incorporated will post 9.39 EPS for the current year.

QUALCOMM Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, September 25th. Shareholders of record on Thursday, September 4th will be issued a dividend of $0.89 per share. This represents a $3.56 annualized dividend and a dividend yield of 2.25%. The ex-dividend date of this dividend is Thursday, September 4th. QUALCOMM's dividend payout ratio (DPR) is presently 36.25%.

Wall Street Analyst Weigh In

A number of analysts recently commented on the company. Seaport Res Ptn raised QUALCOMM to a "hold" rating in a research report on Friday, May 9th. Citigroup reissued a "hold" rating on shares of QUALCOMM in a report on Thursday, July 17th. Benchmark reduced their price objective on QUALCOMM from $240.00 to $200.00 and set a "buy" rating for the company in a report on Thursday, May 1st. JPMorgan Chase & Co. increased their price objective on QUALCOMM from $185.00 to $190.00 and gave the company an "overweight" rating in a report on Thursday, July 17th. Finally, Wall Street Zen lowered QUALCOMM from a "buy" rating to a "hold" rating in a report on Thursday, May 22nd. One research analyst has rated the stock with a sell rating, fourteen have issued a hold rating and twelve have issued a buy rating to the company. According to MarketBeat, the stock has an average rating of "Hold" and an average price target of $184.86.

Read Our Latest Stock Analysis on QCOM

Insider Buying and Selling at QUALCOMM

In other QUALCOMM news, major shareholder Inc/De Qualcomm sold 412,500 shares of the stock in a transaction dated Friday, May 23rd. The shares were sold at an average price of $16.00, for a total transaction of $6,600,000.00. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Heather S. Ace sold 1,600 shares of the stock in a transaction dated Friday, May 2nd. The shares were sold at an average price of $137.74, for a total transaction of $220,384.00. Following the transaction, the insider directly owned 22,793 shares of the company's stock, valued at $3,139,507.82. This trade represents a 6.56% decrease in their position. The disclosure for this sale can be found here. Insiders sold 424,099 shares of company stock valued at $8,310,735 in the last 90 days. Insiders own 0.08% of the company's stock.

QUALCOMM Profile

(

Free Report)

QUALCOMM Incorporated engages in the development and commercialization of foundational technologies for the wireless industry worldwide. It operates through three segments: Qualcomm CDMA Technologies (QCT); Qualcomm Technology Licensing (QTL); and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software based on 3G/4G/5G and other technologies for use in wireless voice and data communications, networking, computing, multimedia, and position location products.

Featured Stories

Before you consider QUALCOMM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QUALCOMM wasn't on the list.

While QUALCOMM currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.