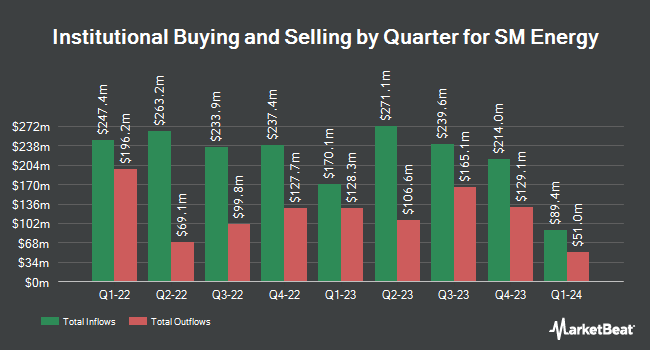

Channing Capital Management LLC lifted its position in SM Energy Company (NYSE:SM - Free Report) by 33.5% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,558,569 shares of the energy company's stock after acquiring an additional 391,536 shares during the quarter. Channing Capital Management LLC owned 1.36% of SM Energy worth $46,679,000 as of its most recent SEC filing.

Several other hedge funds also recently made changes to their positions in SM. HITE Hedge Asset Management LLC bought a new stake in shares of SM Energy in the 1st quarter worth approximately $44,005,000. Invesco Ltd. lifted its holdings in shares of SM Energy by 169.4% in the 1st quarter. Invesco Ltd. now owns 1,873,860 shares of the energy company's stock worth $56,122,000 after purchasing an additional 1,178,397 shares during the last quarter. Westwood Holdings Group Inc. lifted its holdings in shares of SM Energy by 51.4% in the 1st quarter. Westwood Holdings Group Inc. now owns 3,207,245 shares of the energy company's stock worth $96,057,000 after purchasing an additional 1,088,948 shares during the last quarter. New York State Common Retirement Fund bought a new stake in shares of SM Energy in the 1st quarter worth approximately $25,363,000. Finally, Nuveen LLC bought a new stake in shares of SM Energy in the 1st quarter worth approximately $18,910,000. Institutional investors and hedge funds own 94.56% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages recently issued reports on SM. Wells Fargo & Company cut their price target on SM Energy from $33.00 to $29.00 and set an "equal weight" rating on the stock in a report on Monday, June 16th. TD Cowen raised SM Energy to a "strong-buy" rating in a report on Monday, July 7th. Susquehanna raised their price target on SM Energy from $24.00 to $27.00 and gave the stock a "neutral" rating in a report on Wednesday, July 23rd. Raymond James Financial downgraded SM Energy from an "outperform" rating to an "underperform" rating in a report on Tuesday, June 24th. Finally, Mizuho boosted their price target on SM Energy from $42.00 to $44.00 and gave the stock an "outperform" rating in a research report on Friday, August 1st. One investment analyst has rated the stock with a Strong Buy rating, three have assigned a Buy rating, six have assigned a Hold rating and one has given a Sell rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $42.50.

Read Our Latest Stock Report on SM

SM Energy Price Performance

Shares of SM Energy stock traded down $0.73 during trading on Tuesday, hitting $27.64. The stock had a trading volume of 549,391 shares, compared to its average volume of 2,261,055. The company has a debt-to-equity ratio of 0.59, a current ratio of 0.69 and a quick ratio of 0.69. The firm has a market cap of $3.18 billion, a P/E ratio of 3.91 and a beta of 2.29. The business has a fifty day moving average of $26.70 and a two-hundred day moving average of $27.02. SM Energy Company has a fifty-two week low of $19.67 and a fifty-two week high of $47.17.

SM Energy (NYSE:SM - Get Free Report) last announced its quarterly earnings data on Thursday, July 31st. The energy company reported $1.50 earnings per share for the quarter, beating the consensus estimate of $1.23 by $0.27. The business had revenue of $792.94 million during the quarter, compared to analyst estimates of $792.58 million. SM Energy had a return on equity of 18.06% and a net margin of 25.94%.The company's revenue was up 25.0% on a year-over-year basis. During the same quarter in the prior year, the firm posted $1.85 earnings per share. On average, sell-side analysts expect that SM Energy Company will post 8.1 earnings per share for the current fiscal year.

SM Energy Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Monday, August 4th. Stockholders of record on Friday, July 18th were given a dividend of $0.20 per share. The ex-dividend date of this dividend was Friday, July 18th. This represents a $0.80 dividend on an annualized basis and a dividend yield of 2.9%. SM Energy's payout ratio is 11.30%.

SM Energy Profile

(

Free Report)

SM Energy Company, an independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas. It has working interests in oil and gas producing wells in the Midland Basin and South Texas. The company was formerly known as St.

Featured Articles

Before you consider SM Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SM Energy wasn't on the list.

While SM Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.