Alight Capital Management LP lessened its holdings in shares of Snowflake Inc. (NYSE:SNOW - Free Report) by 70.0% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 15,000 shares of the company's stock after selling 35,000 shares during the period. Snowflake comprises approximately 1.0% of Alight Capital Management LP's investment portfolio, making the stock its 25th biggest position. Alight Capital Management LP's holdings in Snowflake were worth $2,192,000 at the end of the most recent quarter.

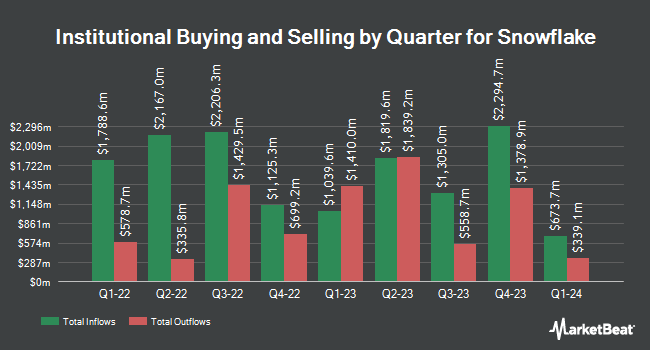

A number of other large investors have also recently modified their holdings of SNOW. Brighton Jones LLC boosted its holdings in shares of Snowflake by 90.0% in the fourth quarter. Brighton Jones LLC now owns 61,885 shares of the company's stock valued at $9,556,000 after purchasing an additional 29,320 shares during the period. Comerica Bank boosted its holdings in shares of Snowflake by 3.9% in the fourth quarter. Comerica Bank now owns 20,763 shares of the company's stock valued at $3,206,000 after purchasing an additional 781 shares during the period. Triumph Capital Management boosted its holdings in shares of Snowflake by 30.3% in the fourth quarter. Triumph Capital Management now owns 7,706 shares of the company's stock valued at $1,190,000 after purchasing an additional 1,791 shares during the period. Aptus Capital Advisors LLC purchased a new stake in shares of Snowflake in the fourth quarter valued at approximately $448,000. Finally, Benjamin Edwards Inc. boosted its holdings in shares of Snowflake by 18.3% in the fourth quarter. Benjamin Edwards Inc. now owns 2,228 shares of the company's stock valued at $344,000 after purchasing an additional 344 shares during the period. Hedge funds and other institutional investors own 65.10% of the company's stock.

Analyst Ratings Changes

SNOW has been the subject of a number of research reports. Needham & Company LLC boosted their price target on Snowflake from $230.00 to $280.00 and gave the company a "buy" rating in a report on Thursday, August 28th. BTIG Research boosted their price target on Snowflake from $235.00 to $276.00 and gave the company a "buy" rating in a report on Thursday, August 28th. Morgan Stanley boosted their price target on Snowflake from $262.00 to $272.00 and gave the company an "overweight" rating in a report on Thursday, August 28th. Royal Bank Of Canada boosted their price objective on shares of Snowflake from $250.00 to $275.00 and gave the stock an "outperform" rating in a research note on Thursday, August 28th. Finally, Wells Fargo & Company boosted their price objective on shares of Snowflake from $250.00 to $275.00 and gave the stock an "overweight" rating in a research note on Thursday, August 28th. Two investment analysts have rated the stock with a Strong Buy rating, thirty-six have given a Buy rating, four have issued a Hold rating and two have given a Sell rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $255.53.

Check Out Our Latest Analysis on SNOW

Snowflake Stock Up 1.6%

Shares of SNOW stock traded up $3.57 during trading hours on Friday, reaching $225.47. 5,885,231 shares of the company's stock were exchanged, compared to its average volume of 7,495,617. The stock's 50 day moving average is $212.34 and its 200-day moving average is $187.31. The company has a market cap of $75.28 billion, a price-to-earnings ratio of -54.33 and a beta of 1.22. The company has a current ratio of 1.58, a quick ratio of 1.58 and a debt-to-equity ratio of 0.94. Snowflake Inc. has a fifty-two week low of $107.13 and a fifty-two week high of $249.99.

Snowflake (NYSE:SNOW - Get Free Report) last issued its quarterly earnings results on Wednesday, August 27th. The company reported $0.35 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.27 by $0.08. The business had revenue of $1.14 billion for the quarter, compared to the consensus estimate of $1.09 billion. Snowflake had a negative return on equity of 41.42% and a negative net margin of 33.53%.The business's quarterly revenue was up 31.8% on a year-over-year basis. During the same period in the prior year, the firm posted $0.18 earnings per share. Analysts predict that Snowflake Inc. will post -2.36 earnings per share for the current fiscal year.

Insider Activity

In other news, Director Frank Slootman sold 710,083 shares of the company's stock in a transaction on Thursday, August 28th. The stock was sold at an average price of $230.47, for a total transaction of $163,652,829.01. Following the transaction, the director directly owned 165,507 shares of the company's stock, valued at approximately $38,144,398.29. This represents a 81.10% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Insiders sold 3,176,168 shares of company stock worth $708,898,070 over the last 90 days. Corporate insiders own 6.80% of the company's stock.

About Snowflake

(

Free Report)

Snowflake Inc provides a cloud-based data platform for various organizations in the United States and internationally. Its platform offers Data Cloud, which enables customers to consolidate data into a single source of truth to drive meaningful business insights, build data-driven applications, and share data and data products, as well as applies artificial intelligence (AI) for solving business problems.

Featured Articles

Before you consider Snowflake, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Snowflake wasn't on the list.

While Snowflake currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.