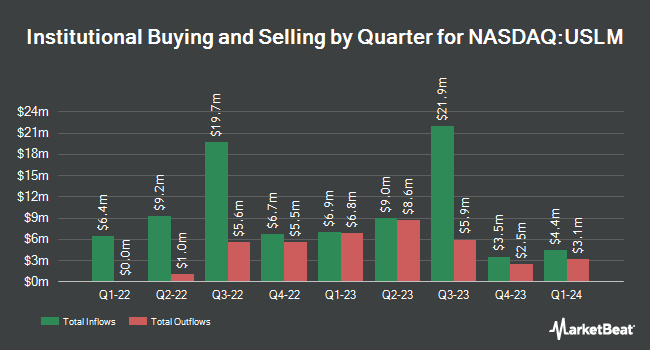

Squarepoint Ops LLC bought a new stake in United States Lime & Minerals, Inc. (NASDAQ:USLM - Free Report) in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 2,516 shares of the construction company's stock, valued at approximately $334,000.

A number of other institutional investors also recently modified their holdings of the company. Global Retirement Partners LLC acquired a new stake in United States Lime & Minerals during the 4th quarter valued at $25,000. State of Wyoming bought a new stake in shares of United States Lime & Minerals during the fourth quarter worth $35,000. Point72 Asia Singapore Pte. Ltd. bought a new stake in shares of United States Lime & Minerals during the fourth quarter worth $36,000. National Bank of Canada FI acquired a new stake in shares of United States Lime & Minerals in the fourth quarter valued at $72,000. Finally, Steward Partners Investment Advisory LLC increased its stake in shares of United States Lime & Minerals by 136.0% in the fourth quarter. Steward Partners Investment Advisory LLC now owns 885 shares of the construction company's stock valued at $117,000 after buying an additional 510 shares in the last quarter. Institutional investors own 27.12% of the company's stock.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen raised shares of United States Lime & Minerals from a "hold" rating to a "buy" rating in a report on Wednesday, April 2nd.

Check Out Our Latest Analysis on USLM

United States Lime & Minerals Price Performance

Shares of USLM stock traded down $3.51 during trading hours on Monday, reaching $102.64. 347,535 shares of the company were exchanged, compared to its average volume of 98,707. United States Lime & Minerals, Inc. has a fifty-two week low of $64.25 and a fifty-two week high of $159.53. The stock's fifty day moving average is $97.01 and its two-hundred day moving average is $109.81. The company has a market cap of $2.94 billion, a price-to-earnings ratio of 27.05 and a beta of 1.01.

United States Lime & Minerals (NASDAQ:USLM - Get Free Report) last announced its quarterly earnings data on Wednesday, April 30th. The construction company reported $1.19 EPS for the quarter. The firm had revenue of $91.25 million for the quarter. United States Lime & Minerals had a return on equity of 24.55% and a net margin of 34.27%.

United States Lime & Minerals Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, June 13th. Investors of record on Friday, May 23rd will be issued a $0.06 dividend. This represents a $0.24 annualized dividend and a yield of 0.23%. The ex-dividend date of this dividend is Friday, May 23rd. United States Lime & Minerals's dividend payout ratio is 5.71%.

United States Lime & Minerals Company Profile

(

Free Report)

United States Lime & Minerals, Inc engages in the manufacture and sale of lime and limestone products. Its products include High Calcium Quicklime, Hydrated Lime, Lime Kiln Dust, Lime Slurry, and High Calcium Limestone. The company was founded in 1948 and is headquartered in Dallas, TX.

Read More

Before you consider United States Lime & Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United States Lime & Minerals wasn't on the list.

While United States Lime & Minerals currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.