Vanguard Group Inc. lowered its position in St. Joe Company (The) (NYSE:JOE - Free Report) by 1.0% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 6,134,191 shares of the financial services provider's stock after selling 63,211 shares during the period. Vanguard Group Inc. owned approximately 10.54% of St. Joe worth $288,000,000 as of its most recent filing with the Securities & Exchange Commission.

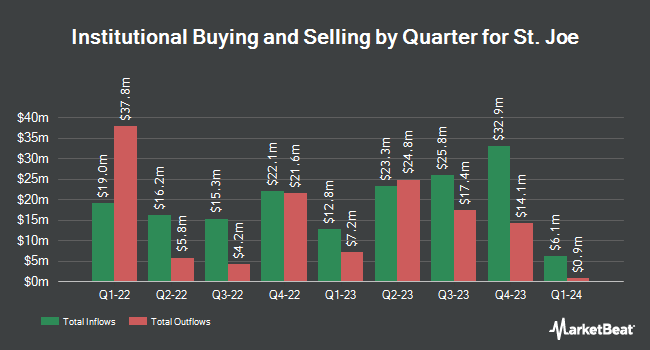

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. Lazard Asset Management LLC purchased a new position in shares of St. Joe during the 4th quarter worth $38,000. CWM LLC increased its position in shares of St. Joe by 472.4% during the 1st quarter. CWM LLC now owns 3,709 shares of the financial services provider's stock worth $174,000 after purchasing an additional 3,061 shares during the last quarter. XTX Topco Ltd acquired a new stake in shares of St. Joe during the 4th quarter worth about $210,000. Bridgefront Capital LLC acquired a new stake in shares of St. Joe during the 4th quarter worth about $225,000. Finally, Corton Capital Inc. purchased a new stake in St. Joe in the fourth quarter valued at approximately $227,000. Hedge funds and other institutional investors own 86.67% of the company's stock.

St. Joe Trading Down 0.4%

Shares of NYSE JOE traded down $0.2180 on Thursday, reaching $48.9520. 59,834 shares of the company traded hands, compared to its average volume of 250,431. St. Joe Company has a fifty-two week low of $40.19 and a fifty-two week high of $62.49. The company has a 50 day moving average of $49.50 and a 200 day moving average of $46.67. The company has a current ratio of 1.45, a quick ratio of 1.45 and a debt-to-equity ratio of 0.81. The stock has a market capitalization of $2.83 billion, a PE ratio of 34.51 and a beta of 1.37.

St. Joe (NYSE:JOE - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The financial services provider reported $0.51 EPS for the quarter. St. Joe had a net margin of 19.39% and a return on equity of 11.19%. The company had revenue of $129.10 million during the quarter.

St. Joe Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, September 19th. Stockholders of record on Friday, August 22nd will be paid a dividend of $0.14 per share. The ex-dividend date of this dividend is Friday, August 22nd. This represents a $0.56 dividend on an annualized basis and a dividend yield of 1.1%. St. Joe's dividend payout ratio is currently 39.44%.

Insider Activity at St. Joe

In other news, major shareholder Bruce R. Berkowitz sold 167,500 shares of St. Joe stock in a transaction dated Wednesday, August 13th. The stock was sold at an average price of $51.44, for a total value of $8,616,200.00. Following the transaction, the insider directly owned 16,634,024 shares of the company's stock, valued at $855,654,194.56. The trade was a 1.00% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this link. In the last quarter, insiders sold 405,600 shares of company stock valued at $20,645,157. Company insiders own 0.32% of the company's stock.

Analyst Ratings Changes

Separately, Wall Street Zen cut St. Joe from a "buy" rating to a "hold" rating in a research note on Sunday, June 8th.

Get Our Latest Report on JOE

St. Joe Profile

(

Free Report)

The St. Joe Company, together with its subsidiaries, operates as a real estate development, asset management, and operating company in Northwest Florida. It operates through three segments: Residential, Hospitality, and Commercial. The Residential segment engages in the development of communities into homesites for sale to homebuilders and on a limited basis to retail customers.

See Also

Before you consider St. Joe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and St. Joe wasn't on the list.

While St. Joe currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.