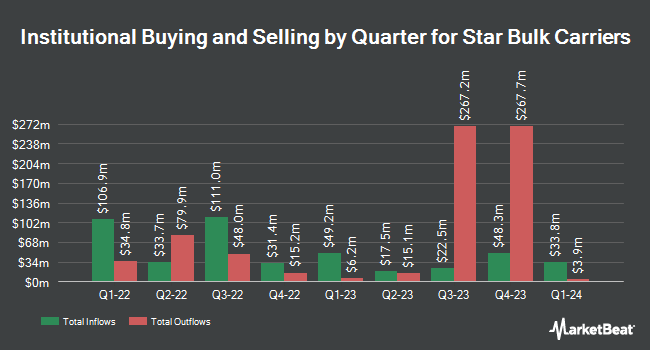

Focus Partners Wealth increased its position in shares of Star Bulk Carriers Corp. (NASDAQ:SBLK - Free Report) by 56.0% in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 938,208 shares of the shipping company's stock after acquiring an additional 336,873 shares during the quarter. Focus Partners Wealth owned about 0.80% of Star Bulk Carriers worth $14,599,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors also recently bought and sold shares of SBLK. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC boosted its stake in Star Bulk Carriers by 59.7% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 1,298,436 shares of the shipping company's stock valued at $20,204,000 after acquiring an additional 485,436 shares in the last quarter. Philosophy Capital Management LLC lifted its holdings in shares of Star Bulk Carriers by 10.1% during the 1st quarter. Philosophy Capital Management LLC now owns 1,519,259 shares of the shipping company's stock valued at $23,640,000 after purchasing an additional 139,930 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. purchased a new stake in shares of Star Bulk Carriers during the 1st quarter valued at $10,734,000. Kettle Hill Capital Management LLC acquired a new stake in shares of Star Bulk Carriers in the 1st quarter worth $4,801,000. Finally, Amundi grew its stake in Star Bulk Carriers by 59.1% during the 1st quarter. Amundi now owns 1,868,249 shares of the shipping company's stock worth $26,548,000 after buying an additional 693,683 shares during the last quarter. Hedge funds and other institutional investors own 33.91% of the company's stock.

Wall Street Analyst Weigh In

SBLK has been the subject of a number of research analyst reports. Jefferies Financial Group reiterated a "buy" rating and issued a $22.00 price target on shares of Star Bulk Carriers in a research note on Thursday, August 7th. Zacks Research upgraded shares of Star Bulk Carriers from a "strong sell" rating to a "hold" rating in a report on Friday, August 15th. Finally, Wall Street Zen raised shares of Star Bulk Carriers from a "sell" rating to a "hold" rating in a research report on Sunday, August 10th. One investment analyst has rated the stock with a Buy rating and three have assigned a Hold rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $21.07.

Get Our Latest Report on Star Bulk Carriers

Star Bulk Carriers Stock Performance

NASDAQ SBLK traded down $0.02 on Thursday, reaching $19.77. 512,808 shares of the company's stock traded hands, compared to its average volume of 1,652,884. The firm has a market cap of $2.33 billion, a price-to-earnings ratio of 18.81 and a beta of 0.97. Star Bulk Carriers Corp. has a fifty-two week low of $12.06 and a fifty-two week high of $23.82. The stock has a 50 day moving average price of $18.87 and a 200-day moving average price of $16.86. The company has a debt-to-equity ratio of 0.40, a quick ratio of 1.42 and a current ratio of 1.61.

Star Bulk Carriers Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, September 10th. Shareholders of record on Thursday, August 28th were given a dividend of $0.05 per share. The ex-dividend date was Thursday, August 28th. This represents a $0.20 dividend on an annualized basis and a yield of 1.0%. Star Bulk Carriers's dividend payout ratio is currently 19.05%.

Star Bulk Carriers Company Profile

(

Free Report)

Star Bulk Carriers Corp., a shipping company, engages in the ocean transportation of dry bulk cargoes worldwide. Its vessels transport a range of bulk commodities, including iron ores, minerals and grains, bauxite, fertilizers, and steel products. As of December 31, 2023, the company owned a fleet of 116 dry bulk vessels with combined carrying capacity of 13.1 million deadweight tonnage (dwt) consisting of Newcastlemax, Capesize, Post Panamax, Kamsarmax, Panamax, Ultramax, and Supramax vessels with carrying capacities between 53,489 dwt and 209,537 dwt.

Read More

Before you consider Star Bulk Carriers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Star Bulk Carriers wasn't on the list.

While Star Bulk Carriers currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.