State of Alaska Department of Revenue boosted its position in shares of Walmart Inc. (NYSE:WMT - Free Report) by 2.5% in the first quarter, according to the company in its most recent disclosure with the SEC. The firm owned 534,559 shares of the retailer's stock after purchasing an additional 13,290 shares during the quarter. Walmart accounts for about 0.5% of State of Alaska Department of Revenue's investment portfolio, making the stock its 27th biggest holding. State of Alaska Department of Revenue's holdings in Walmart were worth $46,928,000 at the end of the most recent reporting period.

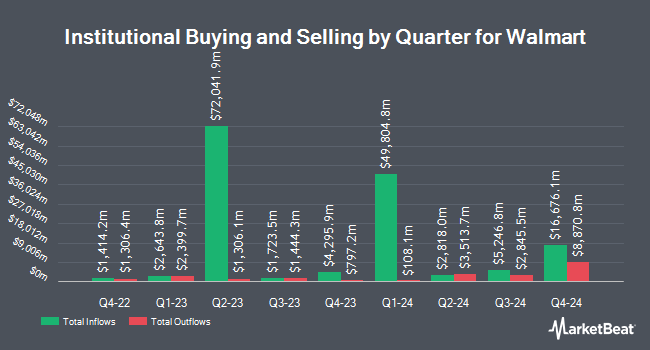

Several other large investors have also recently bought and sold shares of WMT. Vanguard Group Inc. boosted its position in shares of Walmart by 0.5% during the fourth quarter. Vanguard Group Inc. now owns 422,736,888 shares of the retailer's stock worth $38,194,278,000 after purchasing an additional 2,050,683 shares in the last quarter. Geode Capital Management LLC lifted its holdings in Walmart by 3.4% during the fourth quarter. Geode Capital Management LLC now owns 90,635,238 shares of the retailer's stock worth $8,167,186,000 after acquiring an additional 3,017,829 shares in the last quarter. Norges Bank acquired a new position in Walmart in the fourth quarter valued at about $5,737,355,000. Fisher Asset Management LLC grew its stake in Walmart by 2.4% in the fourth quarter. Fisher Asset Management LLC now owns 48,793,045 shares of the retailer's stock valued at $4,408,452,000 after acquiring an additional 1,133,201 shares during the period. Finally, Northern Trust Corp increased its holdings in shares of Walmart by 8.9% in the fourth quarter. Northern Trust Corp now owns 43,641,936 shares of the retailer's stock worth $3,943,049,000 after acquiring an additional 3,550,037 shares in the last quarter. Institutional investors own 26.76% of the company's stock.

Insider Buying and Selling at Walmart

In other Walmart news, CEO C Douglas Mcmillon sold 29,124 shares of the company's stock in a transaction on Thursday, March 27th. The shares were sold at an average price of $85.63, for a total value of $2,493,888.12. Following the transaction, the chief executive officer now directly owns 3,972,517 shares in the company, valued at $340,166,630.71. The trade was a 0.73% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Also, EVP John D. Rainey sold 2,200 shares of the firm's stock in a transaction dated Tuesday, April 1st. The stock was sold at an average price of $88.66, for a total transaction of $195,052.00. Following the sale, the executive vice president now owns 398,024 shares of the company's stock, valued at approximately $35,288,807.84. This represents a 0.55% decrease in their position. The disclosure for this sale can be found here. Insiders sold 135,294 shares of company stock valued at $12,656,659 in the last quarter. 45.58% of the stock is currently owned by insiders.

Walmart Stock Up 0.9%

Shares of WMT stock opened at $95.10 on Thursday. Walmart Inc. has a 52-week low of $66.55 and a 52-week high of $105.30. The stock has a market cap of $758.95 billion, a price-to-earnings ratio of 40.64, a PEG ratio of 4.60 and a beta of 0.69. The firm's 50-day moving average is $96.24 and its 200-day moving average is $94.11. The company has a debt-to-equity ratio of 0.47, a quick ratio of 0.22 and a current ratio of 0.78.

Walmart (NYSE:WMT - Get Free Report) last announced its quarterly earnings results on Thursday, May 15th. The retailer reported $0.61 earnings per share for the quarter, topping analysts' consensus estimates of $0.58 by $0.03. Walmart had a return on equity of 21.76% and a net margin of 2.75%. The firm had revenue of $165.61 billion for the quarter, compared to the consensus estimate of $164.53 billion. During the same quarter in the previous year, the business earned $0.60 earnings per share. The business's revenue was up 2.5% compared to the same quarter last year. Sell-side analysts predict that Walmart Inc. will post 2.55 EPS for the current year.

Walmart Announces Dividend

The firm also recently declared a dividend, which was paid on Tuesday, May 27th. Investors of record on Monday, May 12th were paid a $0.235 dividend. This represents a yield of 0.95%. The ex-dividend date was Friday, May 9th. Walmart's dividend payout ratio (DPR) is presently 40.17%.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on the company. Telsey Advisory Group reiterated an "outperform" rating and set a $115.00 price objective on shares of Walmart in a report on Monday, June 9th. Barclays restated an "overweight" rating on shares of Walmart in a report on Friday, February 28th. Sanford C. Bernstein reiterated an "outperform" rating on shares of Walmart in a report on Monday, May 5th. Mizuho increased their price objective on shares of Walmart from $105.00 to $115.00 and gave the stock an "outperform" rating in a research report on Monday, June 9th. Finally, KeyCorp boosted their price objective on shares of Walmart from $105.00 to $110.00 and gave the company an "overweight" rating in a research report on Monday, June 9th. Two equities research analysts have rated the stock with a hold rating, thirty have given a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $106.50.

View Our Latest Report on WMT

Walmart Profile

(

Free Report)

Walmart Inc engages in the operation of retail, wholesale, other units, and eCommerce worldwide. The company operates through three segments: Walmart U.S., Walmart International, and Sam's Club. It operates supercenters, supermarkets, hypermarkets, warehouse clubs, cash and carry stores, and discount stores under Walmart and Walmart Neighborhood Market brands; membership-only warehouse clubs; ecommerce websites, such as walmart.com.mx, walmart.ca, flipkart.com, PhonePe and other sites; and mobile commerce applications.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Walmart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walmart wasn't on the list.

While Walmart currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report