State of New Jersey Common Pension Fund D raised its position in shares of International Paper Company (NYSE:IP - Free Report) by 40.0% during the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 169,171 shares of the basic materials company's stock after buying an additional 48,301 shares during the quarter. State of New Jersey Common Pension Fund D's holdings in International Paper were worth $9,025,000 at the end of the most recent quarter.

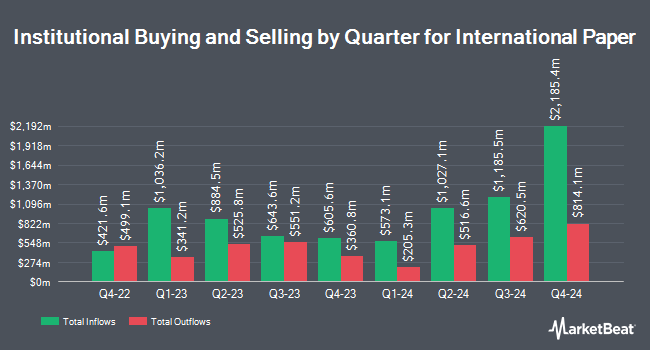

Several other institutional investors and hedge funds have also recently bought and sold shares of the company. Ethic Inc. grew its holdings in shares of International Paper by 41.6% during the first quarter. Ethic Inc. now owns 31,794 shares of the basic materials company's stock valued at $1,706,000 after purchasing an additional 9,337 shares during the last quarter. Aberdeen Group plc grew its holdings in shares of International Paper by 104.6% during the first quarter. Aberdeen Group plc now owns 164,502 shares of the basic materials company's stock valued at $8,799,000 after purchasing an additional 84,096 shares during the last quarter. Horizon Investments LLC grew its holdings in shares of International Paper by 60.5% during the first quarter. Horizon Investments LLC now owns 7,629 shares of the basic materials company's stock valued at $407,000 after purchasing an additional 2,877 shares during the last quarter. Sei Investments Co. grew its holdings in shares of International Paper by 19.8% during the first quarter. Sei Investments Co. now owns 477,800 shares of the basic materials company's stock valued at $25,586,000 after purchasing an additional 78,970 shares during the last quarter. Finally, Kovitz Investment Group Partners LLC grew its holdings in shares of International Paper by 232.3% during the first quarter. Kovitz Investment Group Partners LLC now owns 118,315 shares of the basic materials company's stock valued at $6,312,000 after purchasing an additional 82,706 shares during the last quarter. Institutional investors and hedge funds own 81.95% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have recently commented on IP shares. Wells Fargo & Company reaffirmed an "underweight" rating and set a $43.00 target price (up from $40.00) on shares of International Paper in a report on Thursday, July 10th. JPMorgan Chase & Co. lowered International Paper from an "overweight" rating to a "neutral" rating and decreased their price objective for the stock from $55.00 to $54.00 in a report on Tuesday, August 5th. Zacks Research lowered International Paper from a "hold" rating to a "strong sell" rating in a report on Monday. UBS Group initiated coverage on International Paper in a report on Wednesday, June 4th. They issued a "buy" rating and a $60.00 price objective for the company. Finally, Truist Financial set a $59.00 price objective on International Paper in a report on Wednesday, May 28th. Four equities research analysts have rated the stock with a Buy rating, two have issued a Hold rating and three have issued a Sell rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average target price of $55.46.

View Our Latest Stock Report on International Paper

International Paper Price Performance

IP traded up $1.05 during trading on Friday, reaching $49.08. The stock had a trading volume of 2,486,560 shares, compared to its average volume of 6,450,700. The firm has a market capitalization of $25.91 billion, a price-to-earnings ratio of -490.80, a price-to-earnings-growth ratio of 0.61 and a beta of 1.04. The company has a quick ratio of 0.96, a current ratio of 1.33 and a debt-to-equity ratio of 0.52. International Paper Company has a 1-year low of $43.27 and a 1-year high of $60.36. The stock has a 50 day moving average of $49.15 and a two-hundred day moving average of $49.83.

International Paper (NYSE:IP - Get Free Report) last released its earnings results on Thursday, July 31st. The basic materials company reported $0.20 earnings per share for the quarter, missing analysts' consensus estimates of $0.38 by ($0.18). The firm had revenue of $6.77 billion during the quarter, compared to analyst estimates of $6.64 billion. International Paper had a positive return on equity of 2.63% and a negative net margin of 0.12%.The business's revenue for the quarter was up 42.9% on a year-over-year basis. During the same quarter last year, the company earned $0.55 earnings per share. As a group, equities analysts anticipate that International Paper Company will post 2.77 EPS for the current fiscal year.

International Paper Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, September 16th. Shareholders of record on Friday, August 15th will be given a $0.4625 dividend. This represents a $1.85 dividend on an annualized basis and a yield of 3.8%. The ex-dividend date is Friday, August 15th. International Paper's dividend payout ratio is -1,850.00%.

About International Paper

(

Free Report)

International Paper Company produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa. It operates through two segments, Industrial Packaging and Global Cellulose Fibers. The company offers linerboard, medium, whitetop, recycled linerboard, recycled medium and saturating kraft; and pulp for a range of applications, such as diapers, towel and tissue products, feminine care, incontinence, and other personal care products, as well as specialty pulps for use in textiles, construction materials, paints, coatings, and others.

Featured Stories

Before you consider International Paper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Paper wasn't on the list.

While International Paper currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.