State of New Jersey Common Pension Fund D cut its holdings in LyondellBasell Industries N.V. (NYSE:LYB - Free Report) by 12.9% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 69,219 shares of the specialty chemicals company's stock after selling 10,297 shares during the period. State of New Jersey Common Pension Fund D's holdings in LyondellBasell Industries were worth $4,873,000 as of its most recent filing with the Securities and Exchange Commission.

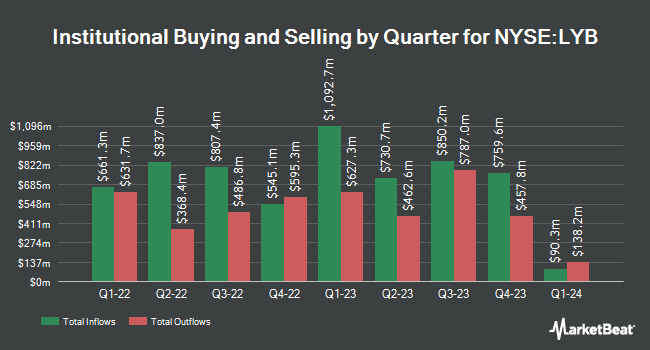

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Pacer Advisors Inc. increased its holdings in LyondellBasell Industries by 3,502.2% during the 1st quarter. Pacer Advisors Inc. now owns 2,015,528 shares of the specialty chemicals company's stock worth $141,893,000 after purchasing an additional 1,959,576 shares in the last quarter. Ensign Peak Advisors Inc grew its holdings in shares of LyondellBasell Industries by 207.8% in the fourth quarter. Ensign Peak Advisors Inc now owns 2,254,589 shares of the specialty chemicals company's stock valued at $167,448,000 after acquiring an additional 1,522,043 shares in the last quarter. HighTower Advisors LLC grew its holdings in shares of LyondellBasell Industries by 137.9% in the first quarter. HighTower Advisors LLC now owns 1,760,045 shares of the specialty chemicals company's stock valued at $123,907,000 after acquiring an additional 1,020,169 shares in the last quarter. Charles Schwab Investment Management Inc. grew its holdings in shares of LyondellBasell Industries by 7.7% in the first quarter. Charles Schwab Investment Management Inc. now owns 9,239,562 shares of the specialty chemicals company's stock valued at $650,465,000 after acquiring an additional 657,443 shares in the last quarter. Finally, Nuveen LLC bought a new position in shares of LyondellBasell Industries in the first quarter valued at approximately $43,280,000. 71.20% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other LyondellBasell Industries news, CEO Peter Z. E. Vanacker sold 20,000 shares of the stock in a transaction dated Friday, August 15th. The stock was sold at an average price of $53.57, for a total value of $1,071,400.00. Following the transaction, the chief executive officer owned 160,351 shares of the company's stock, valued at approximately $8,590,003.07. This represents a 11.09% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 0.14% of the company's stock.

LyondellBasell Industries Stock Up 5.9%

LYB stock traded up $3.2460 during midday trading on Friday, hitting $58.7160. The company's stock had a trading volume of 7,920,792 shares, compared to its average volume of 5,568,035. The company has a market cap of $18.89 billion, a PE ratio of 76.26 and a beta of 0.85. LyondellBasell Industries N.V. has a 12 month low of $47.55 and a 12 month high of $99.36. The company has a current ratio of 1.77, a quick ratio of 1.04 and a debt-to-equity ratio of 0.94. The firm's 50-day moving average is $58.57 and its 200-day moving average is $62.79.

LyondellBasell Industries (NYSE:LYB - Get Free Report) last released its quarterly earnings data on Friday, August 1st. The specialty chemicals company reported $0.62 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.87 by ($0.25). The business had revenue of $7.66 billion during the quarter, compared to the consensus estimate of $7.58 billion. LyondellBasell Industries had a net margin of 0.74% and a return on equity of 9.35%. The business's revenue was down 11.8% compared to the same quarter last year. During the same period last year, the company posted $2.24 earnings per share. On average, equities research analysts forecast that LyondellBasell Industries N.V. will post 6.31 earnings per share for the current fiscal year.

LyondellBasell Industries Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, September 2nd. Shareholders of record on Monday, August 25th will be issued a $1.37 dividend. The ex-dividend date of this dividend is Monday, August 25th. This represents a $5.48 dividend on an annualized basis and a yield of 9.3%. LyondellBasell Industries's dividend payout ratio is currently 711.69%.

Wall Street Analyst Weigh In

Several brokerages have weighed in on LYB. BMO Capital Markets reduced their price objective on LyondellBasell Industries from $60.00 to $58.00 and set a "market perform" rating for the company in a report on Wednesday, August 6th. Mizuho boosted their price target on LyondellBasell Industries from $65.00 to $67.00 and gave the company a "neutral" rating in a report on Tuesday, July 15th. Citigroup reduced their price target on LyondellBasell Industries from $56.00 to $53.00 and set a "neutral" rating on the stock in a report on Monday, August 4th. Wells Fargo & Company dropped their price target on LyondellBasell Industries from $75.00 to $65.00 and set an "overweight" rating on the stock in a research report on Monday, August 4th. Finally, The Goldman Sachs Group cut their price target on LyondellBasell Industries from $81.00 to $65.00 and set a "sell" rating on the stock in a research note on Monday, April 28th. One investment analyst has rated the stock with a Strong Buy rating, two have issued a Buy rating, nine have given a Hold rating and two have issued a Sell rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $63.08.

Check Out Our Latest Research Report on LyondellBasell Industries

LyondellBasell Industries Company Profile

(

Free Report)

LyondellBasell Industries N.V. operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally. The company operates in six segments: Olefins and PolyolefinsAmericas; Olefins and PolyolefinsEurope, Asia, International; Intermediates and Derivatives; Advanced Polymer Solutions; Refining; and Technology.

Recommended Stories

Before you consider LyondellBasell Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LyondellBasell Industries wasn't on the list.

While LyondellBasell Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report