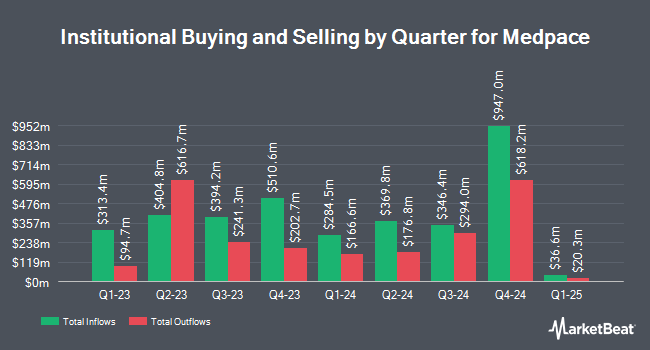

State of New Jersey Common Pension Fund D decreased its position in Medpace Holdings, Inc. (NASDAQ:MEDP - Free Report) by 13.9% during the 1st quarter, according to its most recent filing with the SEC. The institutional investor owned 8,305 shares of the company's stock after selling 1,346 shares during the period. State of New Jersey Common Pension Fund D's holdings in Medpace were worth $2,530,000 as of its most recent filing with the SEC.

Several other hedge funds also recently made changes to their positions in MEDP. Sone Capital Management LLC acquired a new stake in shares of Medpace in the fourth quarter valued at approximately $1,318,000. GAMMA Investing LLC increased its stake in Medpace by 37.1% in the 1st quarter. GAMMA Investing LLC now owns 307 shares of the company's stock valued at $94,000 after buying an additional 83 shares during the last quarter. Fundsmith LLP bought a new stake in Medpace during the 4th quarter worth about $42,372,000. Park Avenue Securities LLC lifted its position in Medpace by 1.8% during the 1st quarter. Park Avenue Securities LLC now owns 2,749 shares of the company's stock worth $838,000 after buying an additional 48 shares in the last quarter. Finally, UMB Bank n.a. boosted its stake in shares of Medpace by 70.7% during the 1st quarter. UMB Bank n.a. now owns 490 shares of the company's stock worth $149,000 after buying an additional 203 shares during the last quarter. 77.98% of the stock is owned by institutional investors.

Medpace Trading Up 2.3%

NASDAQ:MEDP traded up $10.30 on Friday, hitting $463.64. The company's stock had a trading volume of 328,935 shares, compared to its average volume of 403,145. Medpace Holdings, Inc. has a one year low of $250.05 and a one year high of $501.30. The firm has a market capitalization of $13.02 billion, a P/E ratio of 34.47, a price-to-earnings-growth ratio of 2.92 and a beta of 1.42. The stock has a fifty day moving average of $378.86 and a two-hundred day moving average of $334.87.

Medpace (NASDAQ:MEDP - Get Free Report) last issued its earnings results on Monday, July 21st. The company reported $3.10 EPS for the quarter, topping the consensus estimate of $3.00 by $0.10. The company had revenue of $603.31 million during the quarter, compared to the consensus estimate of $537.70 million. Medpace had a return on equity of 67.66% and a net margin of 18.74%.The firm's revenue for the quarter was up 14.2% compared to the same quarter last year. During the same period in the previous year, the company posted $2.75 EPS. Medpace has set its FY 2025 guidance at 13.760-14.53 EPS. As a group, sell-side analysts anticipate that Medpace Holdings, Inc. will post 12.29 EPS for the current year.

Analyst Ratings Changes

MEDP has been the topic of a number of recent research reports. TD Cowen reaffirmed a "sell" rating and issued a $366.00 target price (up previously from $283.00) on shares of Medpace in a research report on Wednesday, July 23rd. Robert W. Baird raised their price target on Medpace from $313.00 to $490.00 and gave the company a "neutral" rating in a research note on Wednesday, July 23rd. Mizuho boosted their price target on Medpace from $328.00 to $510.00 and gave the stock an "outperform" rating in a research report on Friday, July 25th. Cowen downgraded Medpace from a "buy" rating to a "sell" rating in a report on Wednesday, July 23rd. Finally, Deutsche Bank Aktiengesellschaft raised their target price on shares of Medpace from $270.00 to $430.00 and gave the company a "hold" rating in a research note on Wednesday, July 23rd. Two analysts have rated the stock with a Buy rating, nine have assigned a Hold rating and three have assigned a Sell rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Reduce" and a consensus target price of $406.60.

Read Our Latest Report on Medpace

Insider Activity

In other Medpace news, President Jesse J. Geiger sold 41,801 shares of the company's stock in a transaction on Thursday, July 24th. The shares were sold at an average price of $453.11, for a total value of $18,940,451.11. Following the transaction, the president directly owned 36,503 shares in the company, valued at $16,539,874.33. The trade was a 53.38% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Also, VP Susan E. Burwig sold 7,500 shares of the firm's stock in a transaction dated Monday, July 28th. The stock was sold at an average price of $450.14, for a total transaction of $3,376,050.00. Following the sale, the vice president owned 57,500 shares of the company's stock, valued at approximately $25,883,050. This represents a 11.54% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 114,450 shares of company stock valued at $51,791,251. 20.30% of the stock is owned by company insiders.

About Medpace

(

Free Report)

Medpace Holdings, Inc engages in the provision of outsourced clinical development services to the biotechnology, pharmaceutical and medical device industries. Its services include medical department, clinical trial management, data-driven feasibility, study-start-up, clinical monitoring, regulatory affairs, patient recruitment and retention, medical writing, biometrics and data sciences, pharmacovigilance, core laboratory, laboratories, clinics, and quality assurance.

Read More

Before you consider Medpace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medpace wasn't on the list.

While Medpace currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.