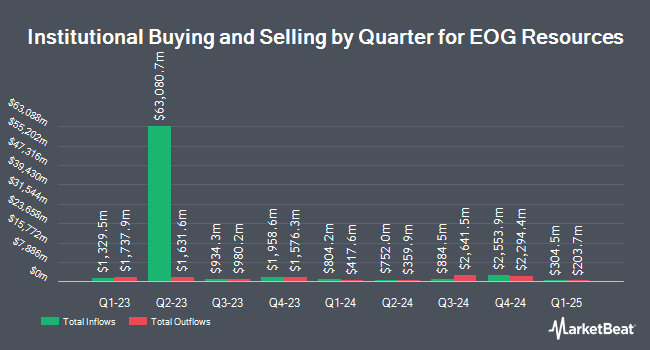

State of New Jersey Common Pension Fund D lowered its stake in EOG Resources, Inc. (NYSE:EOG - Free Report) by 11.0% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 186,604 shares of the energy exploration company's stock after selling 23,037 shares during the period. State of New Jersey Common Pension Fund D's holdings in EOG Resources were worth $23,930,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in EOG. Nuveen LLC acquired a new stake in shares of EOG Resources in the first quarter worth $451,908,000. Capital World Investors raised its holdings in EOG Resources by 5.2% in the 4th quarter. Capital World Investors now owns 45,919,327 shares of the energy exploration company's stock worth $5,628,497,000 after acquiring an additional 2,270,013 shares during the period. GAMMA Investing LLC lifted its position in EOG Resources by 14,784.1% during the 1st quarter. GAMMA Investing LLC now owns 1,281,374 shares of the energy exploration company's stock worth $164,323,000 after acquiring an additional 1,272,765 shares during the last quarter. Charles Schwab Investment Management Inc. lifted its position in EOG Resources by 6.5% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 19,380,866 shares of the energy exploration company's stock worth $2,485,402,000 after acquiring an additional 1,188,552 shares during the last quarter. Finally, Deutsche Bank AG boosted its holdings in EOG Resources by 58.6% during the fourth quarter. Deutsche Bank AG now owns 2,081,409 shares of the energy exploration company's stock valued at $255,139,000 after acquiring an additional 769,362 shares during the period. 89.91% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research firms recently weighed in on EOG. Royal Bank Of Canada cut their price objective on EOG Resources from $145.00 to $140.00 and set an "outperform" rating for the company in a research report on Tuesday, July 8th. Mizuho dropped their price target on EOG Resources from $140.00 to $134.00 and set a "neutral" rating on the stock in a research report on Tuesday, May 13th. Piper Sandler reduced their price objective on EOG Resources from $138.00 to $136.00 and set a "neutral" rating for the company in a research report on Thursday, July 17th. Roth Capital downgraded shares of EOG Resources from a "buy" rating to a "neutral" rating and lowered their price objective for the stock from $140.00 to $134.00 in a research note on Wednesday, July 9th. Finally, Bank of America cut their target price on shares of EOG Resources from $125.00 to $124.00 and set a "neutral" rating for the company in a research note on Friday, May 23rd. One investment analyst has rated the stock with a Strong Buy rating, eleven have given a Buy rating and eleven have issued a Hold rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $143.61.

Read Our Latest Stock Report on EOG

EOG Resources Price Performance

Shares of EOG Resources stock traded down $0.1860 during trading on Thursday, hitting $118.1740. 646,151 shares of the company's stock traded hands, compared to its average volume of 3,600,157. The company has a market cap of $64.52 billion, a PE ratio of 11.48, a PEG ratio of 8.96 and a beta of 0.80. The firm's fifty day moving average price is $120.31 and its 200 day moving average price is $119.25. EOG Resources, Inc. has a twelve month low of $102.52 and a twelve month high of $138.18. The company has a debt-to-equity ratio of 0.12, a current ratio of 1.79 and a quick ratio of 1.61.

EOG Resources (NYSE:EOG - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The energy exploration company reported $2.32 earnings per share for the quarter, beating analysts' consensus estimates of $2.14 by $0.18. EOG Resources had a return on equity of 20.51% and a net margin of 25.25%.The company had revenue of $5.48 billion for the quarter, compared to the consensus estimate of $5.45 billion. During the same period in the previous year, the business earned $3.16 earnings per share. The company's quarterly revenue was down 9.1% on a year-over-year basis. Analysts forecast that EOG Resources, Inc. will post 11.47 earnings per share for the current year.

EOG Resources Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, October 31st. Shareholders of record on Friday, October 17th will be given a $1.02 dividend. This represents a $4.08 dividend on an annualized basis and a yield of 3.5%. This is a positive change from EOG Resources's previous quarterly dividend of $0.98. The ex-dividend date is Friday, October 17th. EOG Resources's dividend payout ratio (DPR) is currently 37.90%.

Insider Transactions at EOG Resources

In other EOG Resources news, COO Jeffrey R. Leitzell sold 3,951 shares of EOG Resources stock in a transaction on Monday, June 30th. The stock was sold at an average price of $119.65, for a total transaction of $472,737.15. Following the completion of the transaction, the chief operating officer directly owned 45,739 shares of the company's stock, valued at approximately $5,472,671.35. This trade represents a 7.95% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. 0.13% of the stock is owned by corporate insiders.

About EOG Resources

(

Free Report)

EOG Resources, Inc, together with its subsidiaries, explores for, develops, produces, and markets crude oil, natural gas liquids, and natural gas primarily in producing basins in the United States, the Republic of Trinidad and Tobago and internationally. The company was formerly known as Enron Oil & Gas Company.

Featured Articles

Before you consider EOG Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EOG Resources wasn't on the list.

While EOG Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report